Business Sale Asset With Gst Journal Entry In Montgomery

Category:

State:

Multi-State

County:

Montgomery

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

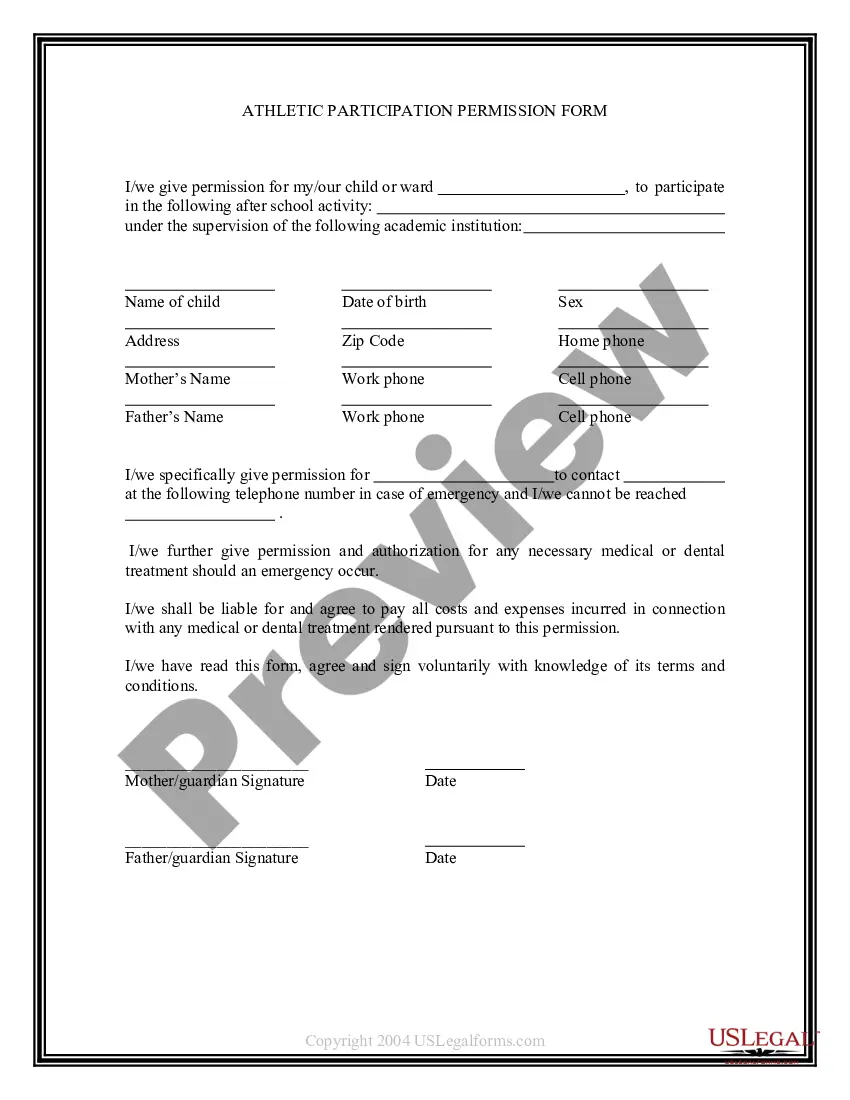

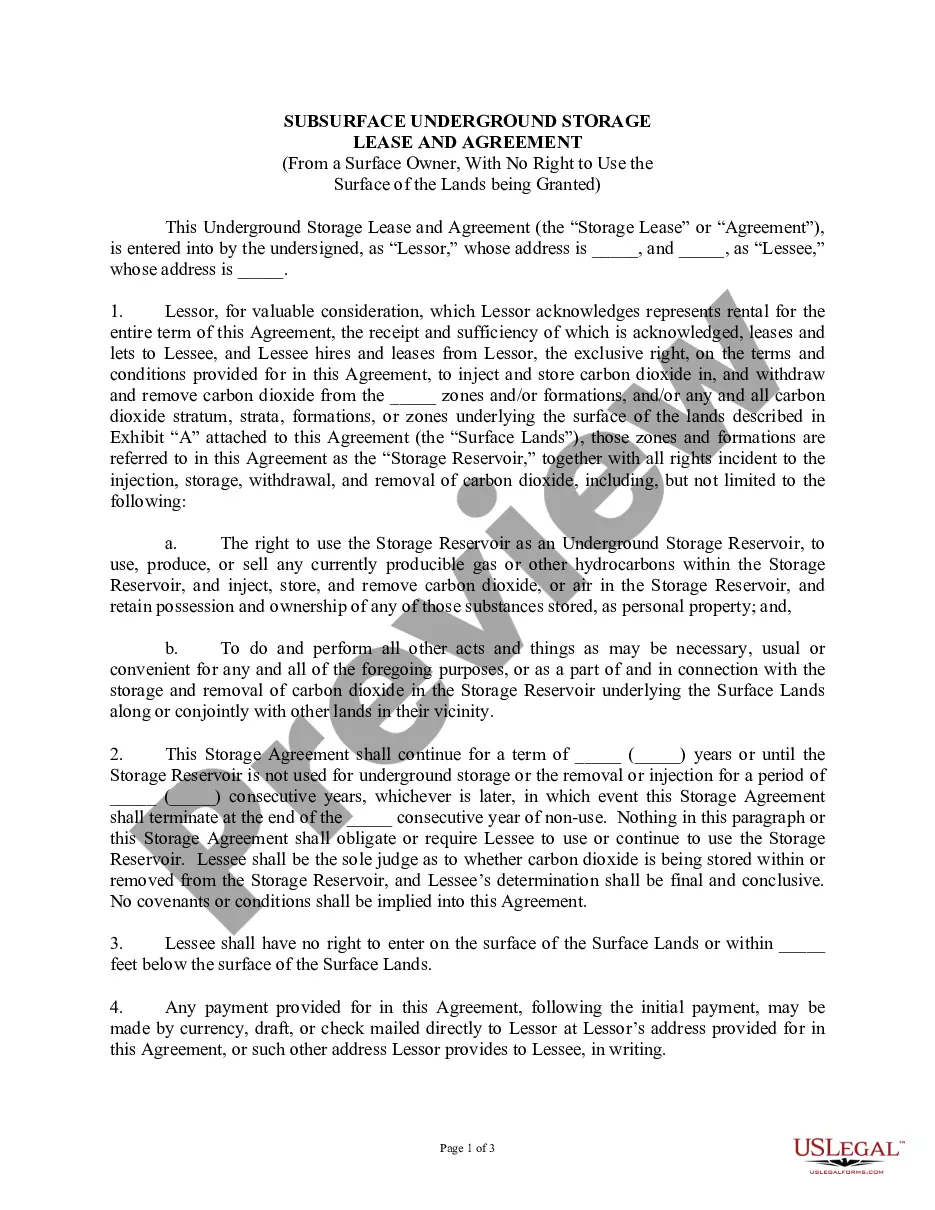

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

The selling price is direct from your settlement sheet. The underlying assets sold may have a current value of zero if fully depreciated.The equipment sold is used. Start out with crediting the original purchase price. Credit improvements if you capitalized these. When we're talking about the gain or loss of the sale of an asset we need to be looking at net book value at the time of the sale. Journalize entries for sale of assets. DECEDENTS, ESTATES AND FIDUCIARIES. Chapter. 1. Fixed Assets: How to record the disposal of assets? Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity.