Difference Between Asset Sale And Stock Sale With Sale In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

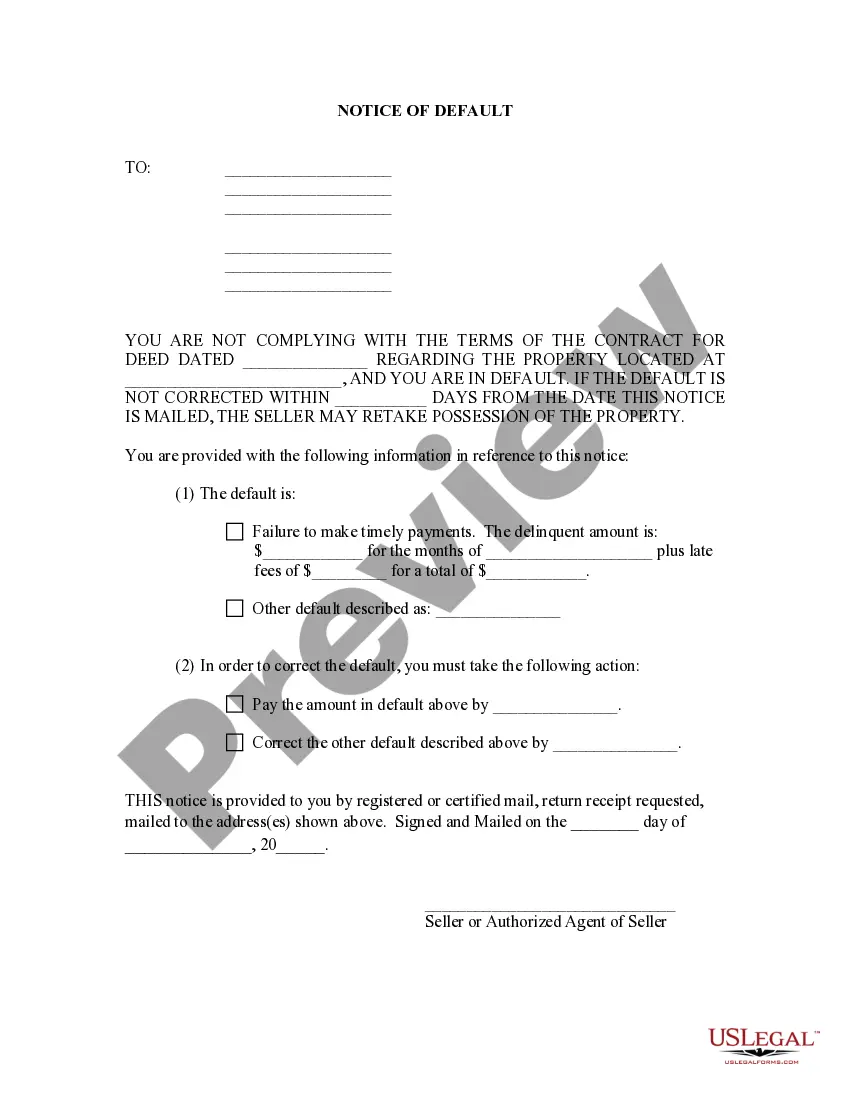

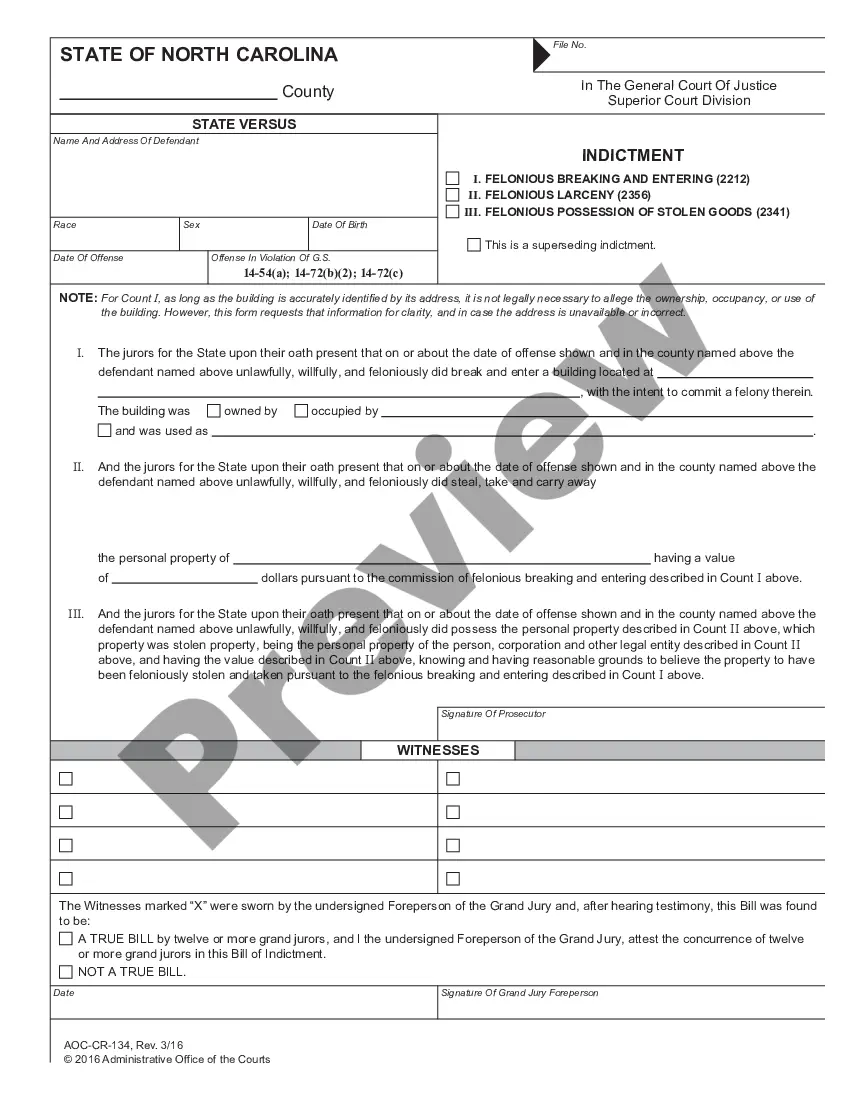

The document is an Asset Purchase Agreement that outlines the differences between an asset sale and a stock sale, particularly in the context of transactions in Travis. In an asset sale, the buyer purchases specific assets, such as equipment and inventory, while assuming certain liabilities, which allows for selective acquisition and often minimizes risk for the buyer. Conversely, a stock sale involves the transfer of ownership of the company itself, including all assets and liabilities. This form includes key features such as detailed sections on the assets being sold, liabilities assumed, purchase price allocation, and conditions precedent to closing. Users are instructed to modify the template to fit their facts, providing clarity on necessary adjustments. The target audience, including attorneys, partners, owners, associates, paralegals, and legal assistants, will find this form useful for structuring transactions, ensuring compliance with legal requirements, and protecting their interests during negotiations. Filling and editing instructions are straightforward, helping users to effectively utilize the form in various business contexts.

Free preview