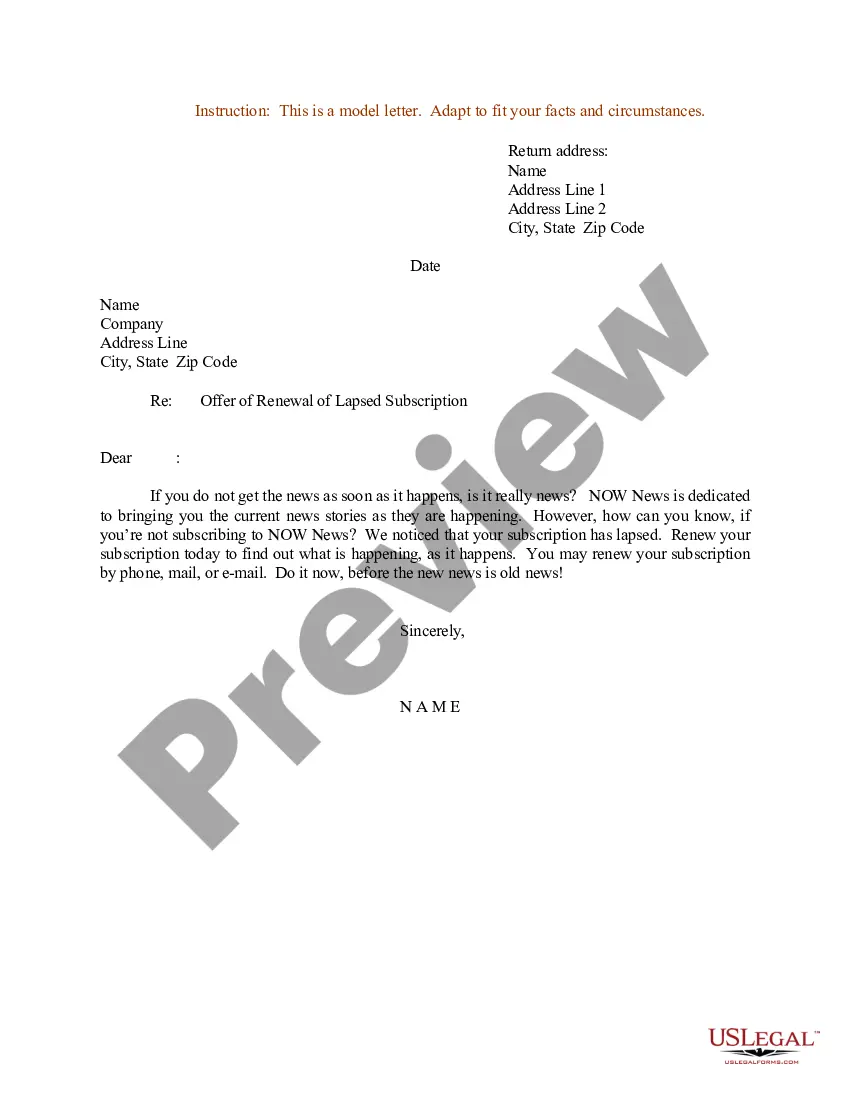

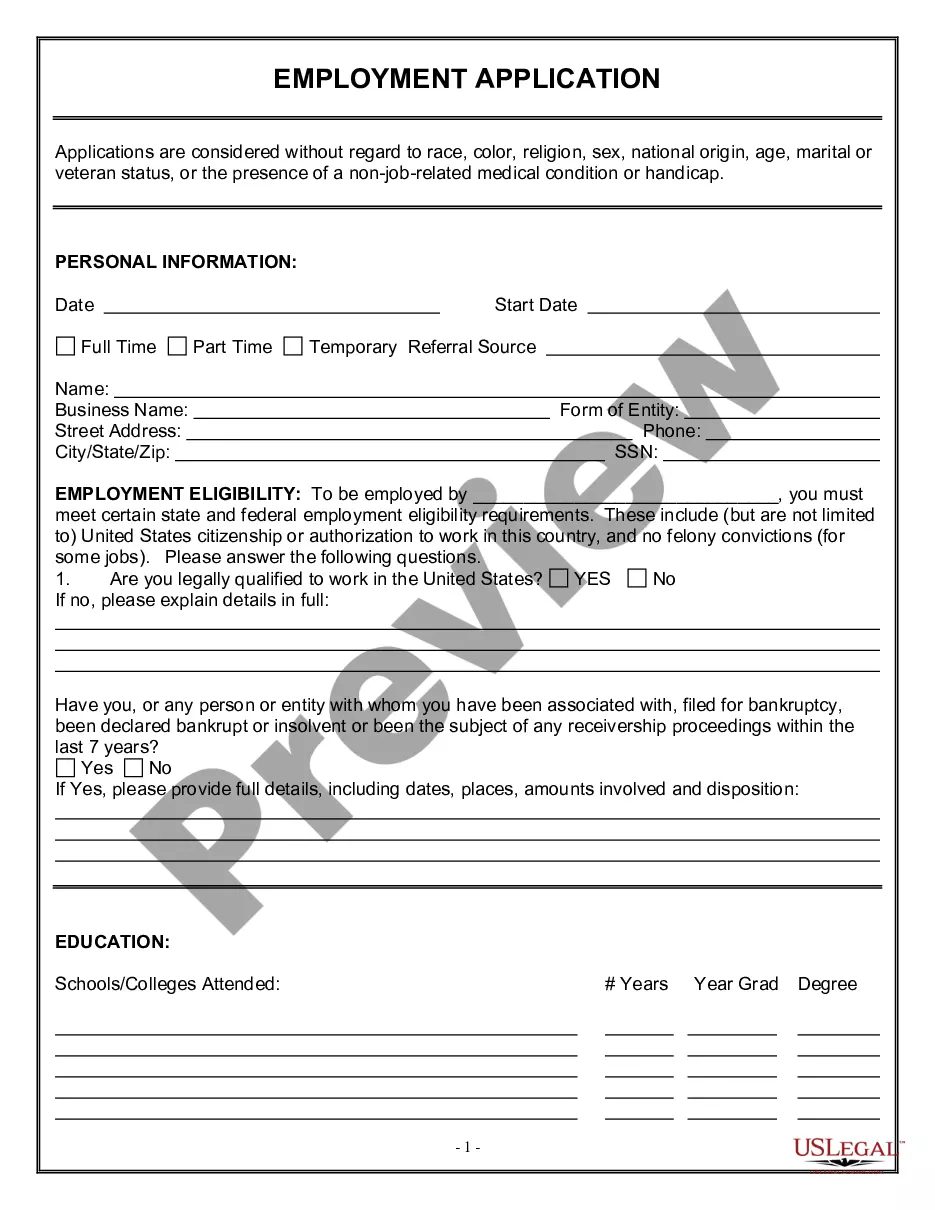

Overpaid Letter To Customer With Check In Houston

Category:

State:

Multi-State

City:

Houston

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

This form is a sample letter in Word format covering the subject matter of the title of the form.