Sale Of Assets Vs Sale Of Business In Sacramento

Category:

State:

Multi-State

County:

Sacramento

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

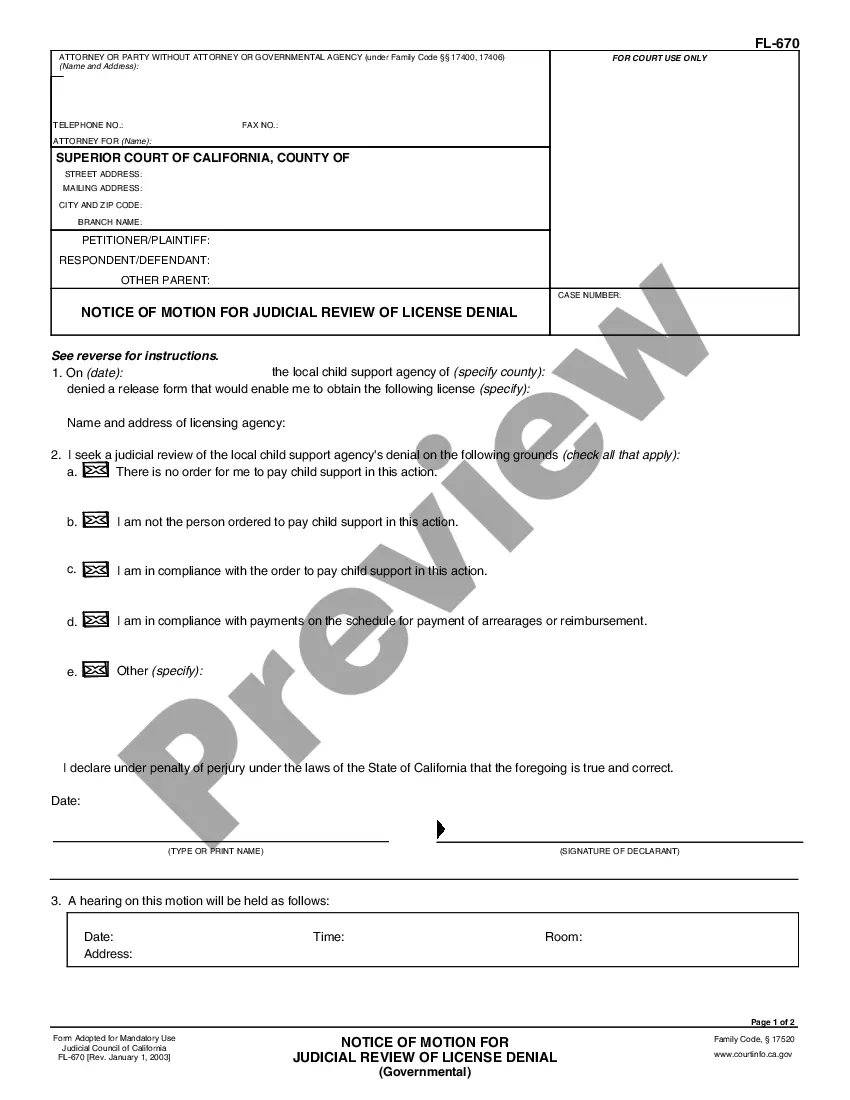

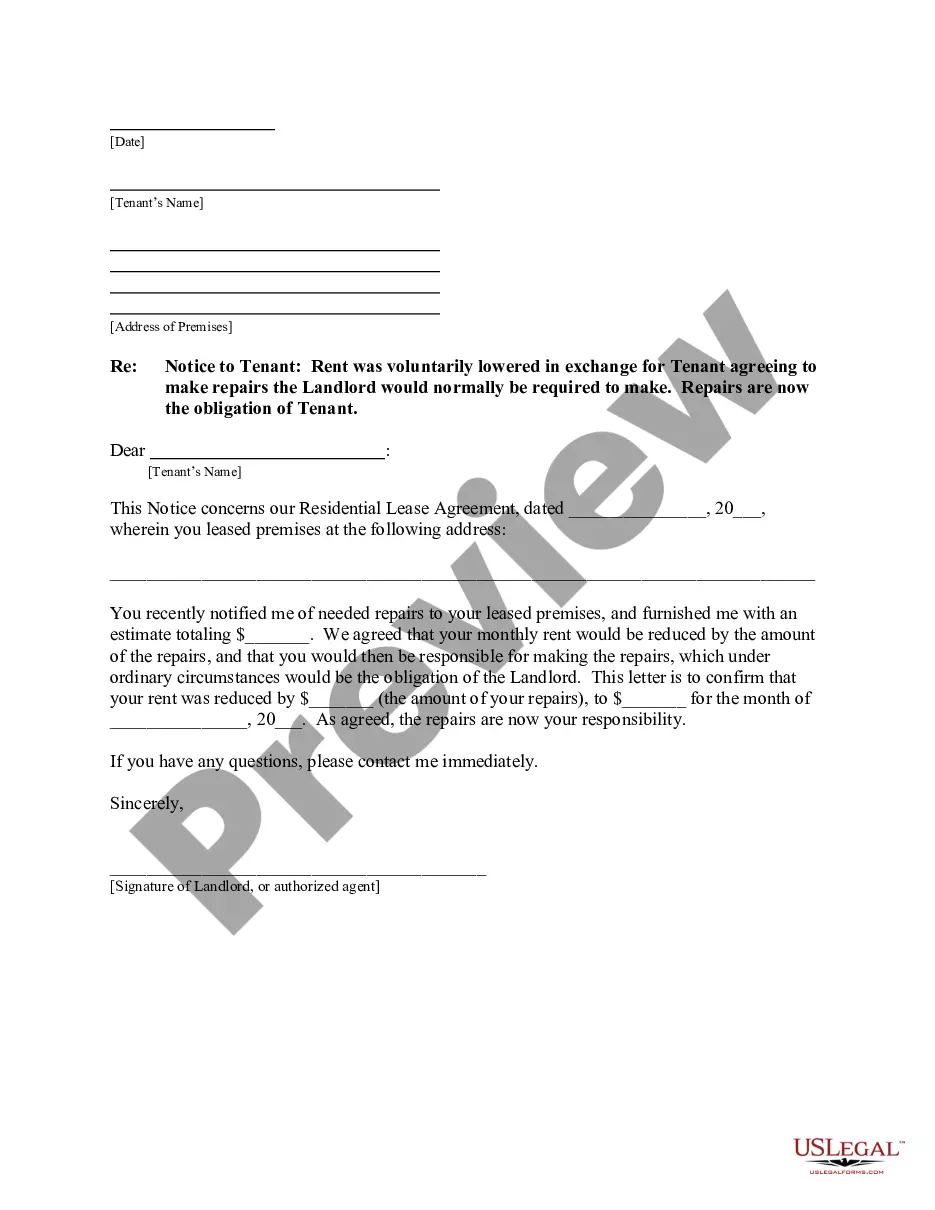

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Many Buyers will require that a sale be structured as an Asset Purchase in order to avoid responsibility for prior liabilities or expenses of the business. However, tax would generally not apply to sales of business assets held or used for haircutting services such as trimmers and blow dryers.If you sold any business assets, such as fixtures and equipment, during the reporting period, you must report the sale. A stock purchase is a complete purchase of a company, including all the assets and liabilities. Stock purchases thus have different tax outcomes. Asset sales offer more tax benefits to buyers. If you sold business-use property during the year, you had a gain or a loss on the sale. Complete and file Form 4797: Sale of Business Property. The purpose of this document is to provide a brief summary of the many steps in the escrow process. When reporting a sale, include the new owner's name and mailing address.