Asset Purchase Agreement Form Irs In Washington

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

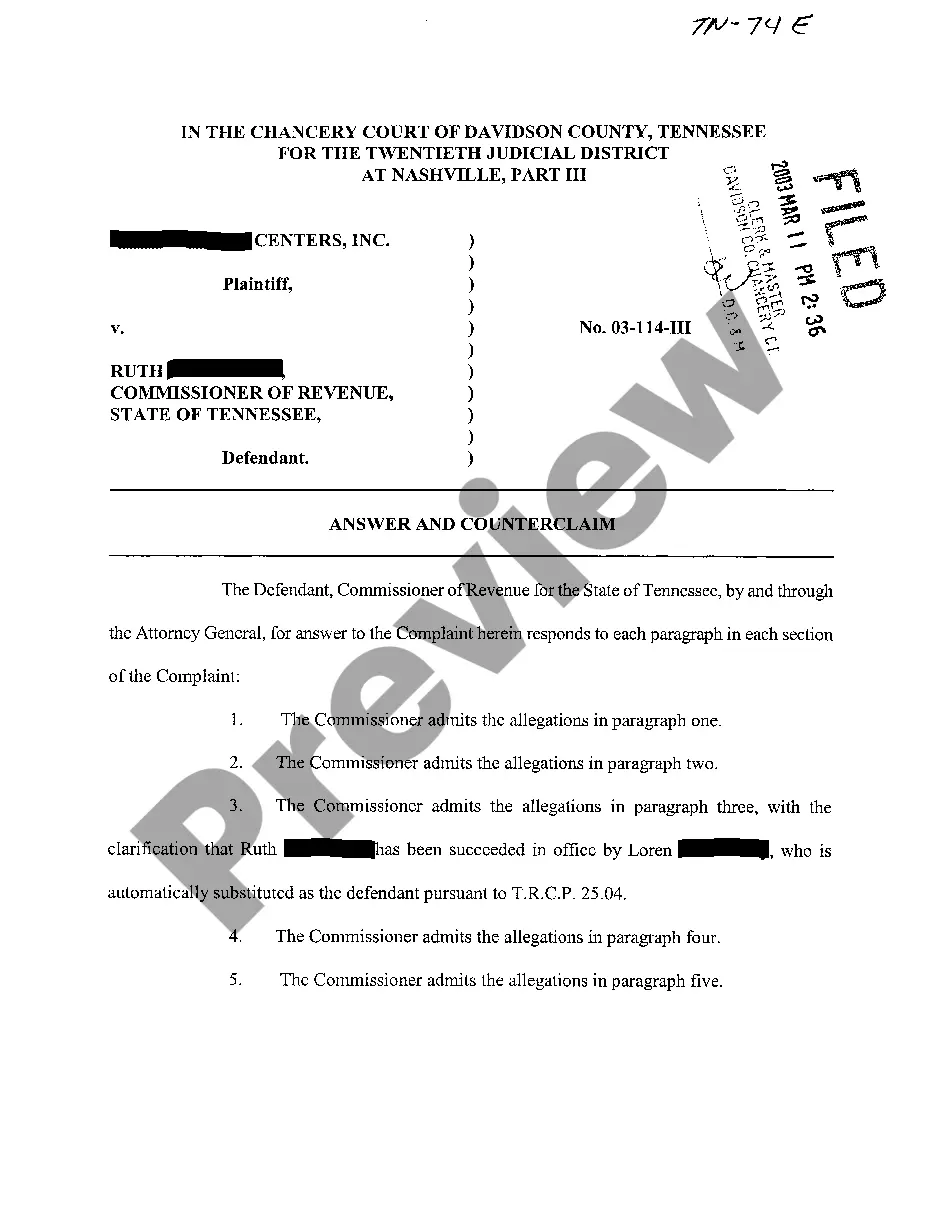

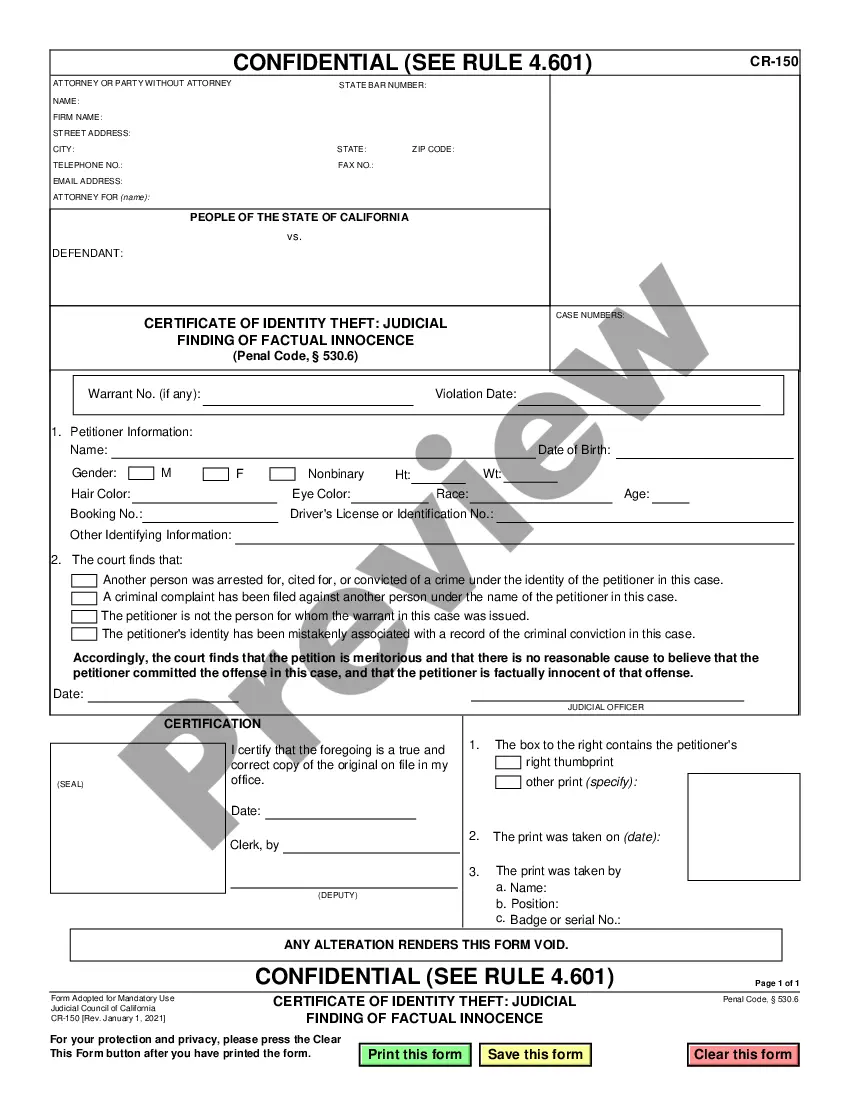

Description

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Both the seller and purchaser of a group of assets that makes up a trade or business must use Form 8594 to report such a sale. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity.The buyer of business assets and the seller must independently report to the IRS the purchase price allocations that both use. When buying the assets of a business, some are subject to sales or use tax, while others are not. Items subject to retail sales tax. Purchaser shall also pay at Closing any and all amounts due to the State of Washington that are associated with the sale under this Agreement,.