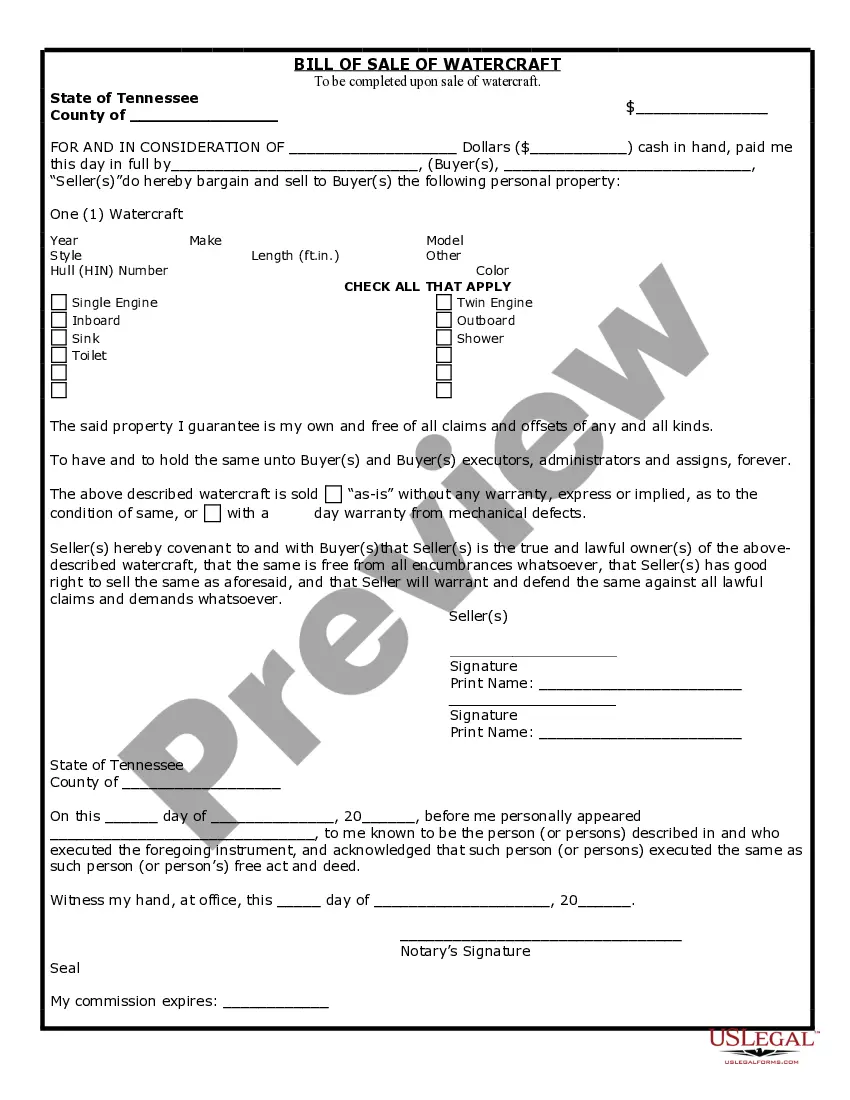

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Form 8594 Foreign Seller In Orange

Category:

State:

Multi-State

County:

Orange

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

Free preview

Form popularity

More info

Form 8594 must also be filed if the purchaser or seller is amending an original or a previously filed supplemental Form. 8594 because of an increase or decrease.Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. Go to Screen 65, Asset Acquisition Statement (8594) (Screen 58 for S-Corp). Who Must File Form 8594? Both the seller and purchaser of a group of assets that make up a trade or business need to file Form 8594. A filer files a Form 1099-MISC (relating to miscellaneous income) with the IRS. Learn about Form 5471 filing requirements, who must file, and the penalties for noncompliance.