Sale Business Asset With Gst Journal Entry In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

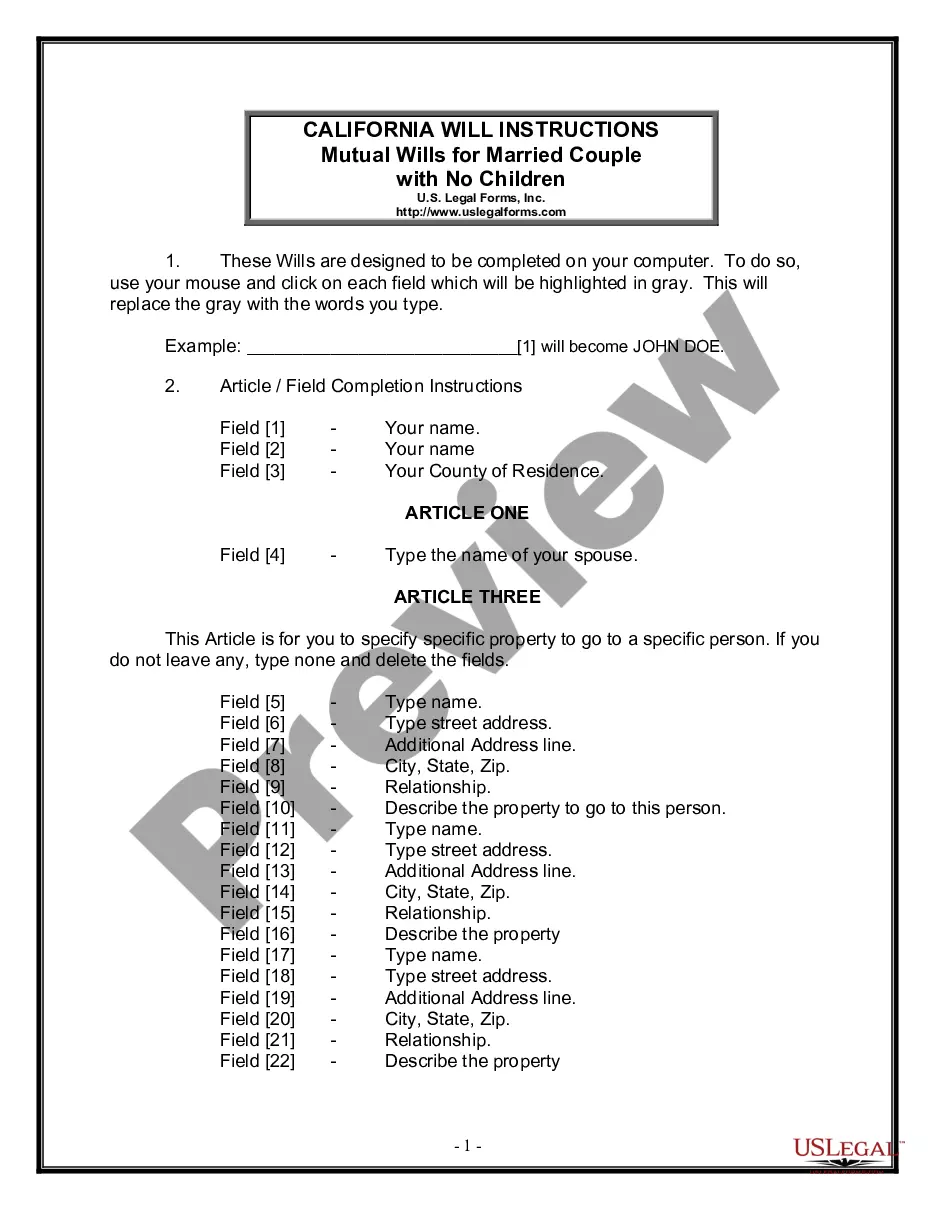

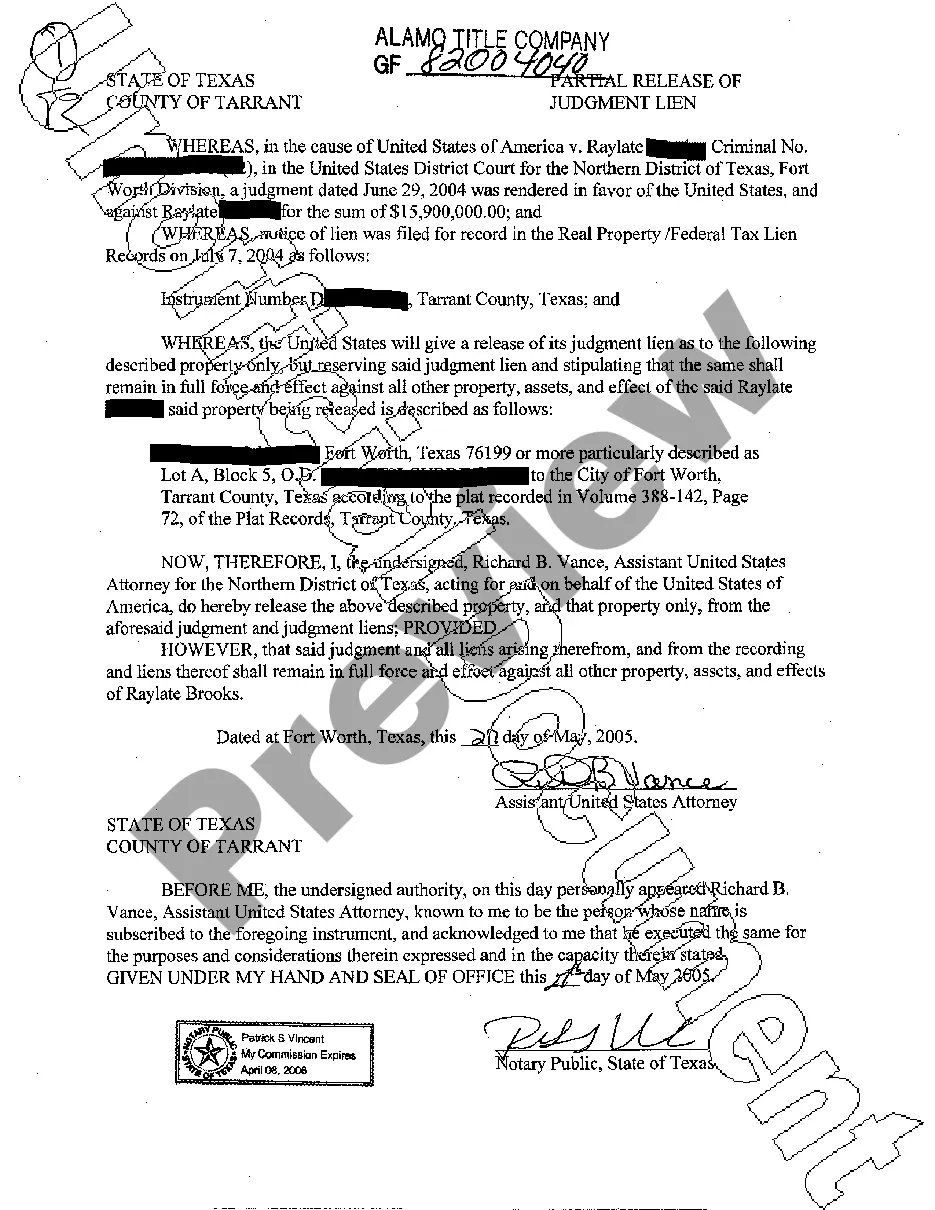

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

The selling price is direct from your settlement sheet. The underlying assets sold may have a current value of zero if fully depreciated.The equipment sold is used. Under a perpetual inventory system, journalize the entries required for these transactions. When we're talking about the gain or loss of the sale of an asset we need to be looking at net book value at the time of the sale. Businesses must record sales tax collections and payments for organized and accurate books. The journal entries for the above transactions under a perpetual inventory system are as follows:1.