Business Partner Buyout Agreement With Seller Financing In Texas

Description

Form popularity

FAQ

Partnership Buyout Formula You can use a simple formula to determine your partner's share in the company. First, find out the appraised value of the business. Then, multiply that value by the percentage of ownership your partner holds in the company.

Partnership Buyout Formula For example, if your partner owns 45% of the company and the appraised value of the business is $1 million, the calculation would be 1,000,000 x . 45 = 450,000. This means your partner's share in the company is $450,000.

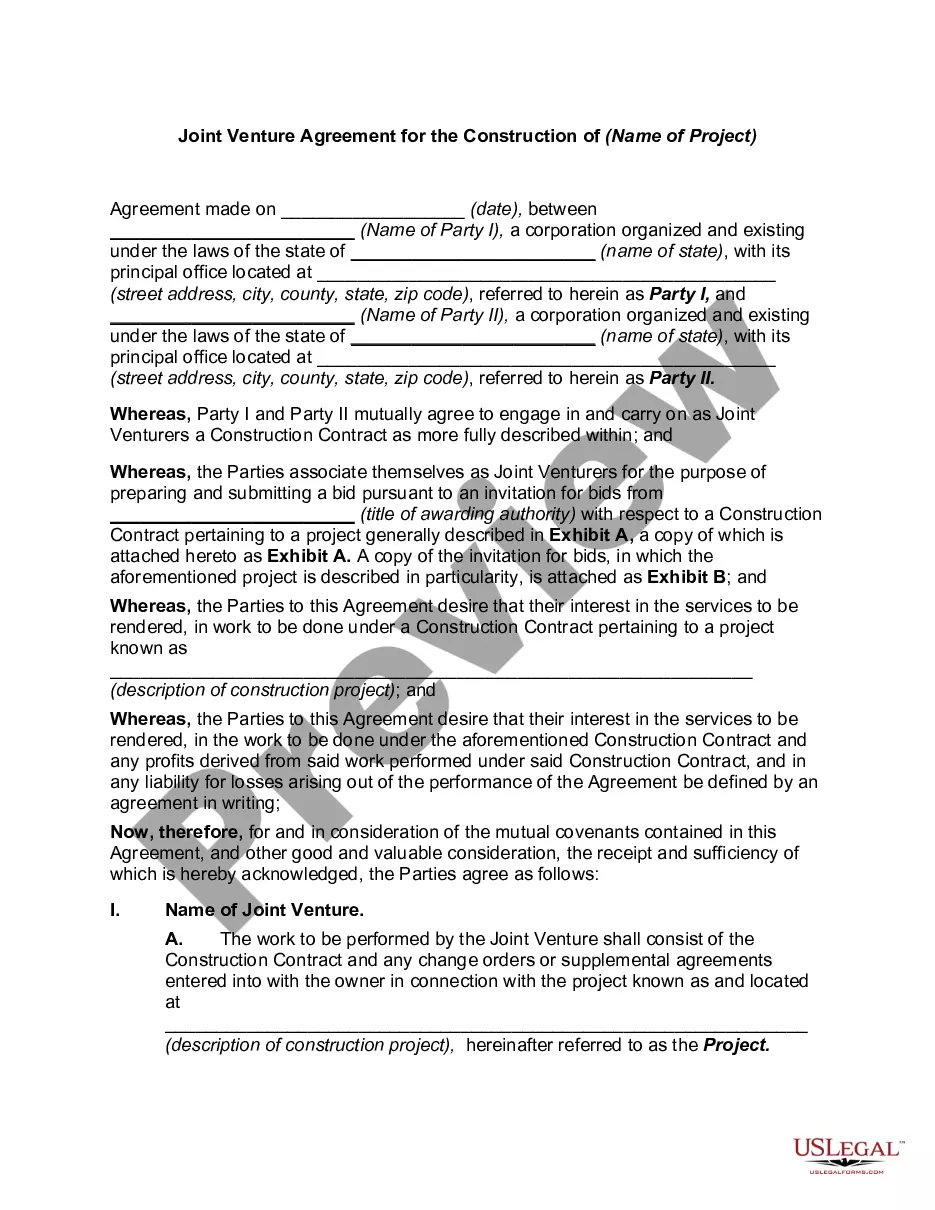

Partner buyout financing refers to the financial arrangement used to facilitate the buyout of a partner's ownership stake in a business by the remaining partners. This type of financing allows the remaining partners to acquire the shares or ownership interest held by a departing or retiring partner.

The formula takes the appraised value of the business and multiplies that number by the percentage of ownership your partner has in the company. Ex: Partner owns 45%, and the company is appraised at $1 million. That would look like: 1,000,000 x . 45 = 450,000.

Established Business: Offer 5% to 10% if they can demonstrate a clear strategy to drive sales growth. Ultimately, the right percentage will depend on the specific circumstances of your business and the individual partner's contributions.

The steps involved include: File a Partnership Dissolution Form. Notify the Parties Associated with the Business. Settle all Debts and Liabilities. Divide Assets. Close All Company Accounts. Strategies for Resolving Conflicts Amicably.

Start with a basic agreement on roles, responsibilities and control. Then, plan to hash out other issues as they arise over time, she said. If you're adding a partner because he or she offers something you lack, make that clear. Spell out your long-term goals as well to make sure you're on the same page.