Fake Documents For Personal Loan

Description

How to fill out Fake Documents For Personal Loan?

Finding a go-to place to take the most current and relevant legal samples is half the struggle of working with bureaucracy. Choosing the right legal documents requirements precision and attention to detail, which is the reason it is vital to take samples of Fake Documents For Personal Loan only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and view all the details regarding the document’s use and relevance for the situation and in your state or county.

Consider the following steps to finish your Fake Documents For Personal Loan:

- Utilize the library navigation or search field to find your sample.

- Open the form’s description to ascertain if it fits the requirements of your state and region.

- Open the form preview, if there is one, to ensure the template is the one you are searching for.

- Return to the search and locate the correct document if the Fake Documents For Personal Loan does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Finalize your purchase by picking a transaction method (bank card or PayPal).

- Pick the file format for downloading Fake Documents For Personal Loan.

- When you have the form on your device, you may modify it using the editor or print it and complete it manually.

Eliminate the hassle that comes with your legal paperwork. Explore the comprehensive US Legal Forms catalog to find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

Most personal loan lenders will require proof of income, even if they don't disclose their minimum income requirements. Only a few lenders, like Upgrade and Universal Credit, offer unsecured loans for a single borrower with no income verification.

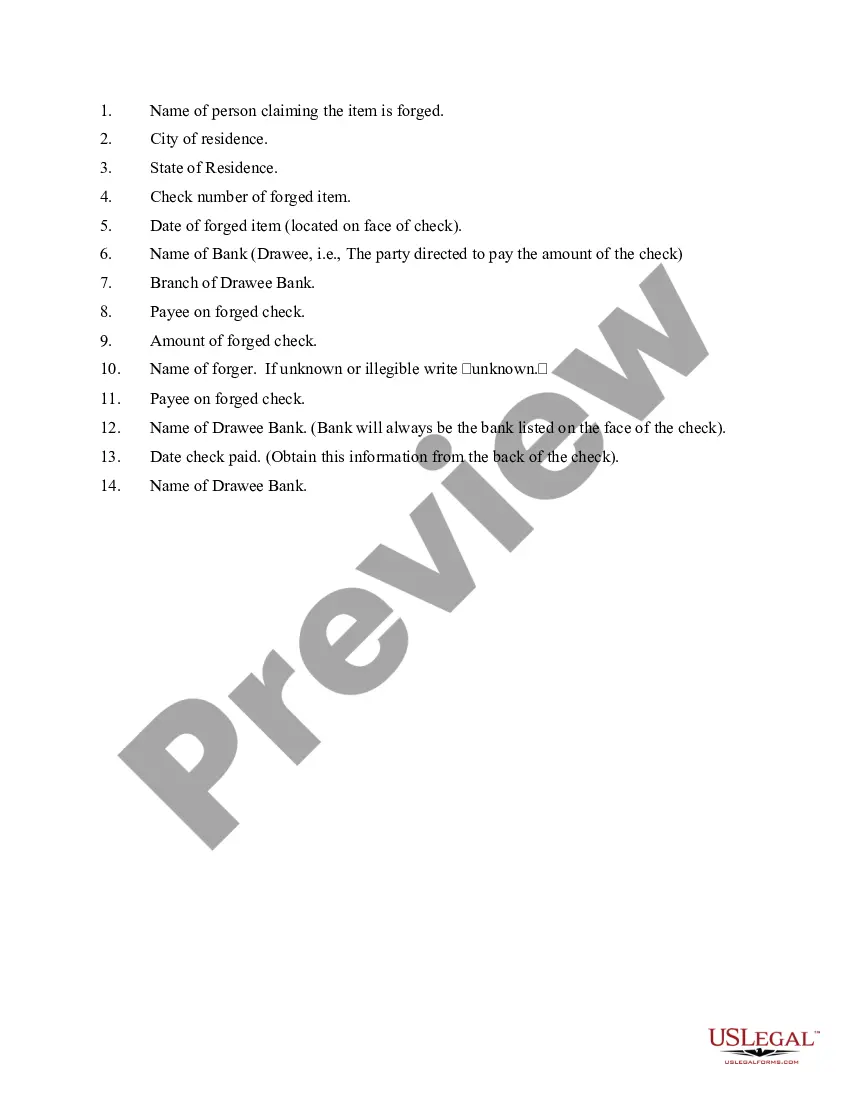

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements.

Knowingly providing false information on a loan application is considered fraud and is a crime. For instance, putting an incorrect salary or falsifying documents would qualify as lying ? and can impact you in serious ways. You could lose your loan.

Banks can call your employer to verify employment for personal loans. But most banks will simply verify your income through a tax document or bank statement when evaluating your application for a personal loan.

Your income can give lenders insight into whether you are able to repay the loan. To verify this, you may have to give documents such as W-2s, pay stubs or tax returns.