Fake Documents For Mortgage Canada In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00419BG

Format:

Word;

Rich Text

Instant download

Description

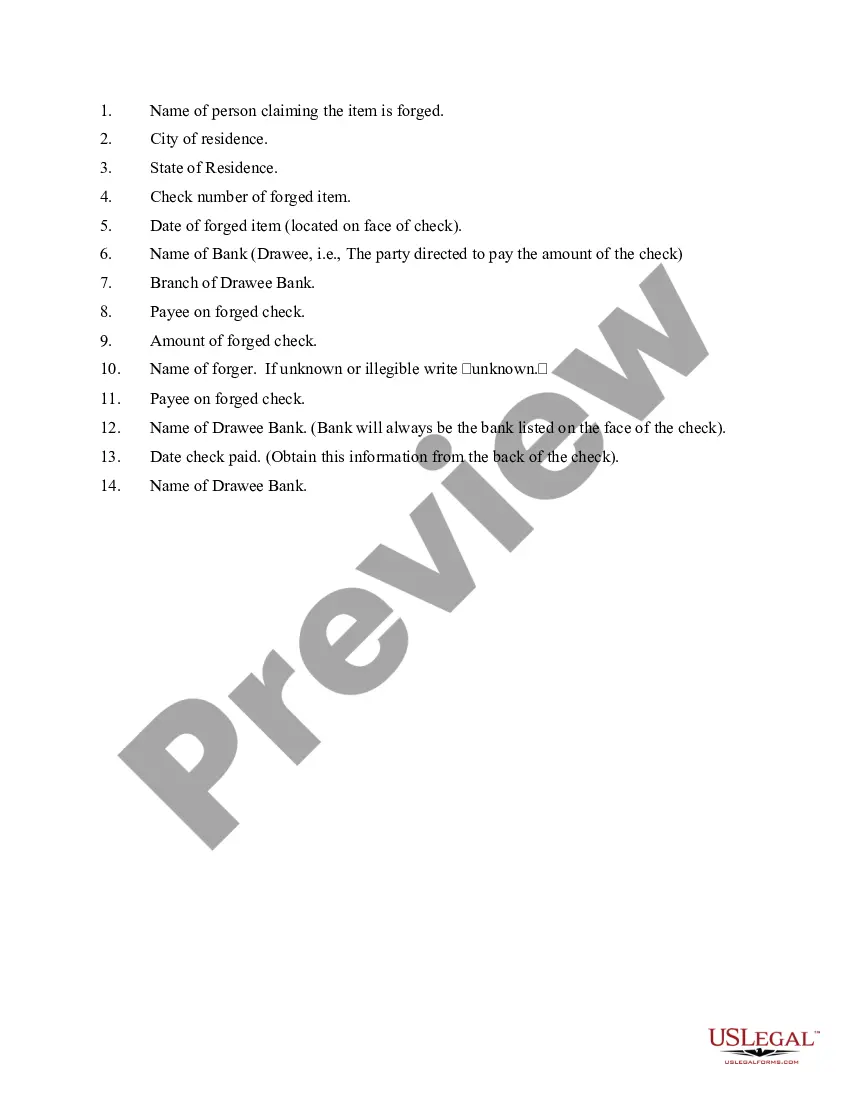

"Forgery" may be defined as the false making or material alteration of a writing with intent to defraud. An essential element of the crime of forgery is making the false writing. An "Affidavit of Forgery" is a notarized sworn statement attesting that the signature which appears on the questioned document is indeed a forgery, and not authorized by the account holder. This type of affidavit may be made for the purpose of having a Bank reimburse its customer for honoring a forged check, or for the purpose of assisting law enforcement in the investigation and prosecution of the forger.

Free preview