Asset Purchase Of A Business In Nevada

Category:

State:

Multi-State

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

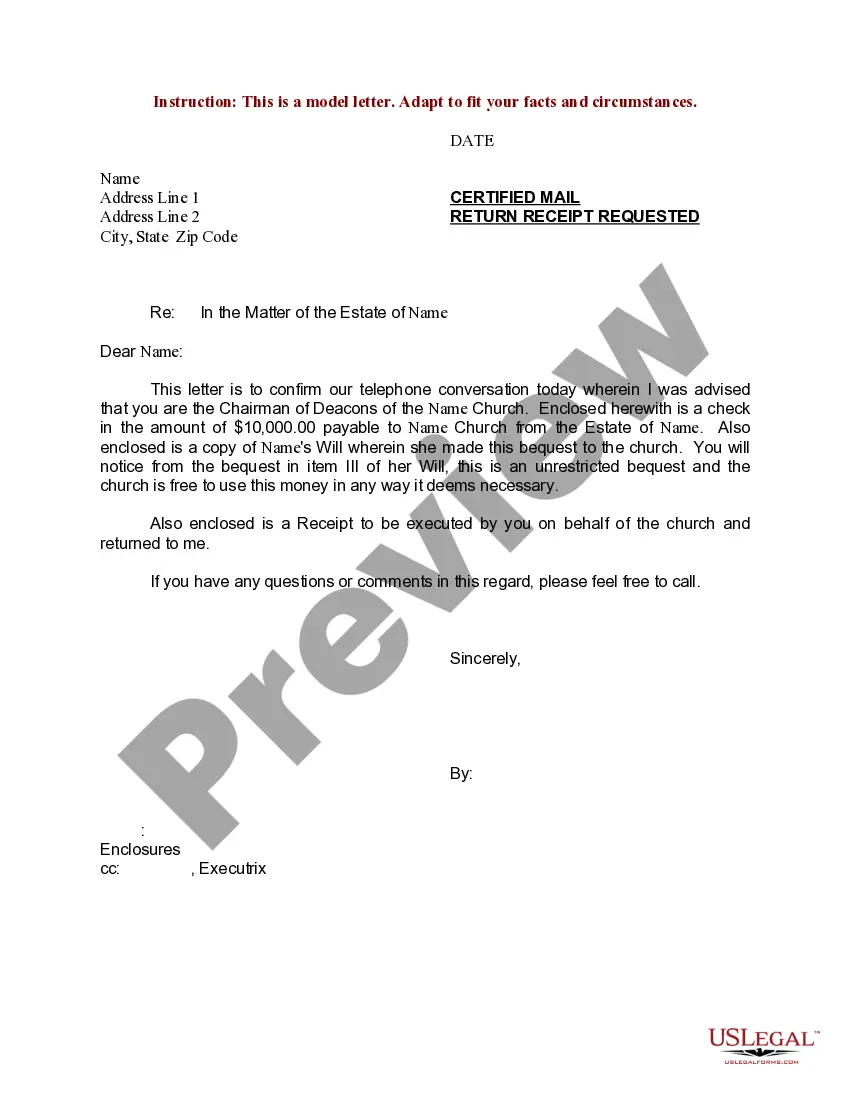

This form is an Asset Purchase Agreement. The seller agrees to sell to the buyer certain assets which are listed in the agreement. The form also provides that the buyer will not be responsible for any unfilled orders from the customers of the seller.

Free preview

Form popularity

More info

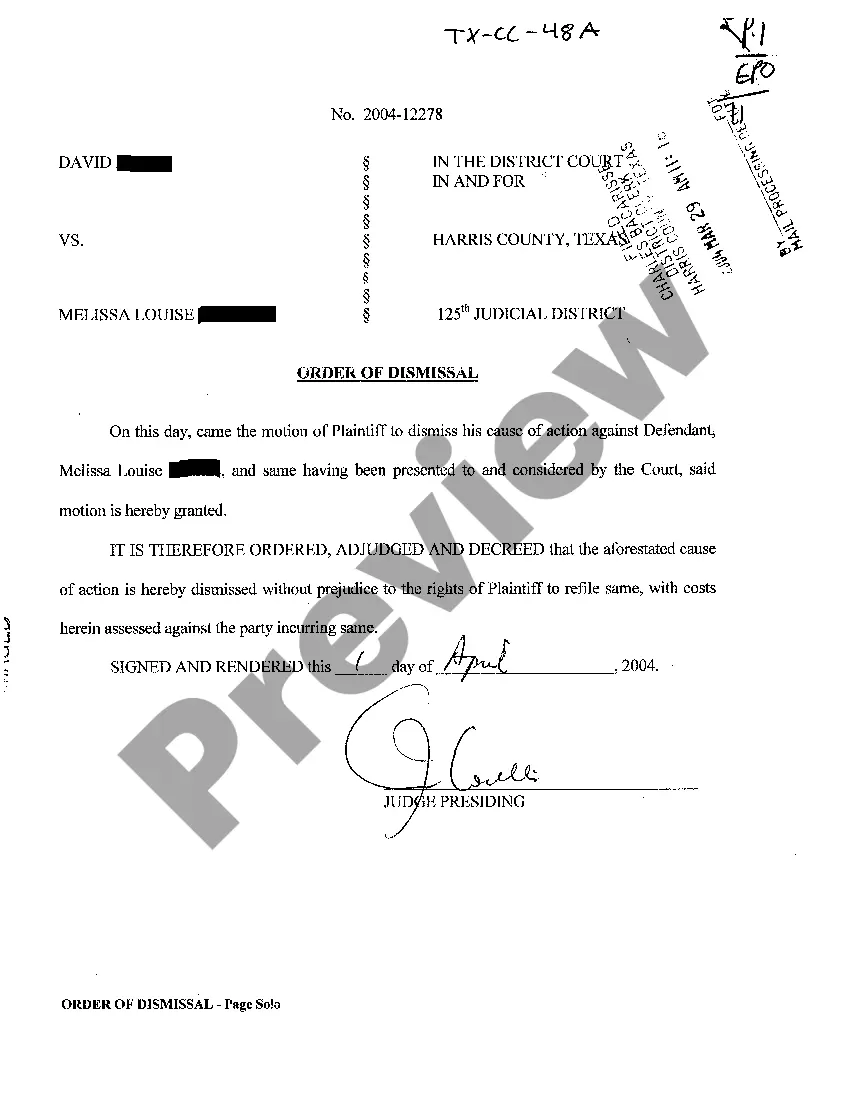

I'm purchasing an existing business in Nevada as an asset sale. I'm creating a new NV entity to eliminate all previous.It is common to review a business' financials, inspect the business' assets, review the lease terms of the business location, etc. Provide the accounting information used to acquire the item(s), purchase order and invoice with total amount paid. Asset purchase agreements are a useful way to: Carve out certain assets of a business without taking on liabilities or debt obligations. The seller must pay taxes on the difference between the basis in the assets and the price paid for the company. We are an asset sale and business law firm serving the Las Vegas area. We help businesses acquire assets, negotiate contracts, and deal with debt issues. If you are selling the assets of your business, as opposed to the stock, you'll need to allocate the purchase price among the assets for tax reasons. Most transactions are available via the online portal, SilverFlume, and will be processed the same day for no additional charge.