Asset Acquisition Form 8594 Instructions In San Diego

Category:

State:

Multi-State

County:

San Diego

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

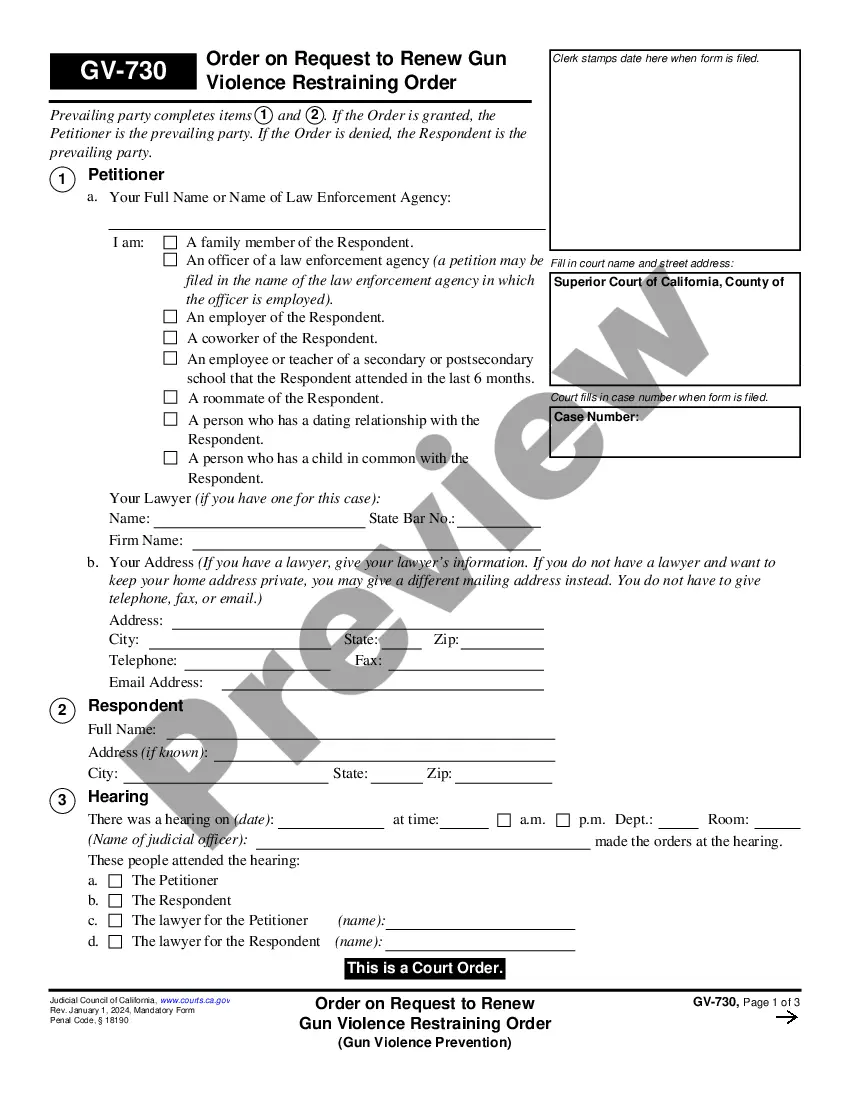

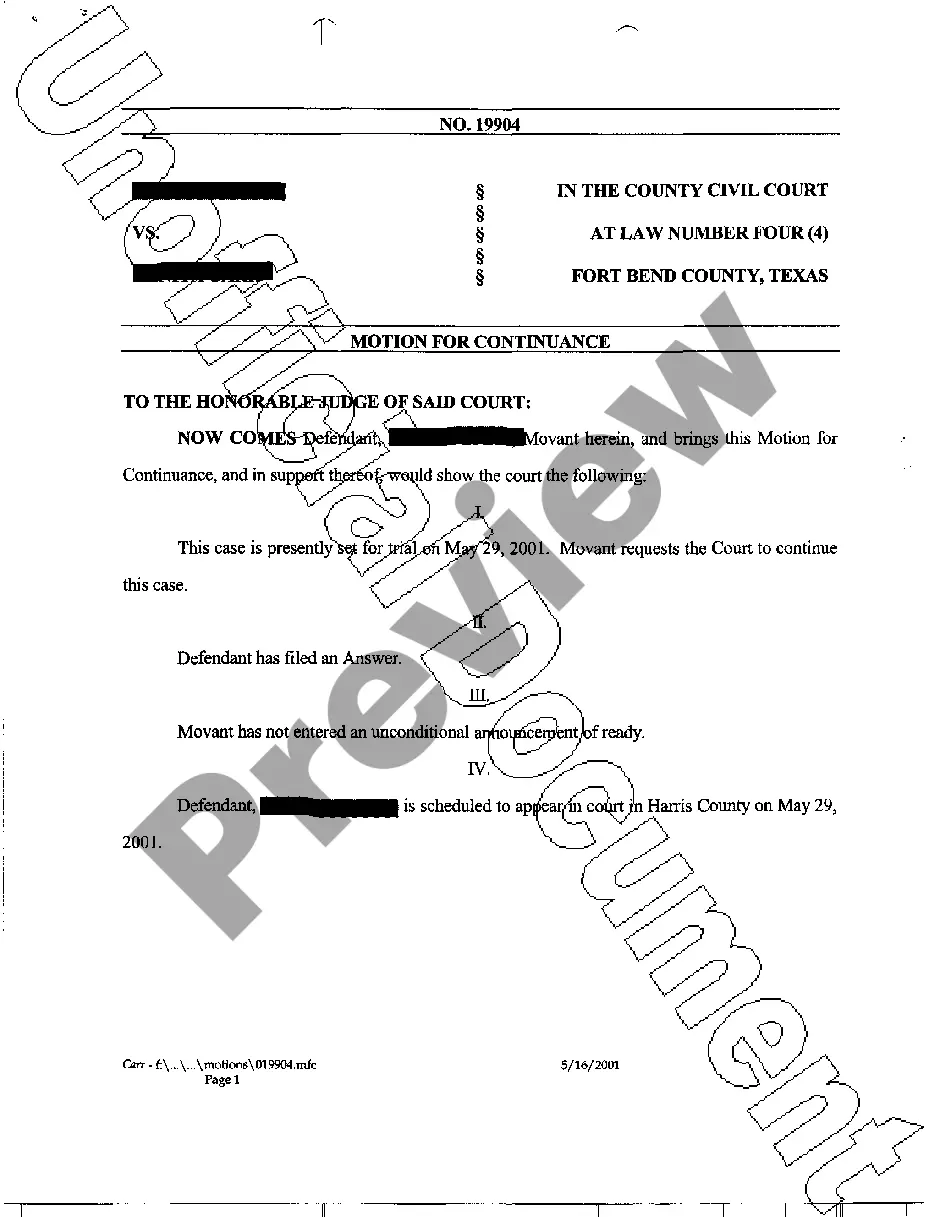

The Asset Acquisition Form 8594 instructions in San Diego provide a structured framework for completing legal documentation related to the purchase and sale of business assets. This form facilitates the transfer of various assets such as equipment, inventory, and goodwill while excluding specific assets like accounts receivable and cash. Key features include detailed allocation of the purchase price, obligations of both parties at closing, and the requirements for executing additional agreements such as non-competition agreements. The form emphasizes clarity in filling out critical sections, including asset descriptions and payment arrangements, guiding users to ensure accuracy and compliance with legal standards. For the target audience, which includes attorneys, partners, owners, associates, paralegals, and legal assistants, the form streamlines the asset acquisition process, providing clear instructions for facilitating complex transactions and reducing potential disputes. Its use cases are particularly relevant for legal professionals involved in mergers, acquisitions, and business transfers, ensuring that all parties are aware of their rights and obligations. Proper completion of the form not only protects the interests of buyers and sellers but also aids in maintaining compliance with applicable laws in San Diego.

Free preview