Deferred Compensation Plan For Government Employees In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

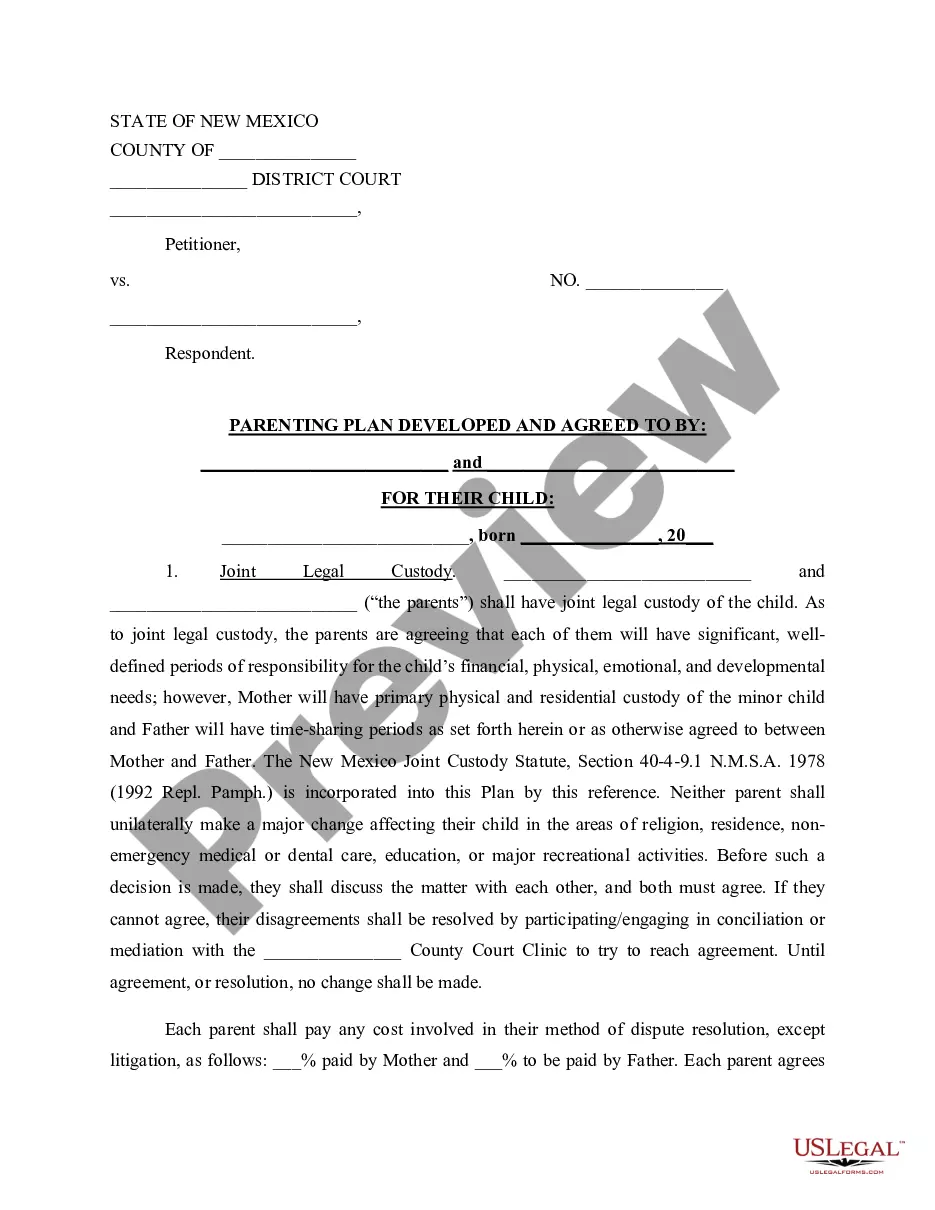

The Deferred Compensation Plan for government employees in Clark is a formal agreement designed to ensure supplemental income for employees post-retirement. The agreement outlines the amounts payable to employees upon retirement, as well as provisions for beneficiaries in the event of the employee's death. Key features include monthly payments based on a multiplier related to the National Consumer Price Index, termination terms depending on employment status, and a non-compete clause to protect the interests of the Corporation. This form is crucial for attorneys, partners, owners, associates, paralegals, and legal assistants working with government employees, as it provides a framework for retaining talent while ensuring financial security post-employment. Detailed filling and editing instructions allow for personalized agreements tailored to specific terms the Corporation may want to enforce. This specialized form is relevant for those in personnel management, providing essential protections and clarifications about employee benefits and obligations.

Free preview