Asset Purchase Buy With Gst Entry In Illinois

Category:

State:

Multi-State

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

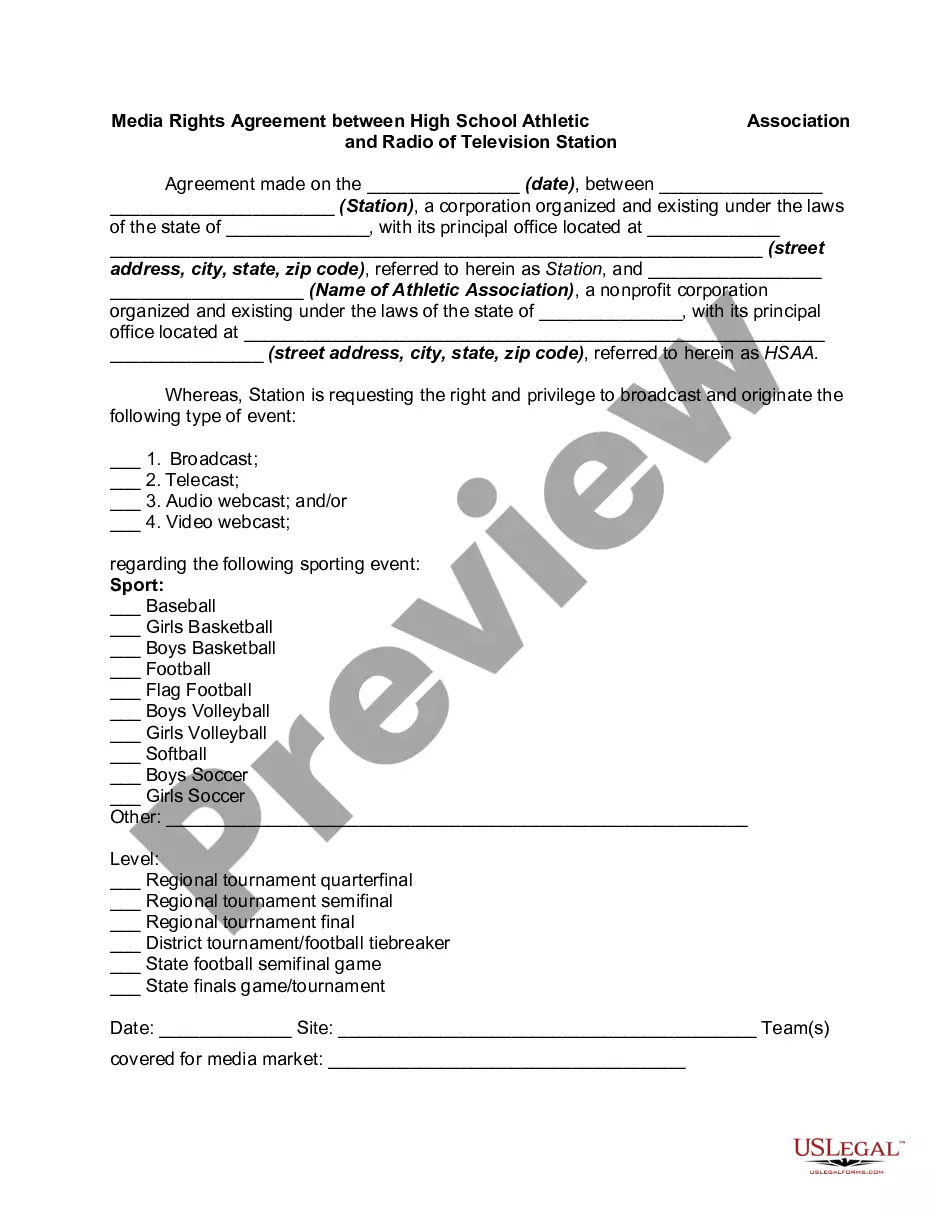

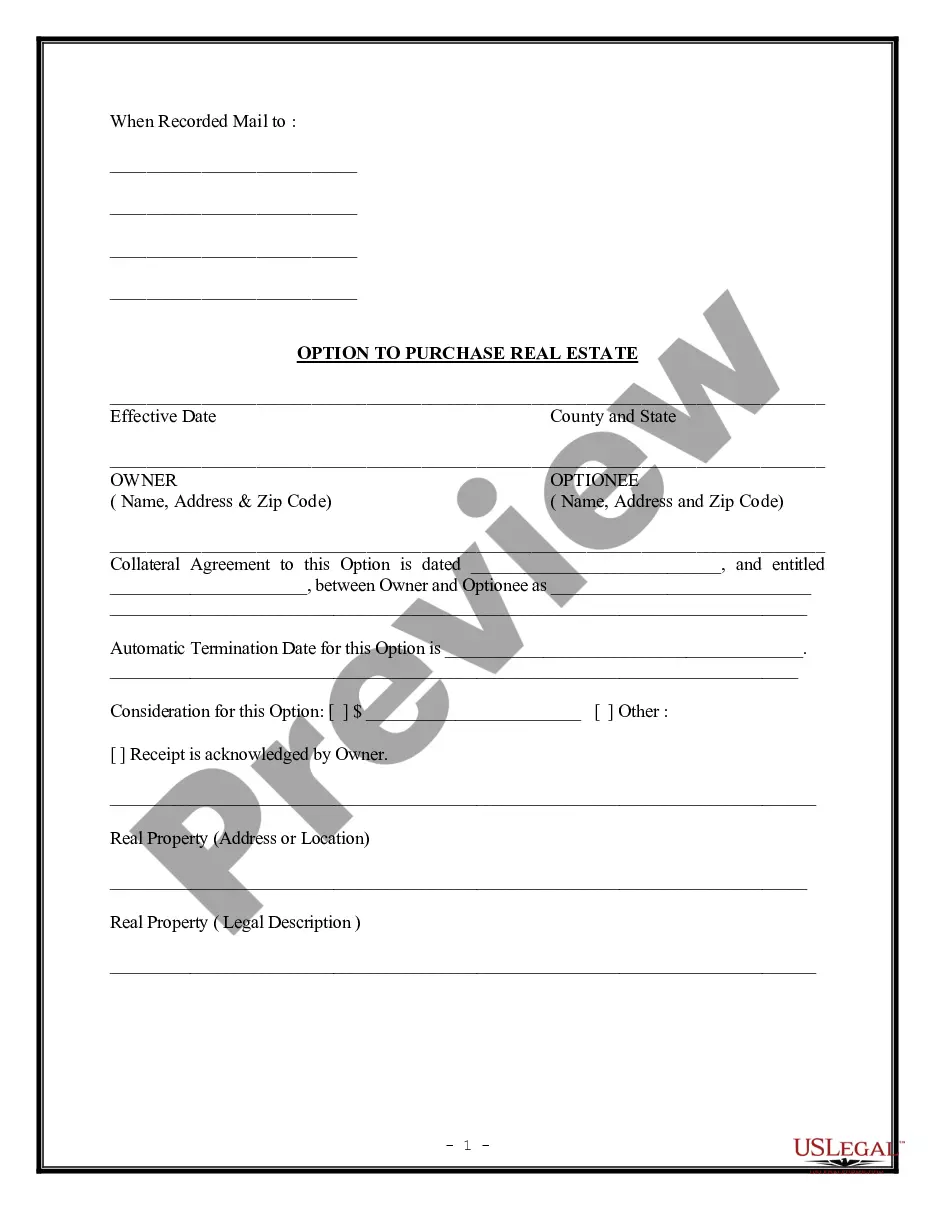

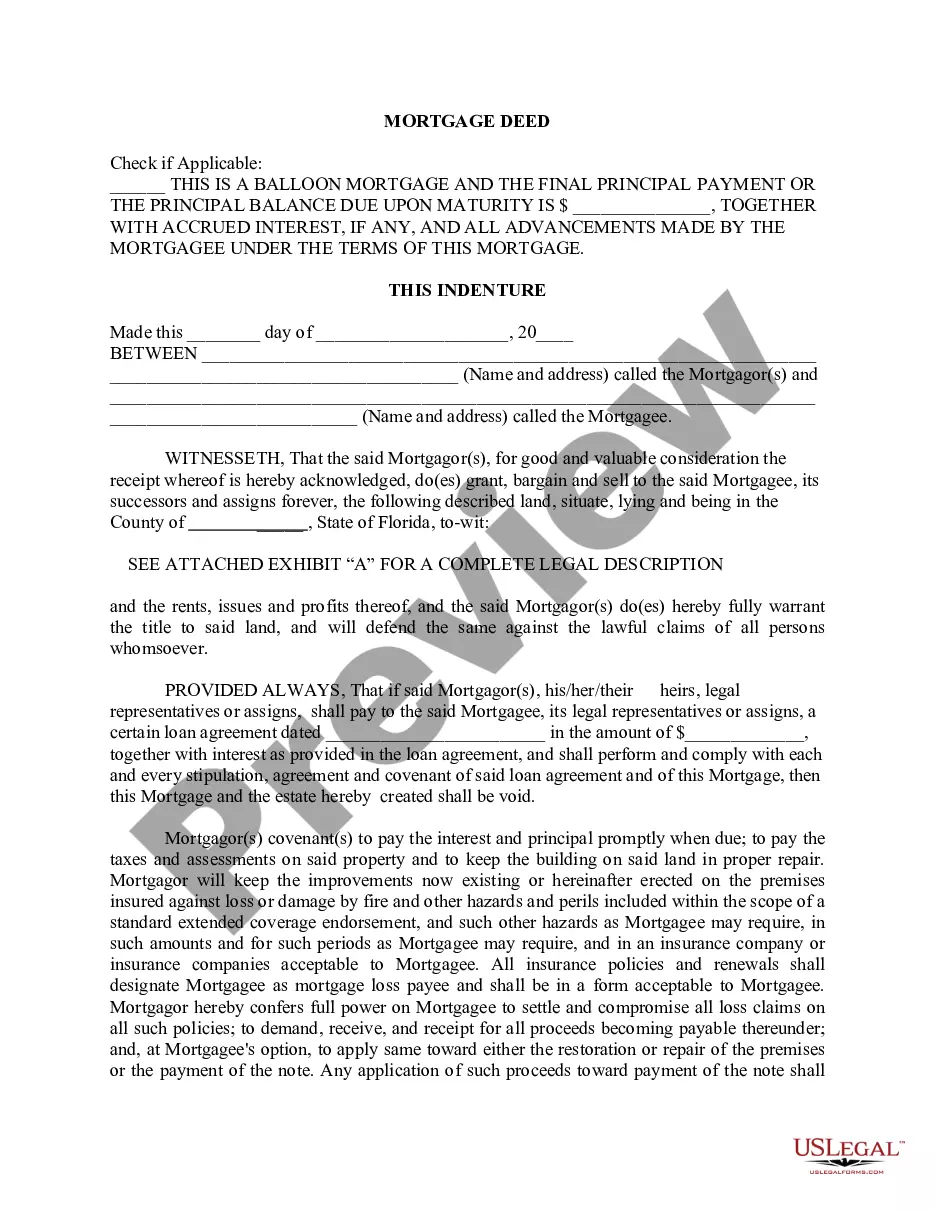

The Asset Purchase Agreement is designed for buyers and sellers in Illinois to facilitate the acquisition of business assets, ensuring compliance with tax obligations, such as the Goods and Services Tax (GST). This form outlines the specifics of assets included in the purchase, excluding liabilities, and includes provisions for payment structures. Key features include sections detailing the purchase price allocation, the obligations of both buyer and seller, and the representations and warranties offered by both parties. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form to navigate the complexities of asset transfers while ensuring legal protections are in place, particularly regarding undisclosed liabilities. Filling instructions emphasize clarity, requiring accurate details for each section, while editing should focus on customization to reflect the unique circumstances of the transaction. Use cases relevant to the target audience include mergers and acquisitions, business succession planning, and resolving conflicts in asset buyouts. This form helps streamline the legal process of asset transfer, providing a clear framework for negotiation and transaction finalization.

Free preview