Asset Purchase Agreement Irs Form In Nassau

Category:

State:

Multi-State

County:

Nassau

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

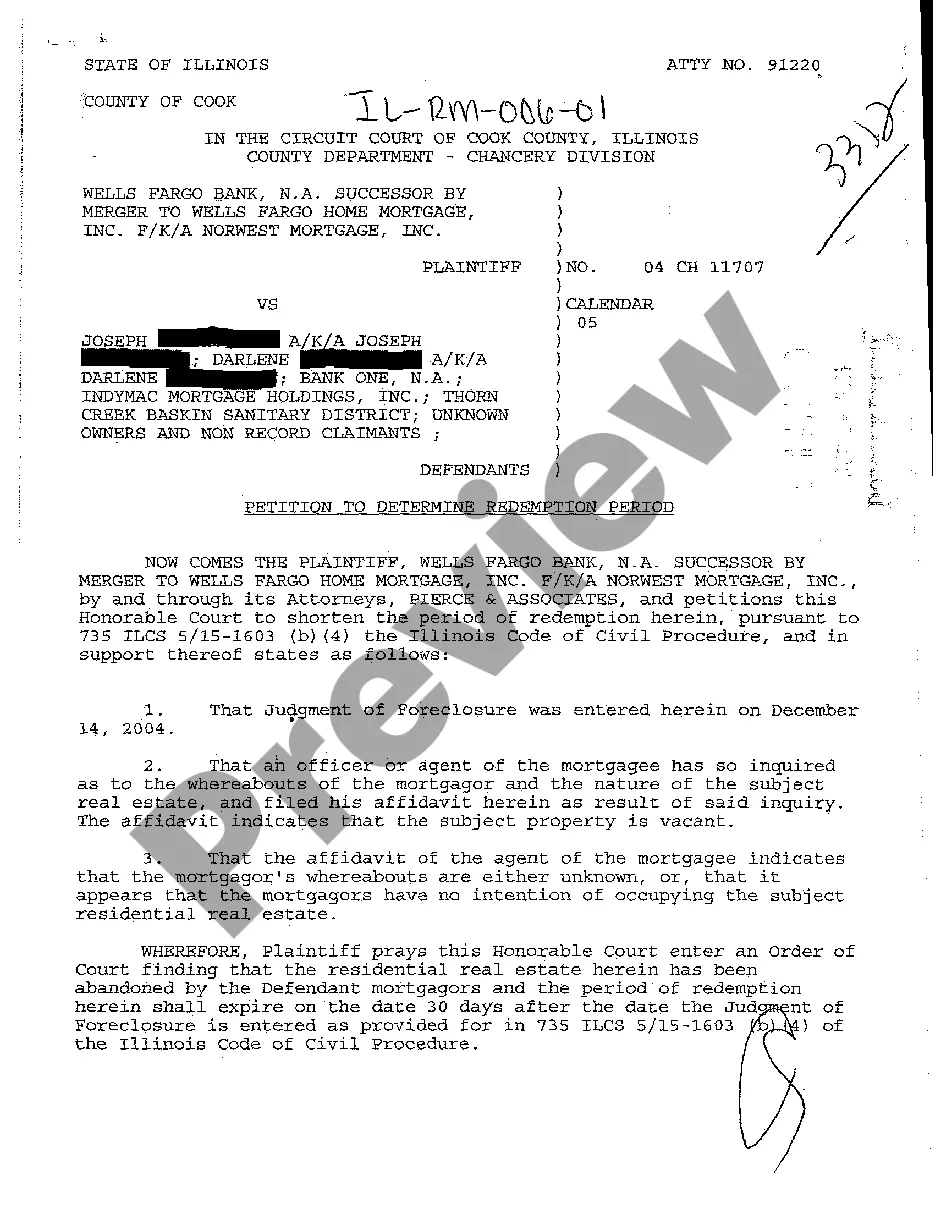

The Asset Purchase Agreement IRS form in Nassau is a legal document used to facilitate the transfer of business assets from a seller to a buyer. It outlines key elements such as the assets being sold, liabilities assumed, the purchase price, and payment terms. The form also includes sections for representations, warranties, and conditions that both parties must fulfill. Attorneys, owners, partners, associates, paralegals, and legal assistants will find this form useful when structuring business acquisition transactions, ensuring compliance with legal standards. Key features include provisions for non-competition agreements, a security interest in the assets sold, and due diligence requirements. Furthermore, the form allows for specific exclusions of certain assets, protecting both parties' interests. To fill out and edit the form, users should modify sections relevant to their circumstances, ensuring that all parties understand their rights and obligations. Careful completion of this document ensures a smoother transaction process and helps mitigate potential disputes.

Free preview