Overpayment With Unemployment In Hennepin

Category:

State:

Multi-State

County:

Hennepin

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

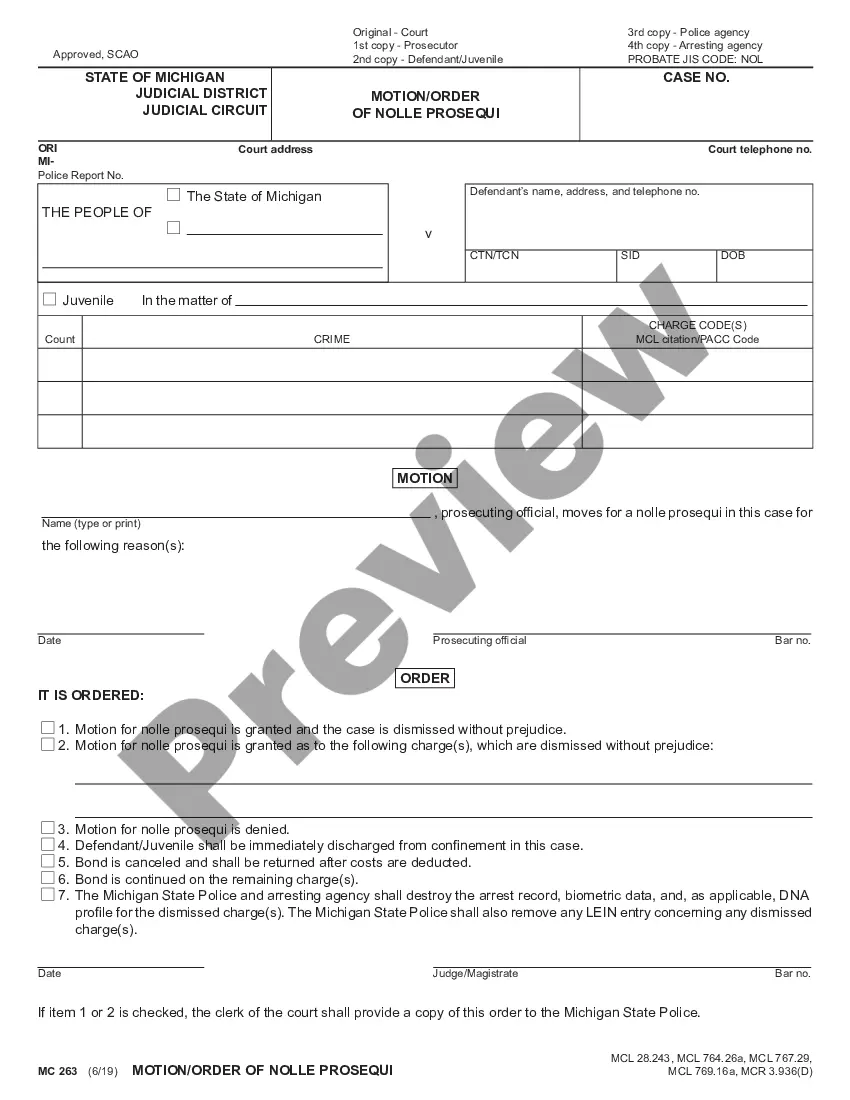

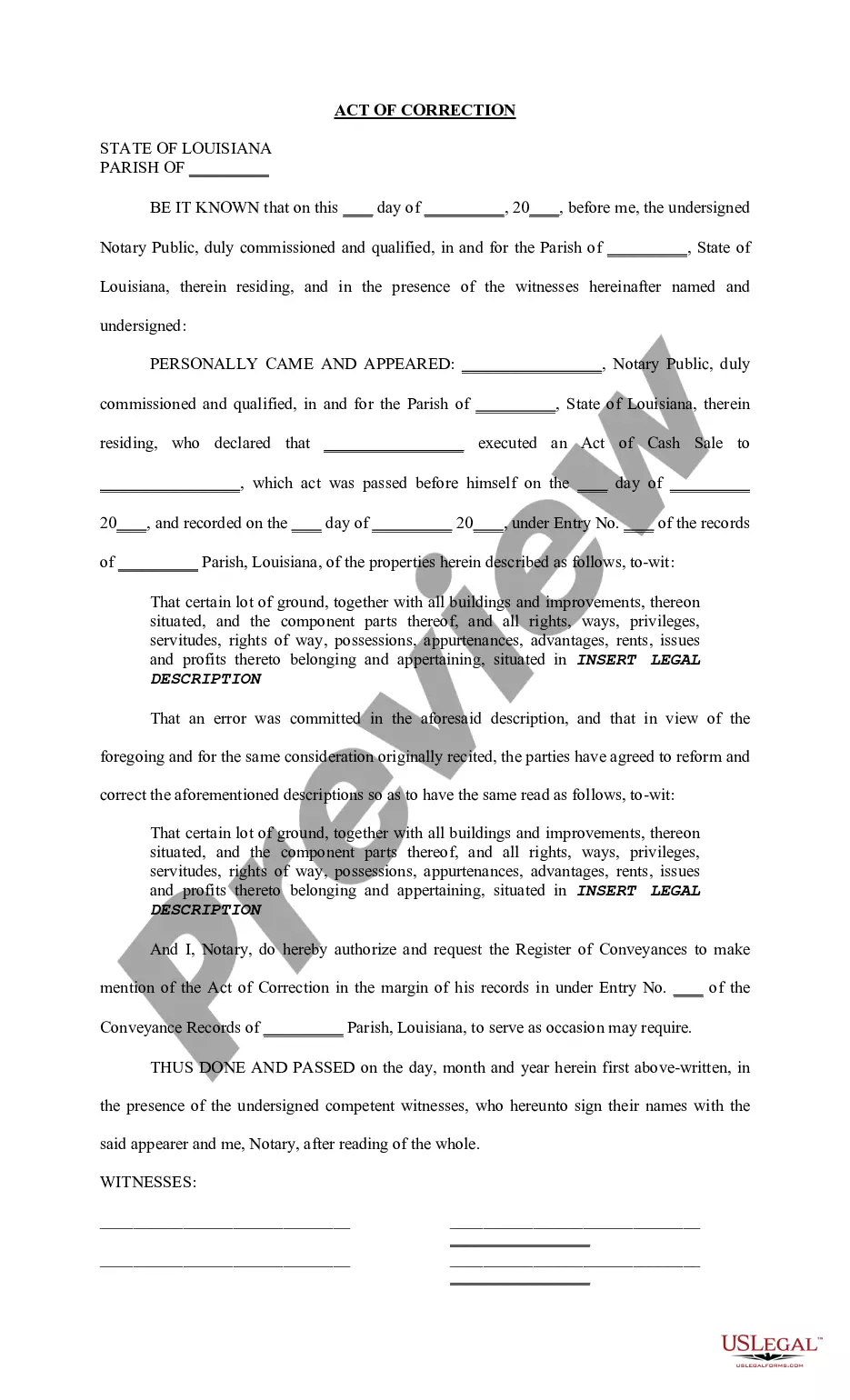

The Overpayment with unemployment in Hennepin form is a crucial document for addressing instances where individuals or businesses have overpaid their unemployment taxes or benefits. This form facilitates the communication of overpayment details to relevant authorities, allowing for proper adjustments or refunds. Users must complete the form by providing specific information such as the amount overpaid, the relevant dates, and any supplementary documentation. It is essential to adhere to the guidelines provided to ensure accurate processing of the claim. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who represent clients navigating unemployment overpayments in Hennepin. By using this form, legal professionals can help clients secure rightful refunds or resolve misunderstandings with state agencies. Additionally, the clear structure and straightforward instructions make it accessible for individuals with varying degrees of legal knowledge. Overall, this document serves as an effective tool for managing unemployment-related financial discrepancies.