Difference Between Asset Sale And Business Sale In Phoenix

Category:

State:

Multi-State

City:

Phoenix

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

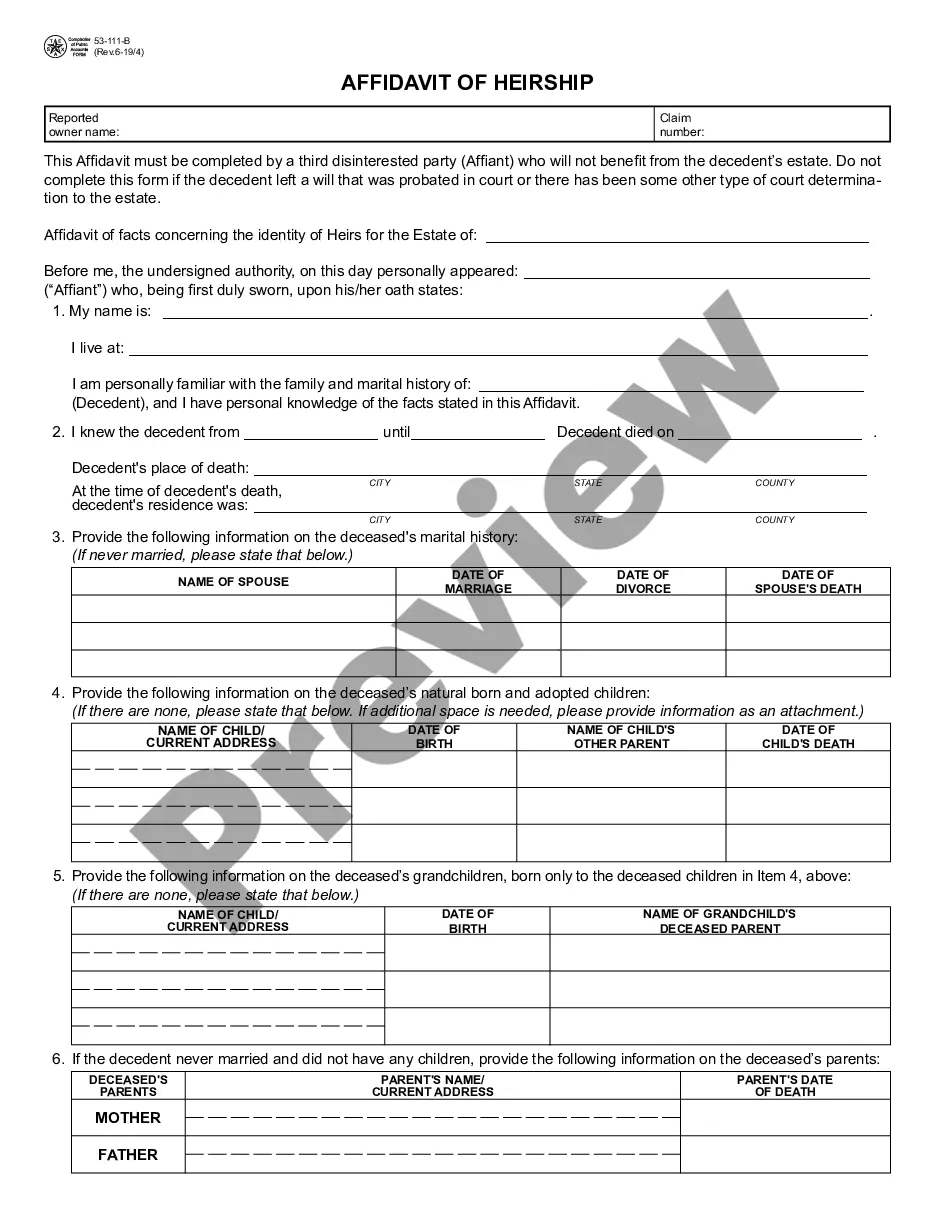

The document serves as an Asset Purchase Agreement, which outlines the difference between an asset sale and a business sale in Phoenix. In an asset sale, the buyer acquires specific assets of a business, such as equipment and inventory, while in a business sale, the entire entity and its ongoing business operations are purchased. The key features of this agreement include detailed sections on assets purchased, liabilities assumed, and a clear purchase price allocation. Additionally, it provides comprehensive instructions for filling out and editing necessary provisions to tailor the agreement to the specific facts of the transaction. Users should carefully consider the liabilities they choose to assume and the assets they intend to acquire. This form is a valuable tool for attorneys, partners, owners, associates, paralegals, and legal assistants who need to navigate the complexities of business transactions in Phoenix. It supports clear communication between parties and ensures compliance with legal standards, thereby protecting their interests in the sale process.

Free preview