Difference Between Asset Sale And Stock Sale With Sale In Phoenix

Category:

State:

Multi-State

City:

Phoenix

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

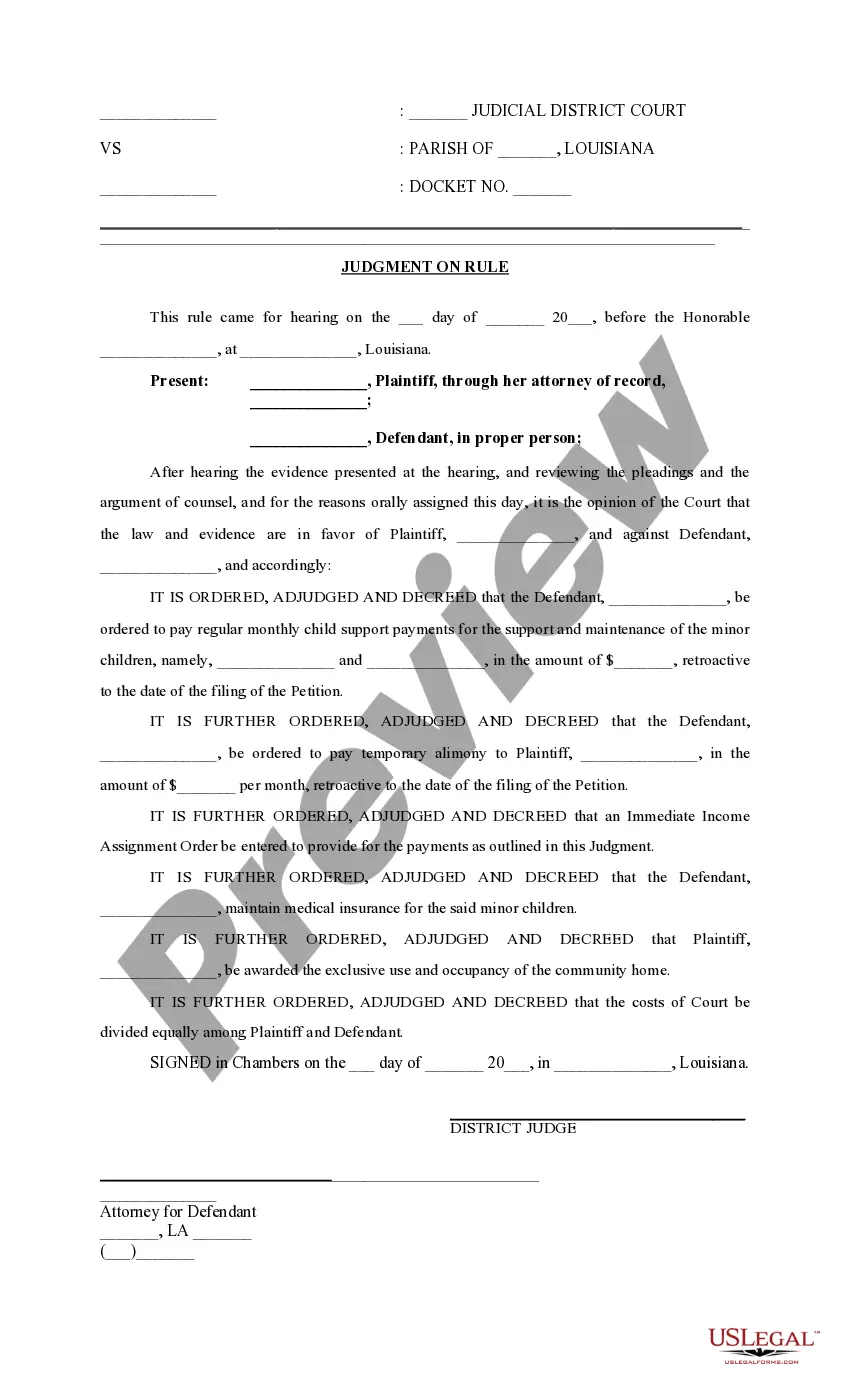

The document is an Asset Purchase Agreement that outlines the process and terms for the sale of business assets in Phoenix. It distinguishes between an asset sale and a stock sale, emphasizing that in an asset sale, the buyer acquires specific assets and may selectively assume liabilities, while in a stock sale, the buyer purchases the shares of the company, acquiring all assets and liabilities. Key features of the agreement include sections on asset descriptions, purchase price allocation, payment terms, and representations and warranties from both parties. Filling and editing instructions suggest customizing the template to reflect the specific facts of the transaction. The form is particularly relevant for legal professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants, who may require precision in documenting asset acquisitions to ensure compliance with legal standards and protections. It also offers guidance on liabilities and indemnification that professionals should consider when advising clients on business transactions.

Free preview