Overpayment Rules In Cuyahoga

Category:

State:

Multi-State

County:

Cuyahoga

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

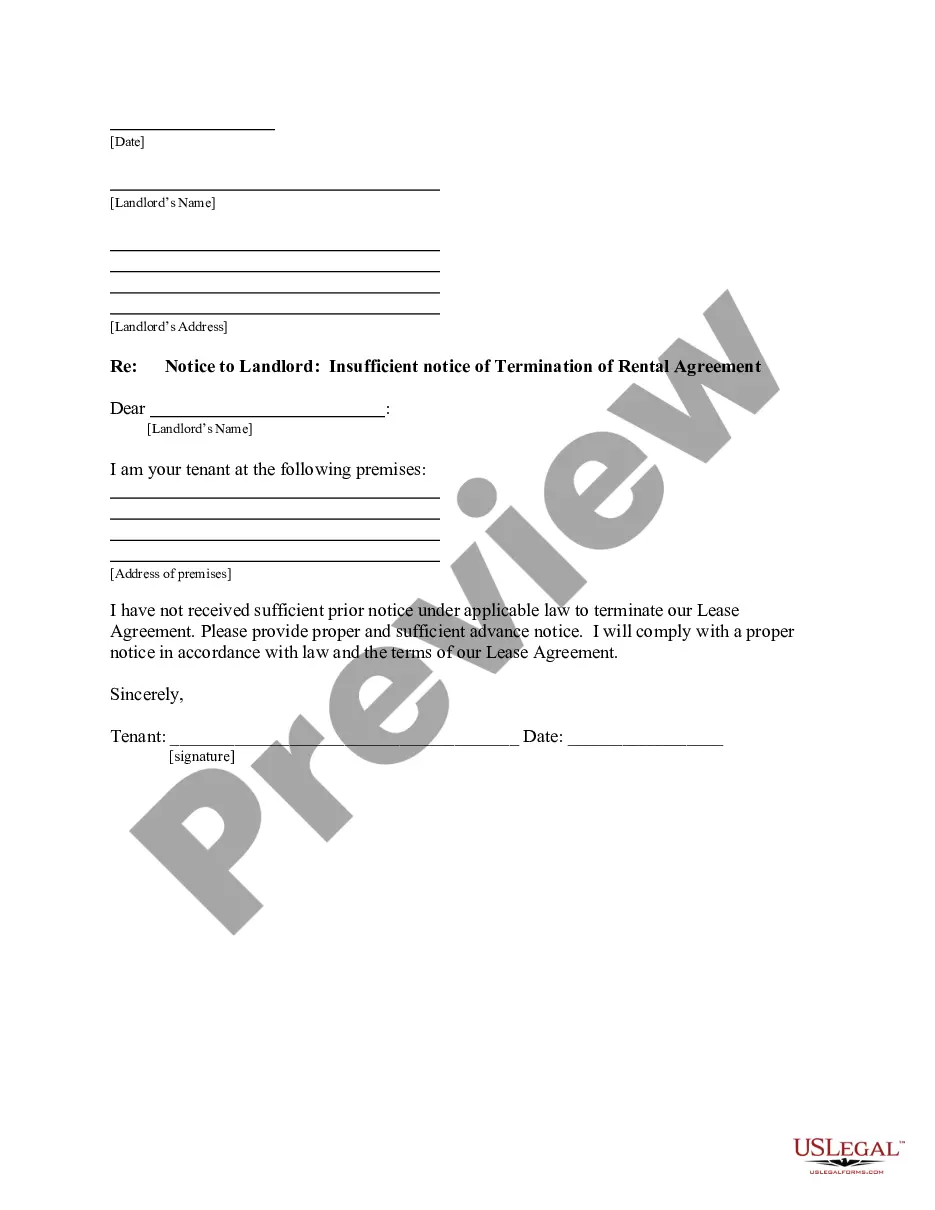

The document outlines the overpayment rules in Cuyahoga, specifically detailing how to handle instances of overpayment made to the State by individuals or businesses. It emphasizes the importance of using a Payment Voucher along with a check to rectify any overpayment issues identified during the filing of the Annual Report. Users must ensure the form is correctly addressed and the correct amount is specified to expedite the refund process. Filling out the form involves inserting the specific date, recipient's name, and relevant payment details, making it easy for users to customize according to their unique circumstances. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form useful as it provides a structured approach to managing overpayment instances, helping to streamline communication with state departments. Moreover, the supportive guidelines ensure accuracy and clarity, which are vital for effective resolution of any overpayment concerns. This document serves as a practical resource for legal professionals tasked with assisting clients in recovering excess payments made to state entities.