Deferred Compensation Plan Vs 401k In North Carolina

Category:

State:

Multi-State

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

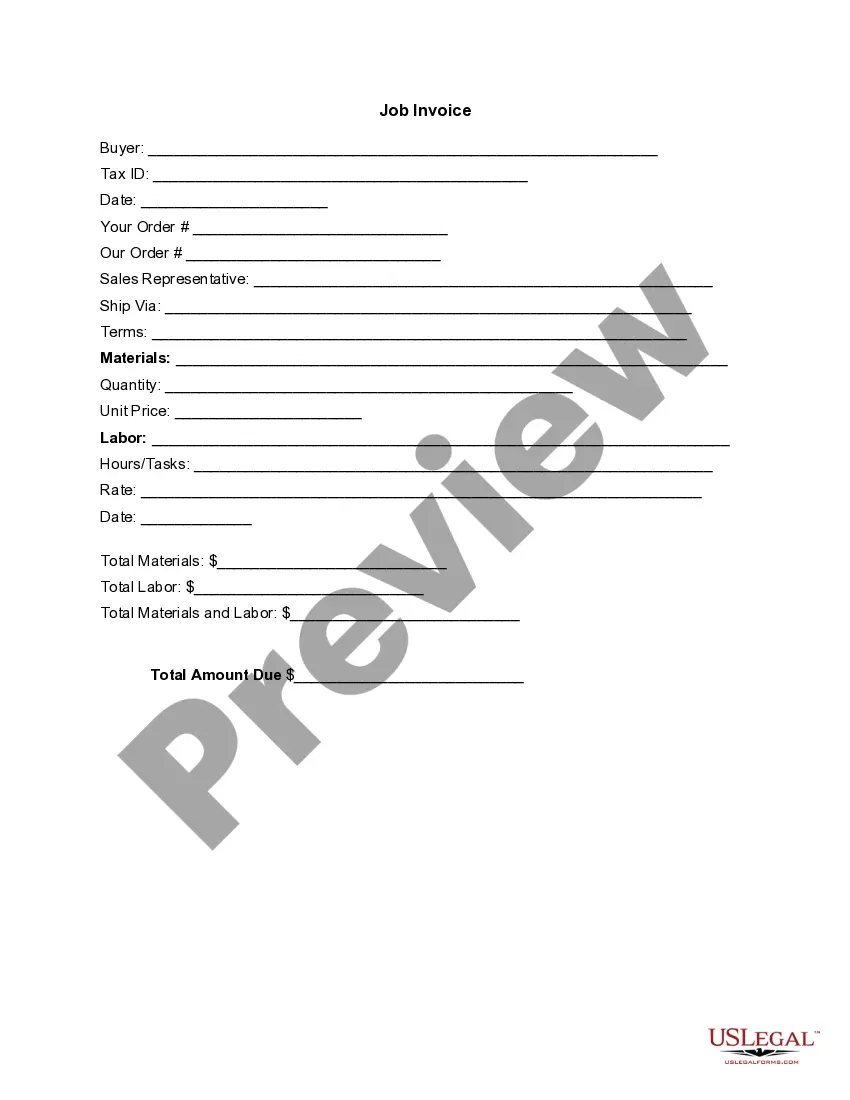

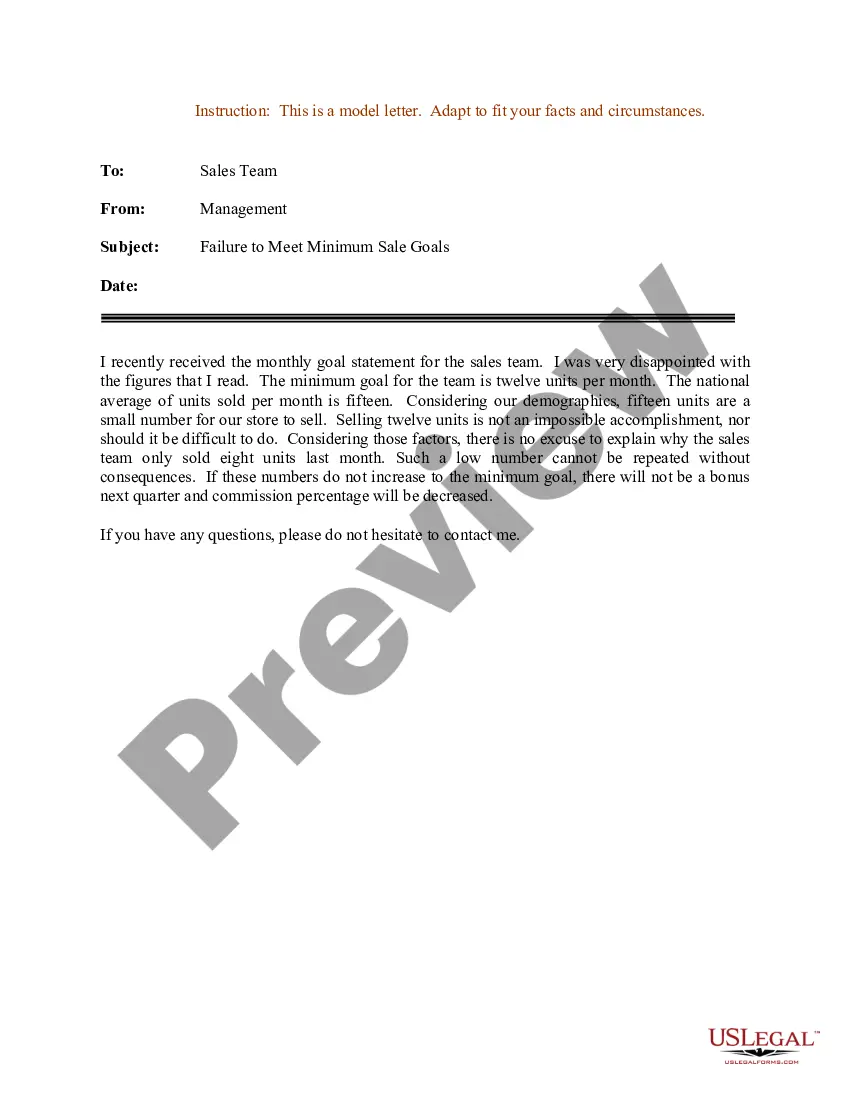

Description

The Deferred Compensation Agreement is a document designed to outline the terms between an employer and employee regarding a deferred compensation plan, as opposed to a traditional 401k plan, particularly in North Carolina. This type of agreement provides extra financial benefits to key employees after retirement, ensuring post-retirement income or death benefits for beneficiaries, which surpass the compensation from regular pension plans. Key features include specific monthly payment amounts, conditions for payment upon retirement or death, multipliers based on cost-of-living indices, restrictions on employment with competitors, and terms of termination and secession of payments. To fill out this form, users must provide certain details, including the names of the corporation and employee, payment amounts, and timelines. This agreement serves as a useful tool for attorneys, partners, and business owners for negotiating executive compensation; for associates and paralegals to assist in drafting agreements; and for legal assistants to manage compliance with legal requirements surrounding deferred compensation.

Free preview