Difference Between Asset Sale And Business Sale In Wake

Category:

State:

Multi-State

County:

Wake

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

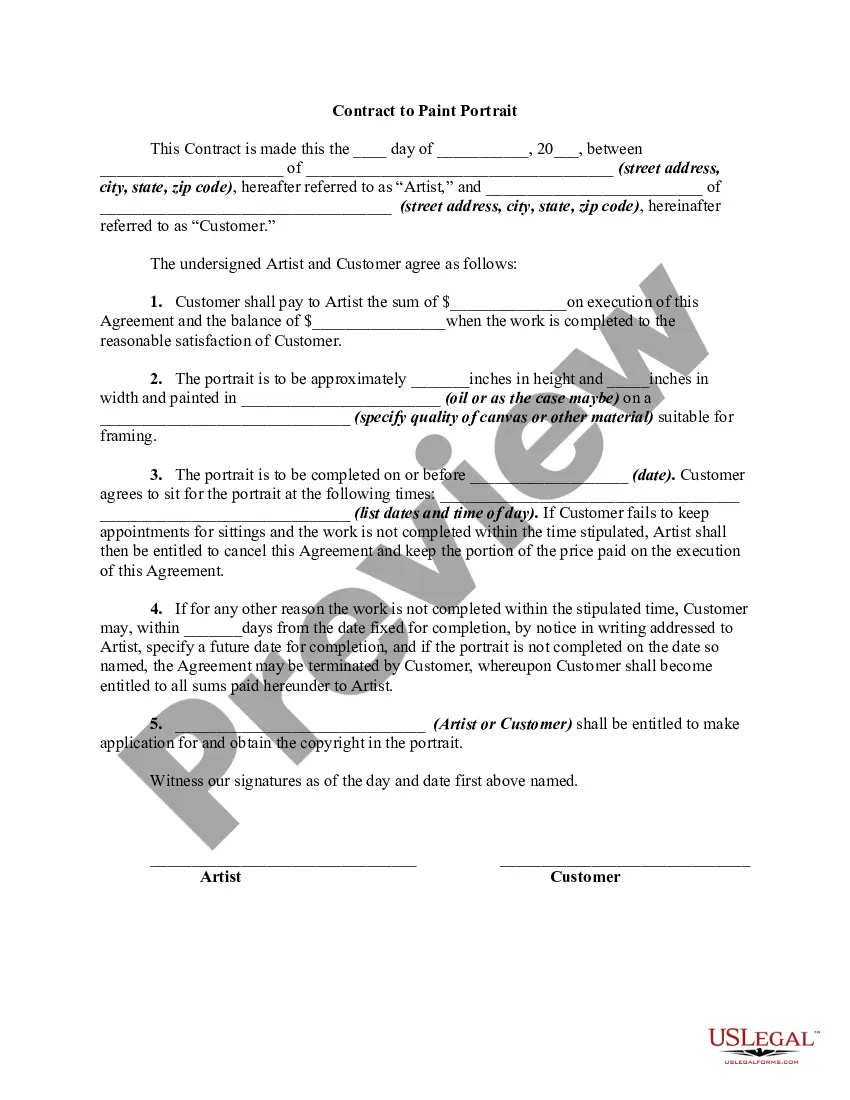

The document primarily outlines the differences between an asset sale and a business sale in Wake, focusing on specific features pertinent to both types of transactions. In an asset sale, only the specified assets such as equipment, inventory, and contract rights are sold, while a business sale typically involves the sale of the company's entire stock or ownership interests. The form details the requisite provisions for asset purchases, including the assumption of liabilities and a clear outline of what assets are excluded from the sale. Attorneys, partners, and other legal professionals can utilize this form to facilitate transactions, ensuring compliance with local regulations and protecting their clients' interests. It provides structured guidelines for negotiations, payment schedules, and closure procedures. Furthermore, the document includes instructions for filling out and editing specific sections, which are vital for accurate documentation. Relevant use cases include structuring negotiations for a client buying or selling a business, determining asset values, and ensuring clarity in liabilities and obligations.

Free preview