A purchase contract with gift of equity is a legally-binding agreement between a seller and a buyer, where the seller gifts a portion of the property's equity to the buyer. This type of arrangement is often used to help a buyer who may not have enough funds for a down payment or to qualify for a traditional mortgage. In this type of purchase contract, the seller agrees to reduce the purchase price by a specific amount equal to the gifted equity, thus giving the buyer immediate equity in the property. This can be beneficial for the buyer as it reduces the amount of the loan they need to secure and can potentially result in a lower interest rate and a more favorable loan-to-value ratio. There are different types of purchase contracts with gift of equity, including: 1. Traditional Purchase Contract with Gift of Equity: This is the most common type where the seller, usually a family member or close friend, gifts equity to the buyer. The gifted amount is subtracted from the purchase price, reducing the buyer's financial burden. 2. Employee Purchase Contract with Gift of Equity: Some employers offer their employees a purchase contract with a gift of equity as part of their benefits package. This arrangement encourages employees to become homeowners and can serve as an incentive to stay with the company long-term. 3. Non-Profit Organization Purchase Contract with Gift of Equity: Non-profit organizations sometimes facilitate home purchases by offering a gift of equity. These organizations help individuals or families with limited financial resources become homeowners, promoting community development and affordable housing. 4. Builders/Developers Purchase Contract with Gift of Equity: In some cases, builders or developers offer a purchase contract with a gift of equity as part of their marketing strategy to sell new homes quickly. This type of gift can be in the form of upgrades or incentives to make the purchase more financially appealing. 5. Government Assistance Purchase Contract with Gift of Equity: Certain government programs, such as the Federal Housing Administration (FHA), provide assistance to homebuyers by allowing a gift of equity to be used toward the purchase price, making homeownership more accessible and affordable. When entering into a purchase contract with gift of equity, both the buyer and the seller should consult with their respective real estate attorneys or professionals to ensure that all legal requirements are met and to protect their interests. Keywords: purchase contract, gift of equity, buyer, seller, equity, down payment, mortgage, loan, interest rate, loan-to-value ratio, traditional, family member, friend, employee, employer, non-profit organization, builder, developer, government assistance, real estate attorney.

Purchase Contract With Gift Of Equity

Description

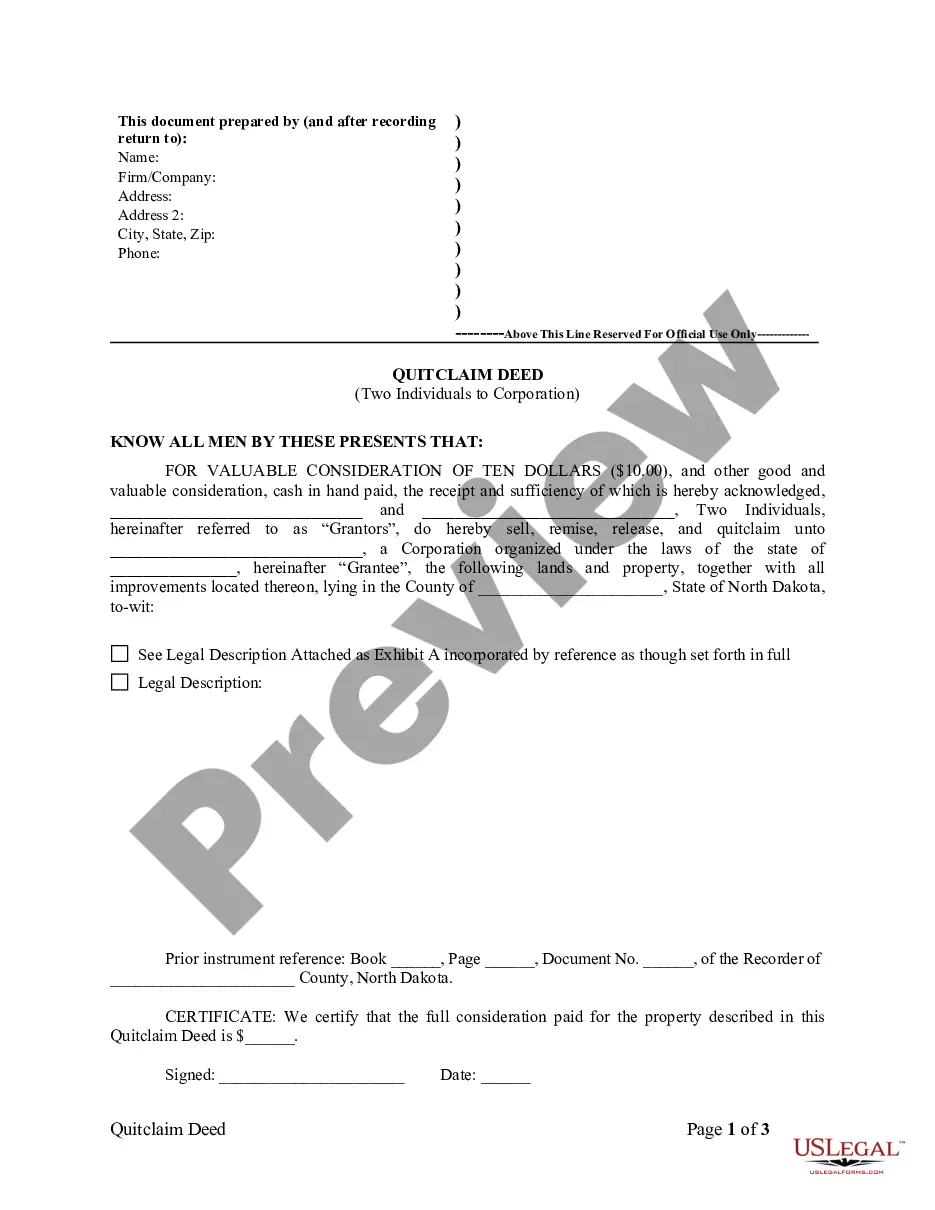

How to fill out Purchase Contract With Gift Of Equity?

Accessing legal document samples that comply with federal and state regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the right Purchase Contract With Gift Of Equity sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all papers organized by state and purpose of use. Our professionals keep up with legislative changes, so you can always be sure your form is up to date and compliant when getting a Purchase Contract With Gift Of Equity from our website.

Getting a Purchase Contract With Gift Of Equity is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the instructions below:

- Analyze the template using the Preview option or via the text outline to ensure it meets your needs.

- Locate another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Purchase Contract With Gift Of Equity and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

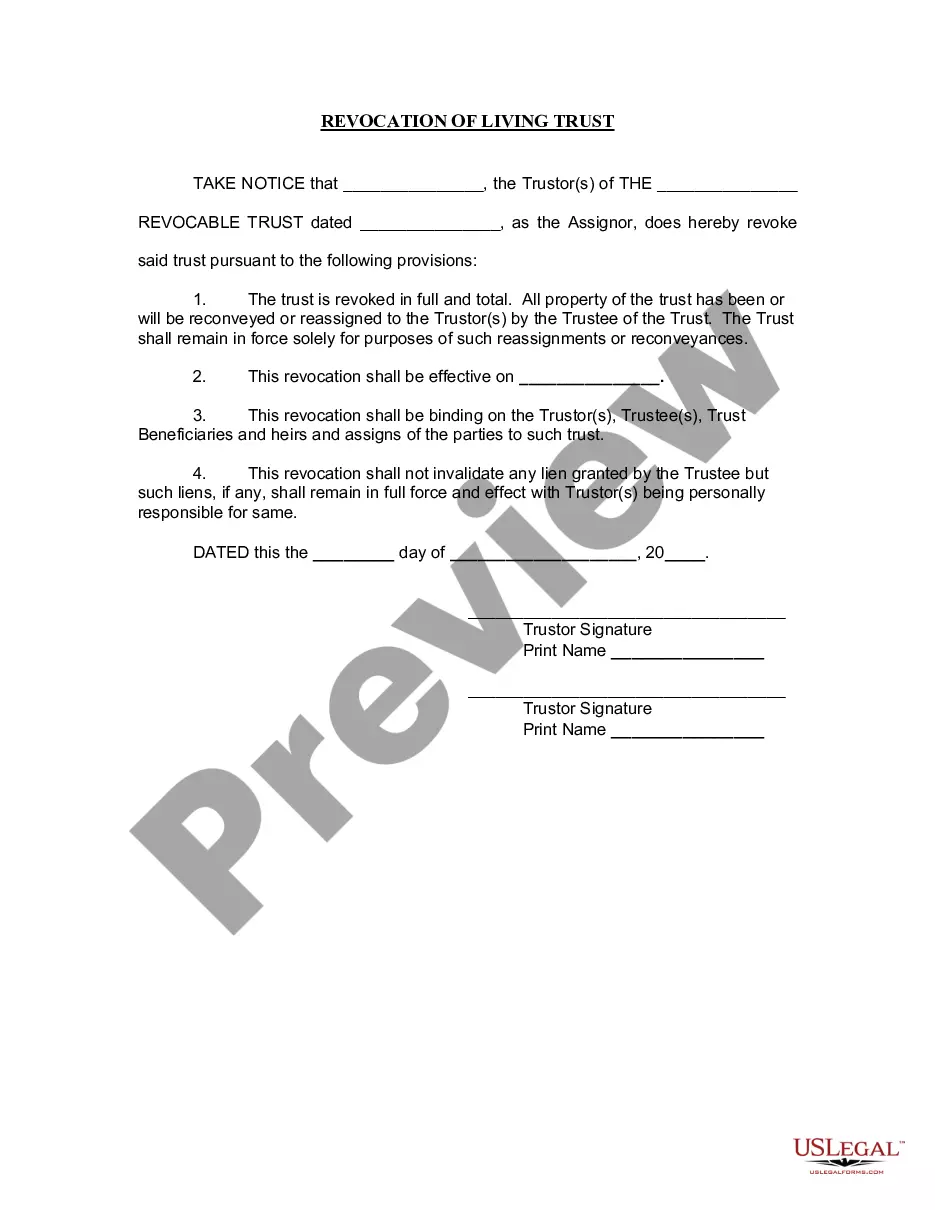

A gift of equity letter must be included in the loan file, and it should clearly state the monies are not a loan so there is no repayment involved (hence the phrase ?gifted money?). The letter should be signed by the buyer and the seller. Funds must also be properly documented through financial records.

In the case of a family gift, the amount is disclosed as an ?other credit? in the cost to close section of the Loan Estimate (LE) and the Closing Disclosure (CD). In the case of a sale for less than market value there are various opinions on the proper method of disclosure.

Sign A Gift of Equity Letter A gift letter is a document that summarizes all of the information about the gift, including the appraisal price and the sale price. Both the buyer and seller must sign the letter. A second letter will accompany other official documents at the home's closing.

Fannie also says the gift of equity can be used to pay the borrower's upfront closing costs as well as their down payment. Freddie Mac says, " ... a gift of equity is an eligible source of funds for a Mortgage secured by a Primary Residence or second home provided ... the funds are from a Related Person.?

Use the gift of equity to cover closing costs and/or the down payment and lower the overall size of your mortgage loan. Your lender will have you fill out a gift of equity form which will need to be signed by both the seller and the borrower. With the gift of equity, the seller doesn't expect to ever receive repayment.