Asset Acquisition Form 8594 Instructions In Orange

Category:

State:

Multi-State

County:

Orange

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

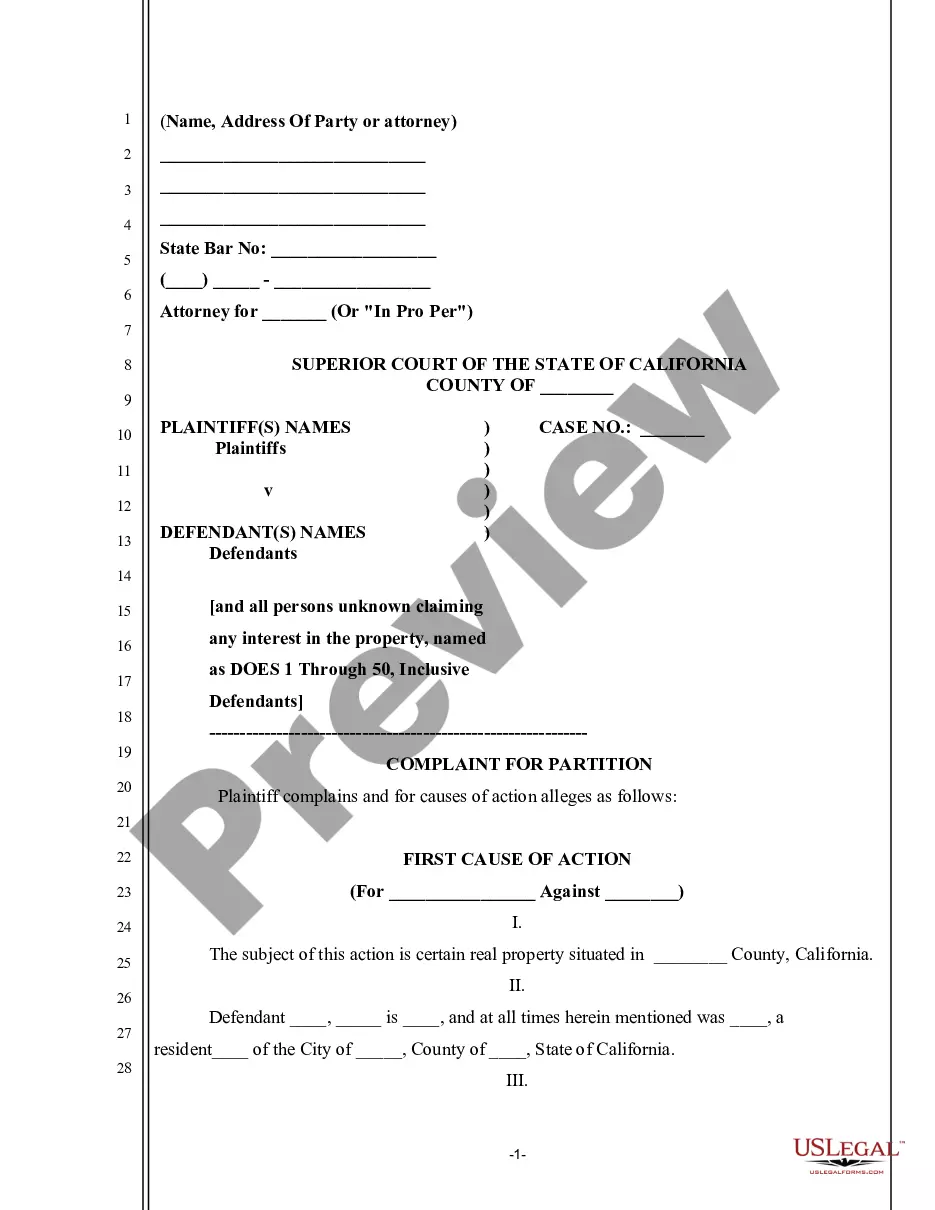

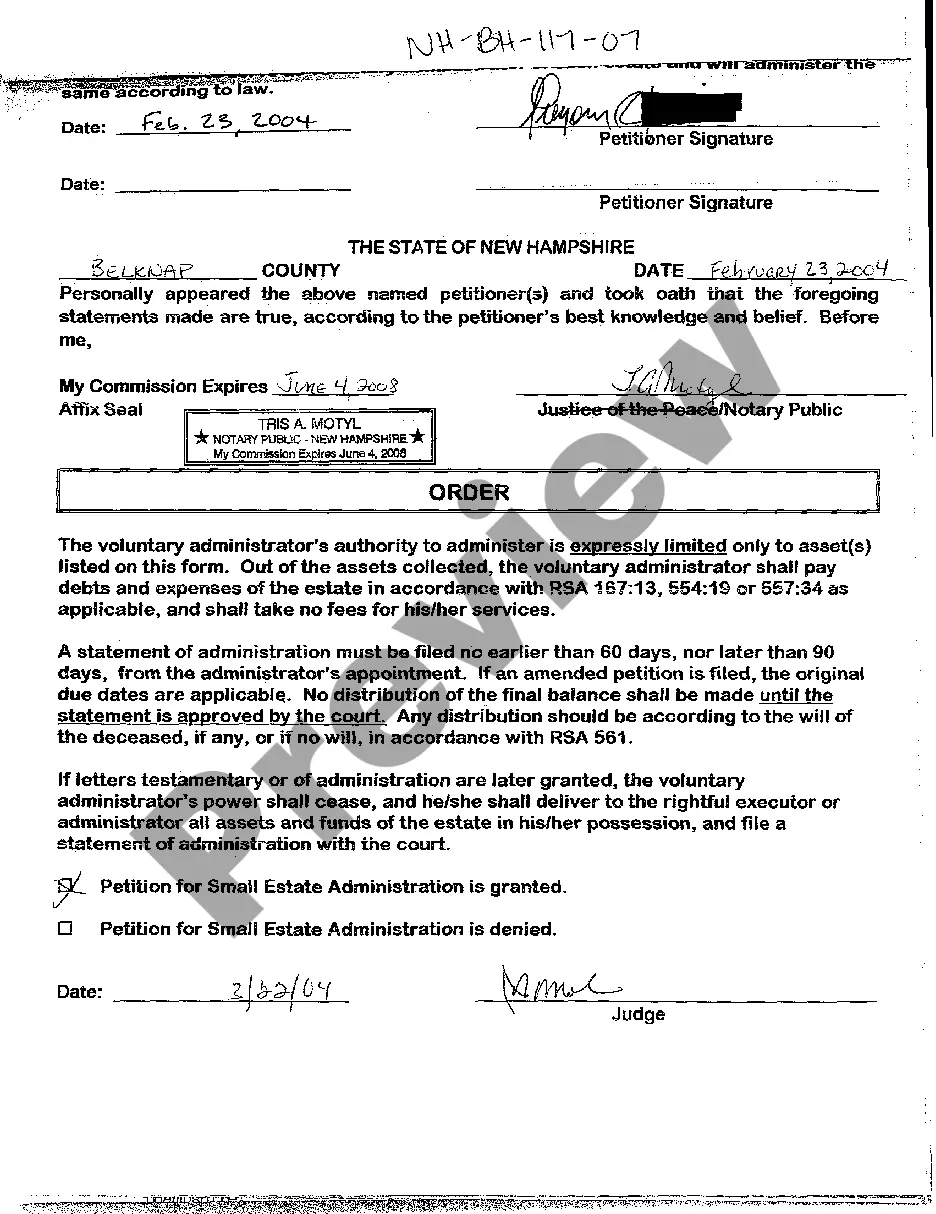

The Asset Acquisition Form 8594 Instructions in Orange provides a structured guideline for users involved in the asset purchase transactions. This form outlines the necessary steps, key features, and crucial details required for successfully navigating asset acquisitions. It emphasizes the importance of accurately completing sections related to the assets being transferred, the purchase price allocation, and the responsibilities of both Buyer and Seller. Users are instructed to fill out the form clearly, ensuring all values, dates, and terms reflect mutual agreements. The form is particularly useful for attorneys and legal assistants, guiding them in drafting comprehensive agreements while ensuring compliance with legal standards. Additionally, partners and owners benefit from the form as it delineates their rights and obligations, helping to prevent disputes post-transaction. Associates and paralegals can use it to understand the mechanics of asset purchase agreements, allowing them to assist effectively in legal proceedings. Clear and concise instructions are provided to facilitate the editing and completion of the form, making it accessible even to those with limited legal experience.

Free preview