Sales Of Assets Business Advantages And Disadvantages In Nevada

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

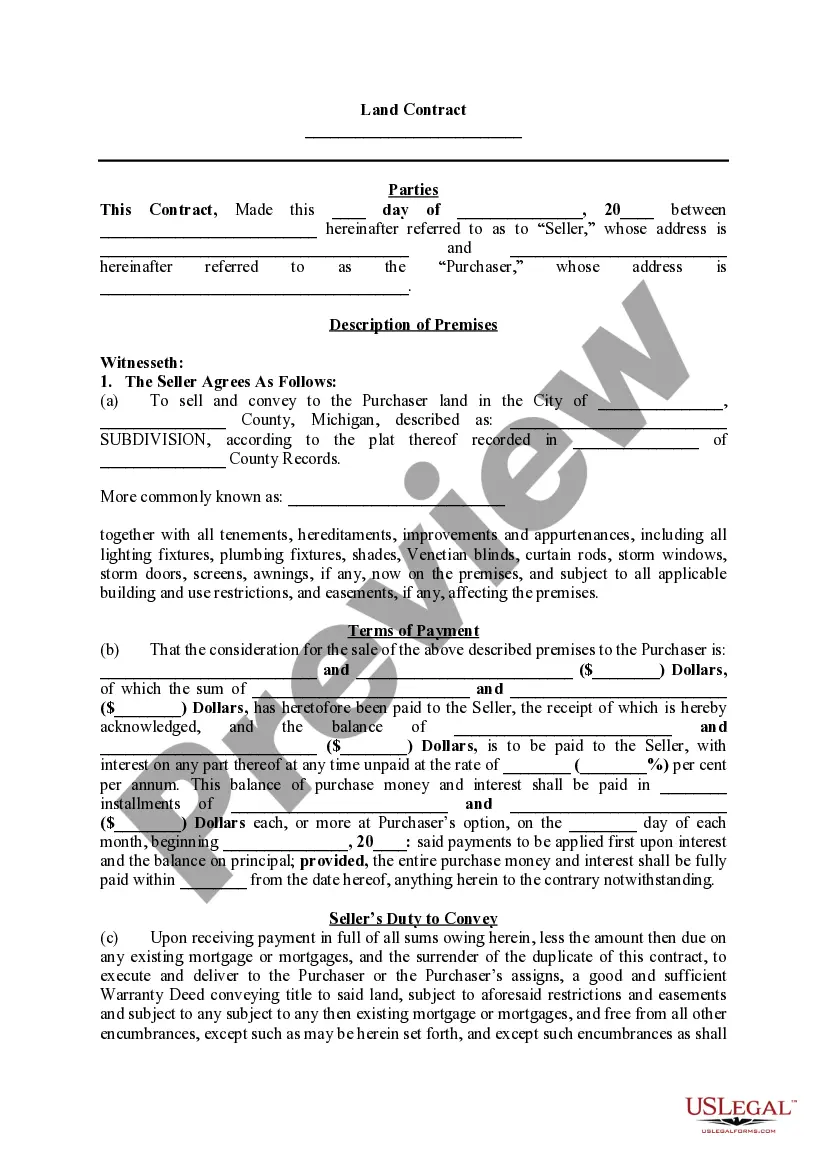

The Asset Purchase Agreement is a crucial legal document for parties involved in the sale of business assets in Nevada. It outlines the terms of the transaction, including the assets being sold, any liabilities being assumed, and the purchase price allocation. Key advantages of this agreement include enabling businesses to transfer assets while potentially avoiding certain tax liabilities and mitigating risks associated with pending liabilities. However, disadvantages may include the complexities of due diligence and the potential for undisclosed liabilities. This form caters specifically to attorneys, partners, owners, associates, paralegals, and legal assistants, providing clear filling and editing instructions to facilitate compliance with state regulations. Users must ensure they accurately describe the assets and liabilities involved, and any exclusions must be specified. Use cases may involve transitioning ownership in private companies or managing asset dispositions during financial restructuring. Ultimately, this agreement streamlines the transfer process and clarifies responsibilities for both sellers and buyers.

Free preview