Sale Business Asset With Loan Journal Entry In Ohio

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

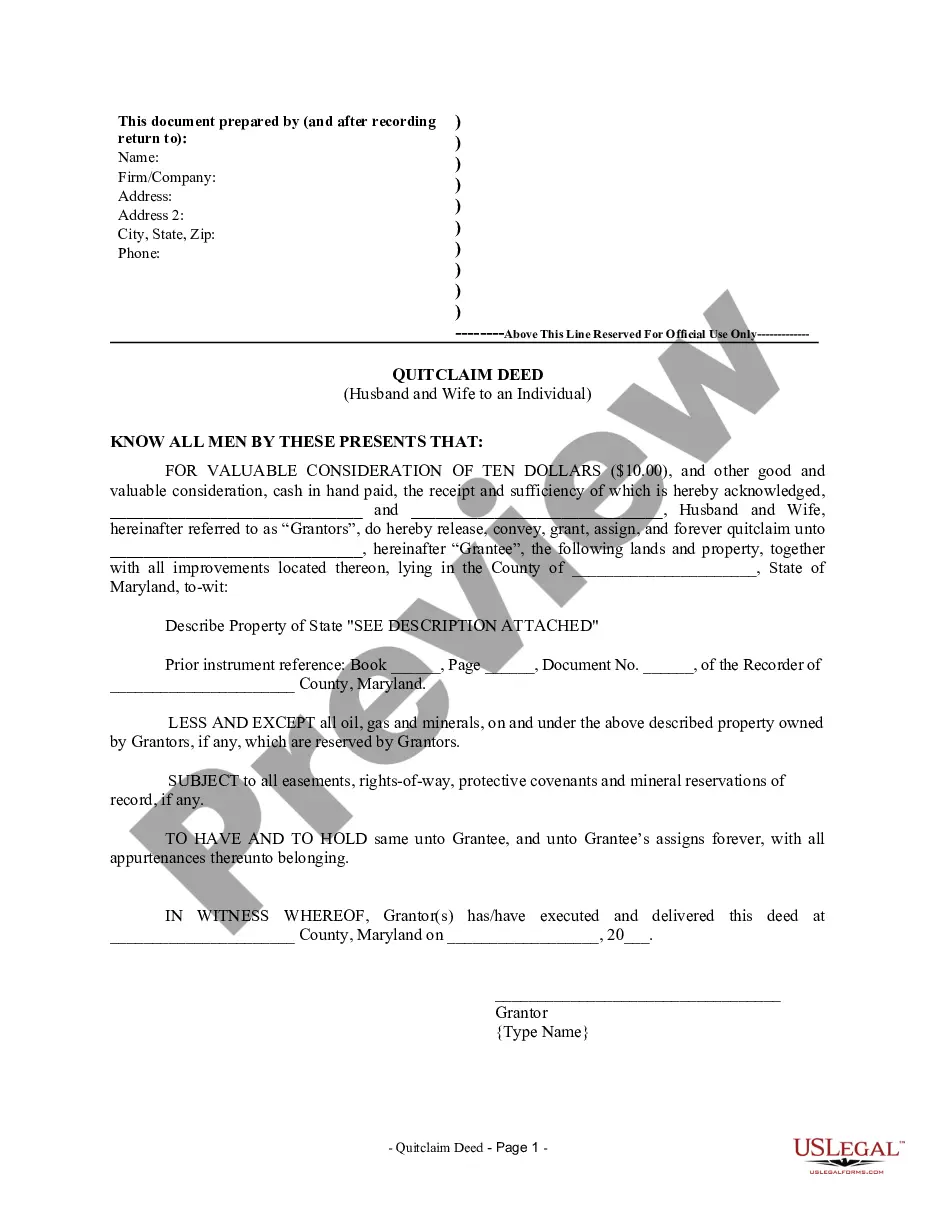

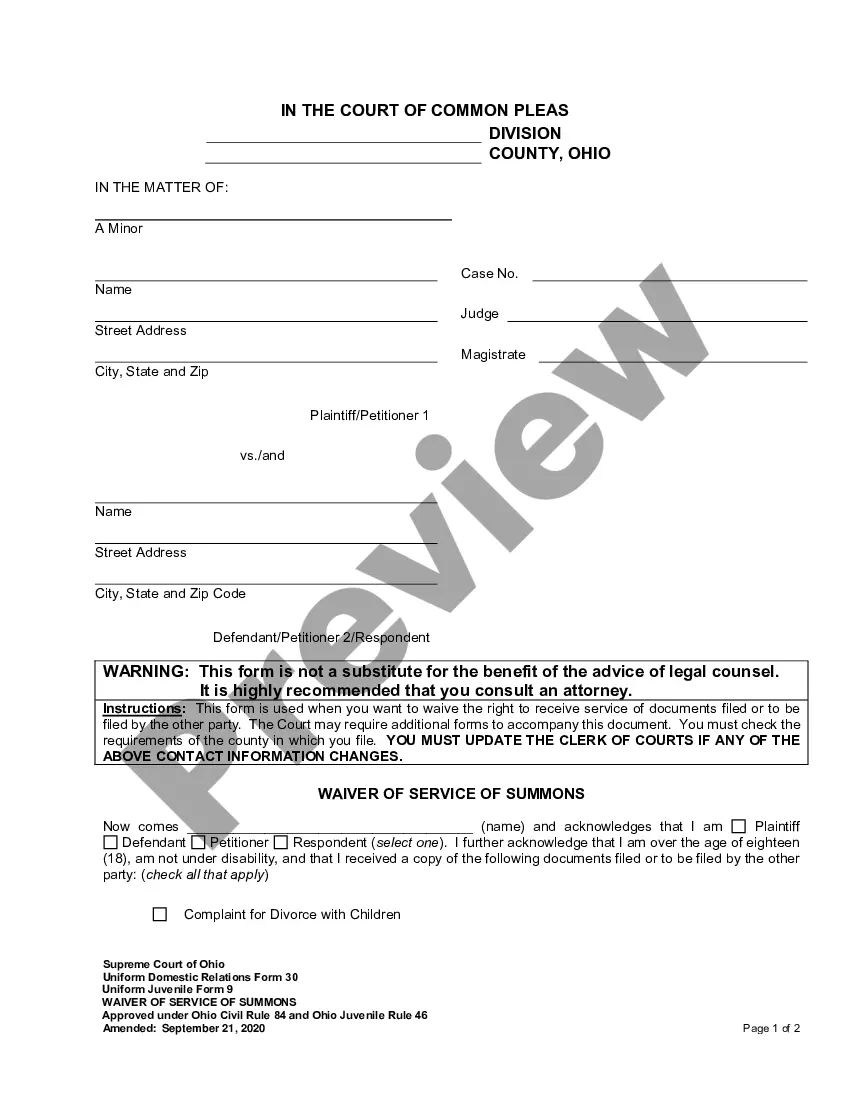

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

What is the journal entry for sale of a fixed asset, including payoff of a mortgage loan and net gain on the transaction? The question is extremely unclear, so I am going to assume that there is a company (Y) that has sold someone (S) a loan (L).Should I use a Journal entry again and get rid of the asset and diminish my Loan to 0 and only then dispose the Fixed asset? Fixed assets represent a significant capital investment, so it's critical the accounting be applied correctly. Journalize entries for sale of assets. This entry has several steps to account for the updates to your portfolio. It removes the property from your balance sheet, clears its accumulated depreciation.