Asset Business Sale Form For Corporation In Nassau

Category:

State:

Multi-State

County:

Nassau

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

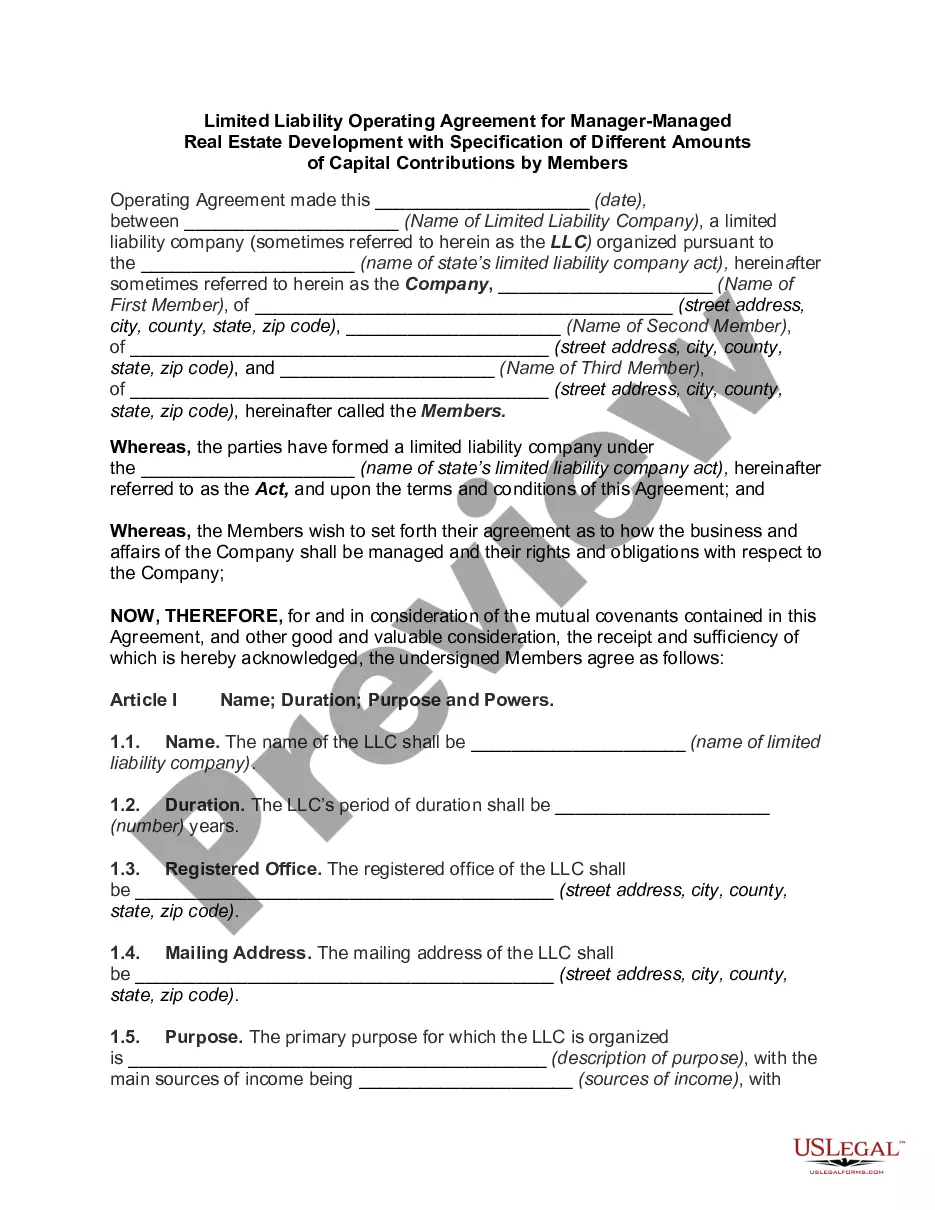

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

This form is for general instructions that apply to all corporation tax forms. It includes a variety of topics about how to fill out your form.Both the seller and purchaser of a group of assets that makes up a trade or business must use Form 8594 to report such a sale. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. • If your claim was about the judgment debtor's licensed. You must follow this procedure: On your return: Sale of Business form. Asset sales typically generate higher federal taxes because many types of assets are subject to higher ordinary income tax rates. (depends on seller's bracket). What information will I need to fill out the form? You will need the correct name and street address of each defendant and claimant.