Asset Sale For Business In Utah

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

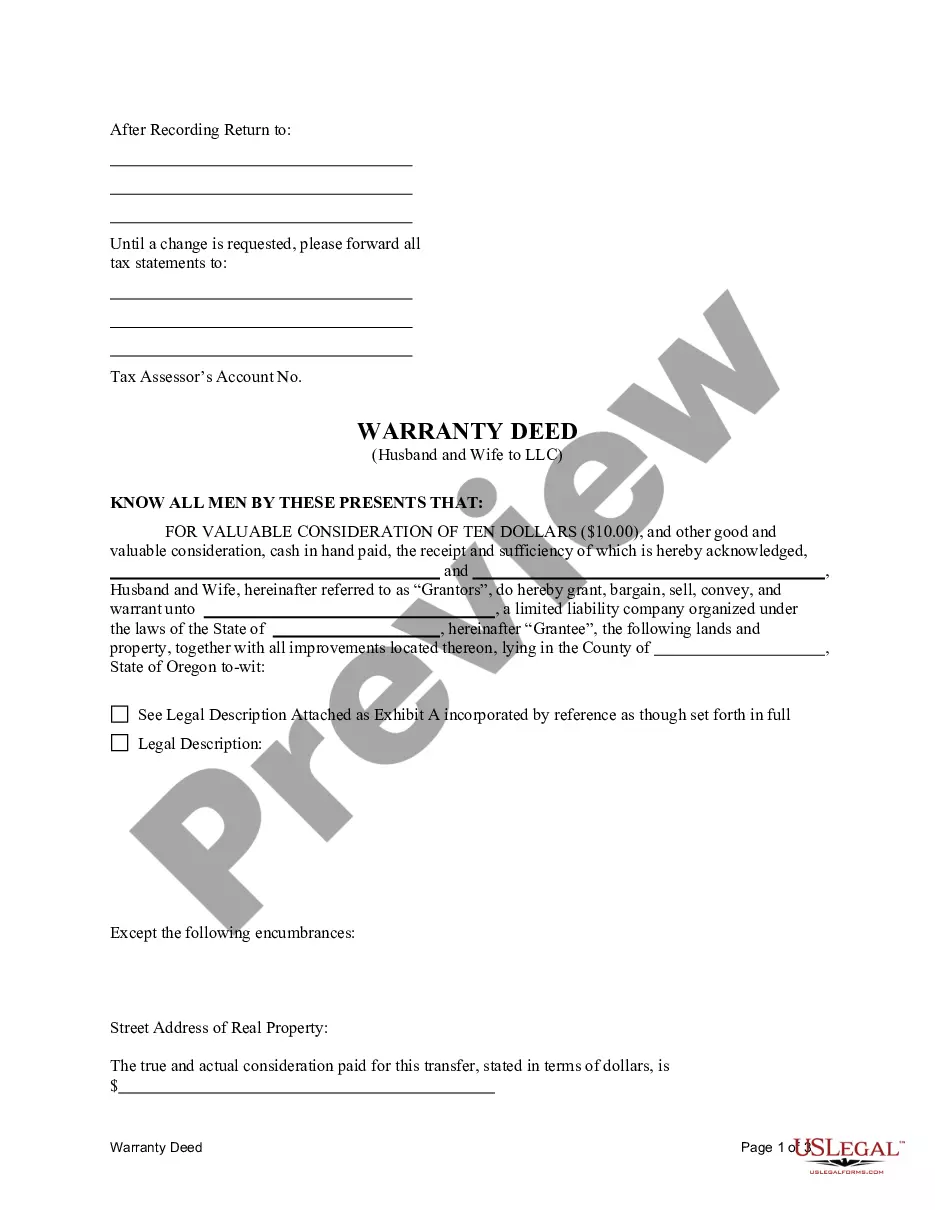

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

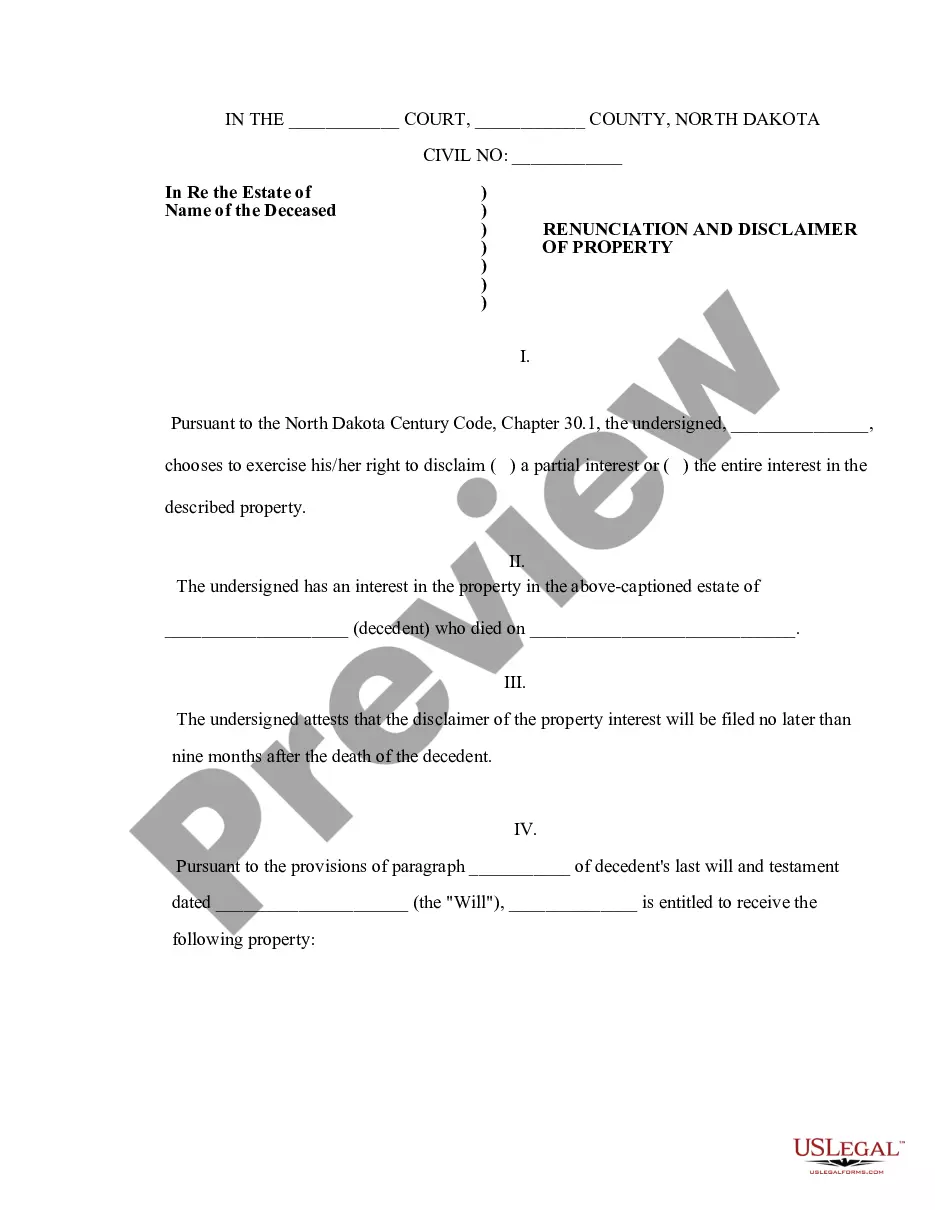

If you are selling a business Utah law requires you to: File final tax returns within 30 days of the business sale. Appendix A: Site References; Legal Description.How to Sell a Business in Utah. Here are the steps you must take when selling your business in the Beehive State: Prepare your business' documentation. Use a Business Bill of Sale to set out the terms for the sale of a business and transfer the ownership and all assets to the buyer. An asset sale will likely result in a combination of gain taxed at both ordinary and capital gains rates, depending on the nature of the individual assets. You must prepare a sales agreement to sell your business officially. This document allows for the purchase of assets or stock of a corporation. Our business law experts provide tailored solutions for business and asset purchases. In an asset sale, the new owner purchases the business's physical assets.