Sale Of Business Assets Agreement With Seller Financing In San Diego

Category:

State:

Multi-State

County:

San Diego

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

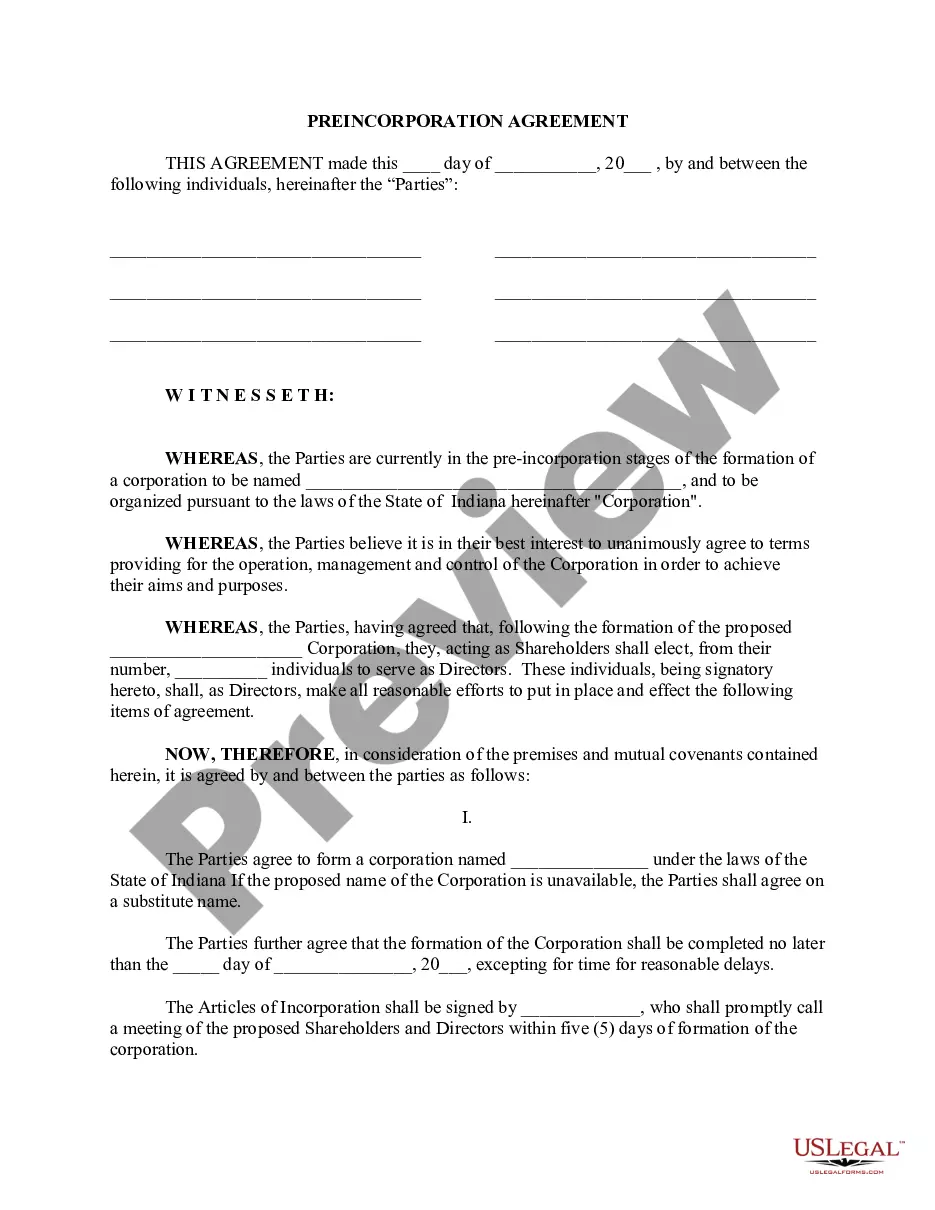

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

The key documents in a seller financing transaction include: (1) Purchase Agreement; (2) Promissory Note; and (3) Deed of Trust. We'll discuss seller financing for business and how it works, as well as highlight the pros and cons for both buyers and sellers.Typically, this involves two documents: a financing agreement (basically a loan document outlining the details and terms of the loan) and a promissory note. The buyer must complete Form 593-I, "Real. Estate Withholding Installment Sale Agreement. A business purchase agreement is a legal contract specifying terms for buying or selling a business, including conditions and obligations.