Asset Business Sale Form With Tax Id In Tarrant

Category:

State:

Multi-State

County:

Tarrant

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

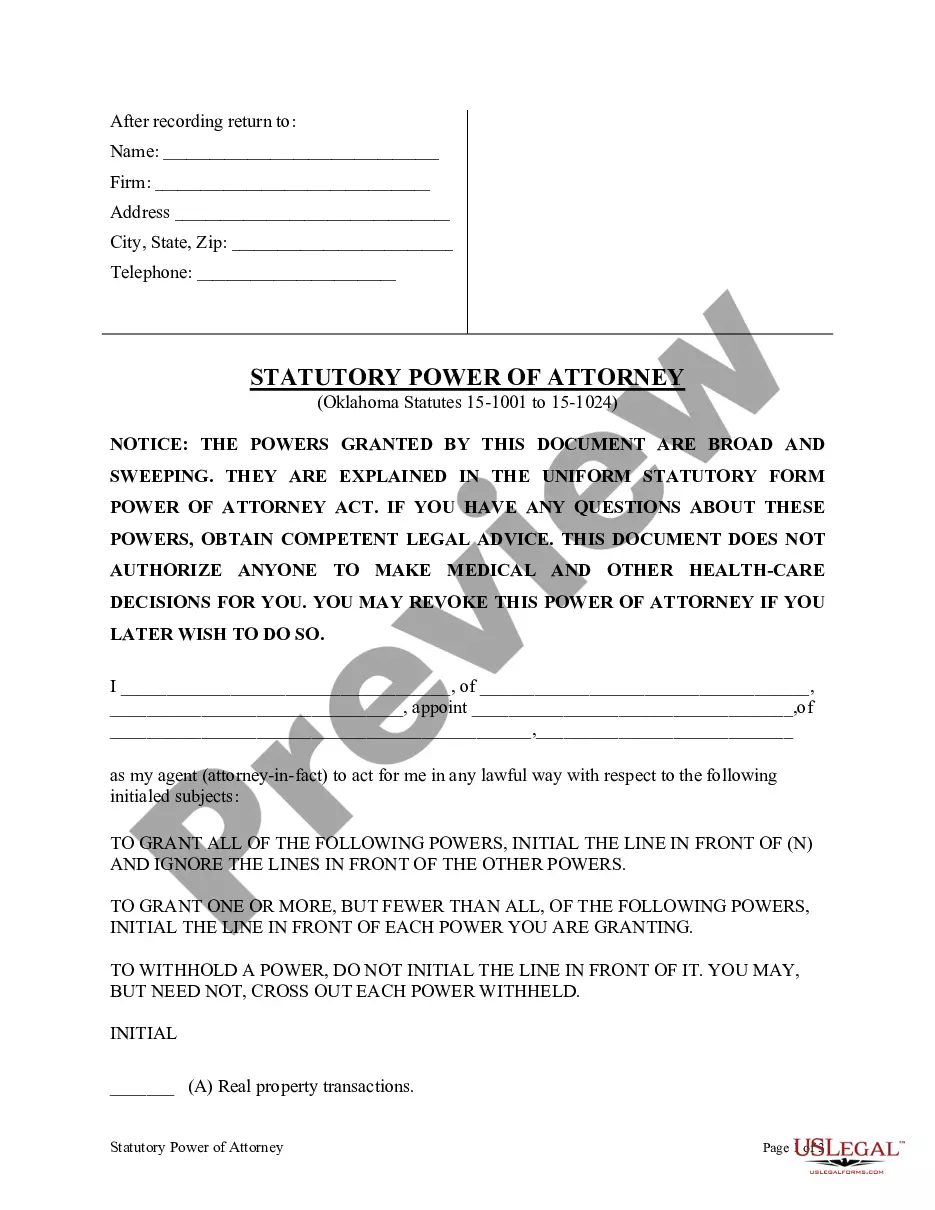

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Both the seller and purchaser of a group of assets that makes up a trade or business must use Form 8594 to report such a sale. This application must be filed at least 20 days before either taking possession of the business assets or paying for them, whichever comes first.Look on the Sales and Use tax menu under Account Self-Service and select "Request a Duplicate Sales Tax Permit". Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. Provide a bidders registration, which may be downloaded from the Delinquent Tax Sales website or filled out before a.m. Each item below must be included in the bid packet to the City of Fort Worth Purchasing Department located at 200.