Ohio Deferred Comp Withdrawal In Dallas

Category:

State:

Multi-State

County:

Dallas

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

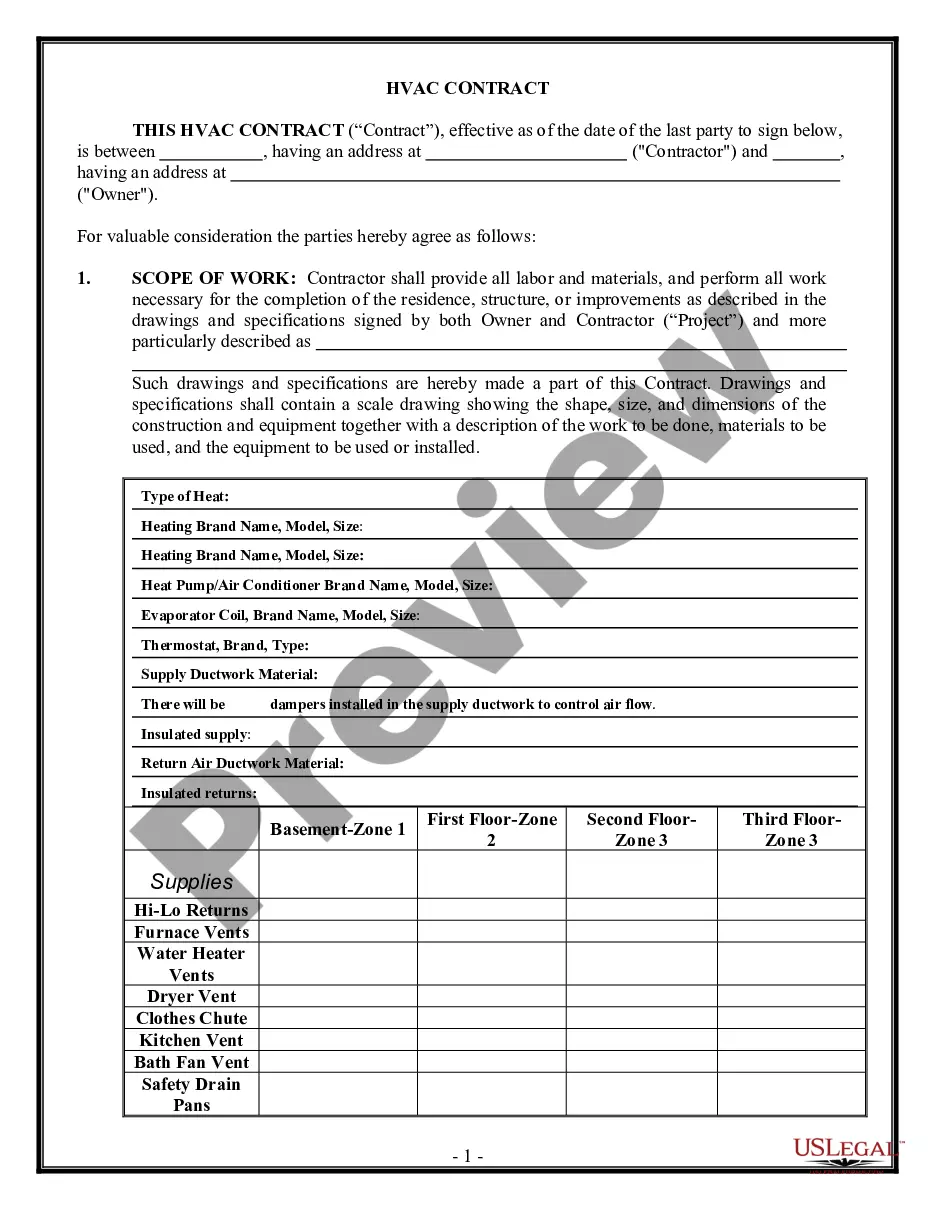

The Ohio Deferred Comp Withdrawal in Dallas form facilitates the process of withdrawing from a deferred compensation plan established by an employer for an employee. This agreement outlines the terms for payments made to an employee upon retirement, detailing the payment amounts and conditions surrounding both retirement and death of the employee. Key features include provisions for monthly payments post-retirement, conditions under which payments continue after the employee's death, and multipliers based on the National Consumer Price Index to adjust monthly payments for inflation. The form necessitates careful filling, requiring the accurate entry of names, addresses, and financial amounts, ensuring clarity in the agreement. It is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in employment law, as it underscores the legal obligations of both the employer and employee. It can serve as a vital tool for legal representatives when negotiating terms of employment compensation, ensuring compliance with applicable laws, and protecting the interests of both parties in the contractual relationship.

Free preview