Sale Of Assets Vs Sale Of Business In Michigan

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

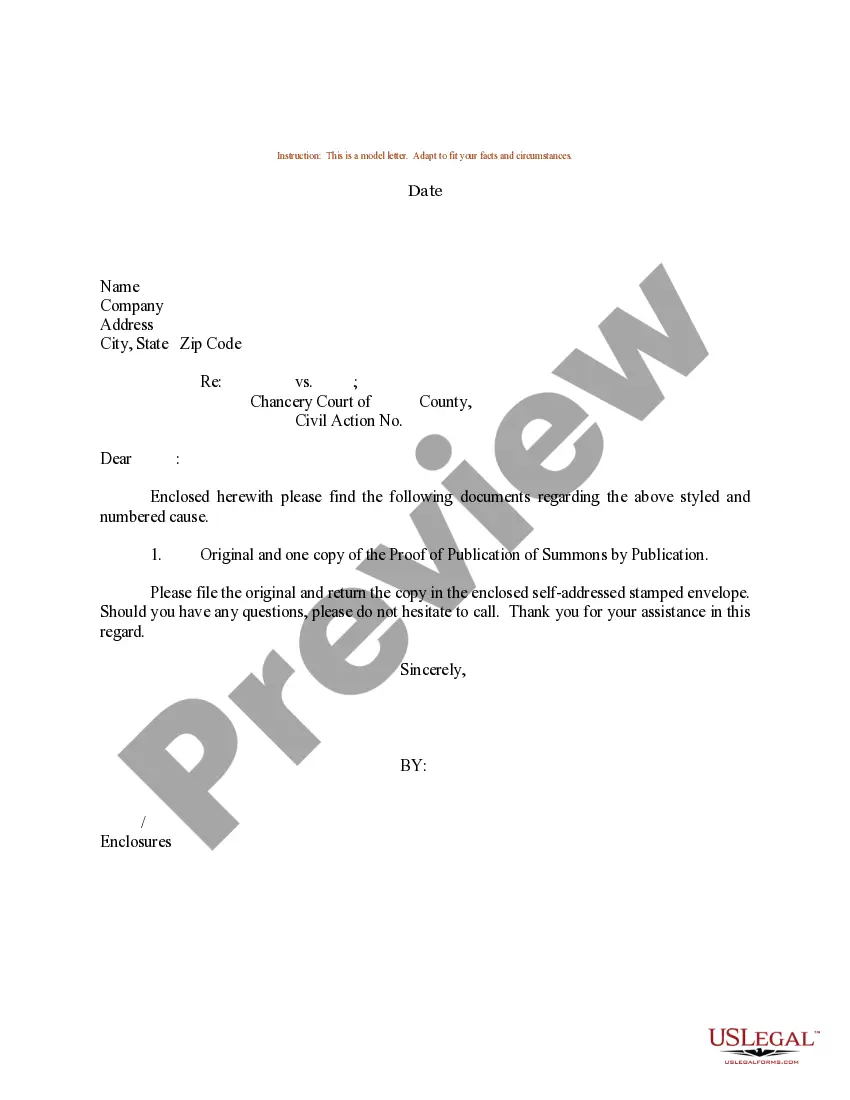

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

A business sale transaction can take several forms: (1) sale of assets, (2) sale of stock, (3) merger, ( 4) consolidation, or (5) share exchange. There are several steps you must take when you sell or close a business.Which option do I select on Form 5156? Select the first option for reason of request: I am selling my business or business assets. (a) Sell, lease, exchange, or otherwise dispose of all, or substantially all, of its property and assets in the usual and regular course of its business. In an asset sale, the new owner purchases the business's physical assets. The seller retains all rights to the legal entity. The Michigan Supreme Court held that for the former Michigan Business Tax, gain from a significant asset sale is treated as business income. In an asset sale, the business' assets, such as equipment, property, customer lists, and goodwill is sold. The sale of a business usually is not a sale of one asset.