Overpayment Letter To Customer With Payment In Houston

Description

Form popularity

FAQ

Obviously, these types of losses attributed to overpayments are both material and significant. Additionally, it is the responsibility of all stakeholders to return any overpayment because every buyer is a seller at some point.

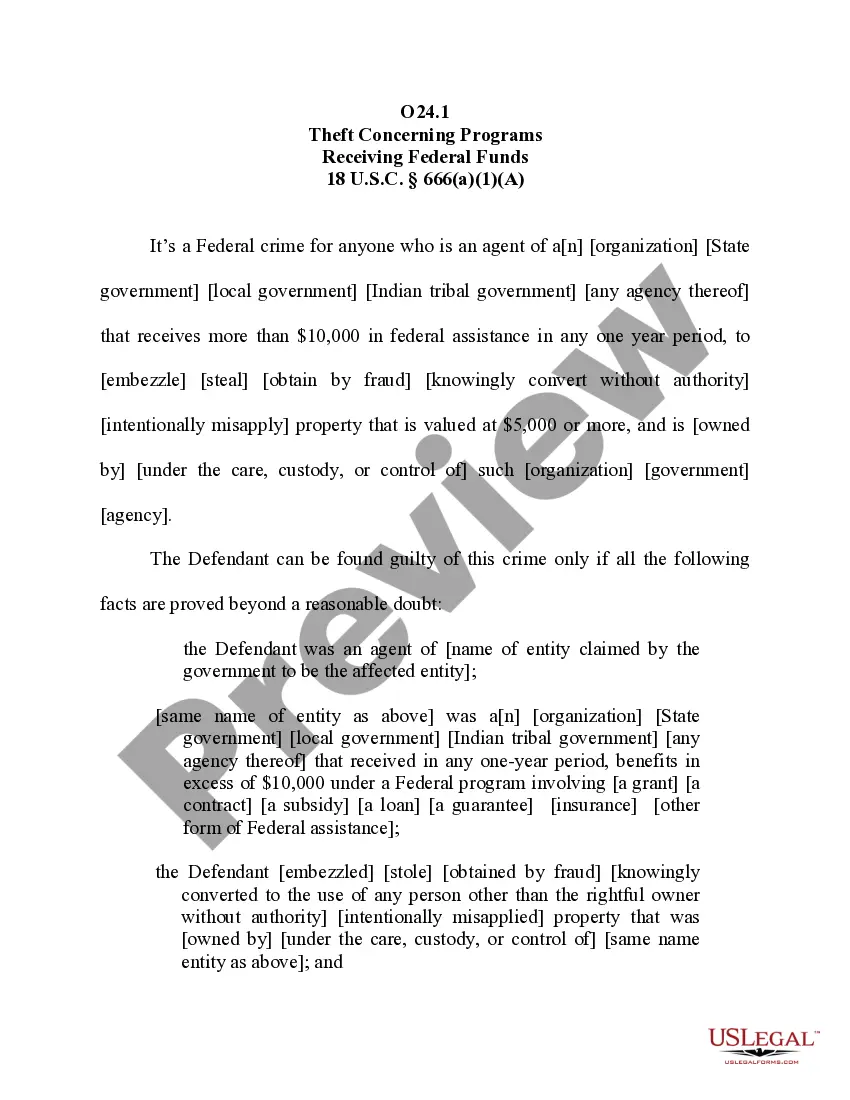

An overpayment letter is a formal request to repay a debt owed to the Medicare Trust Fund. Payment is due upon receipt of the notice. Send the payment with a copy of the overpayment letter received or request an immediate offset.

Let them know as soon as possible and immediately offer a way to resolve the overpayment, either as crediting their next invoice or issuing a credit.

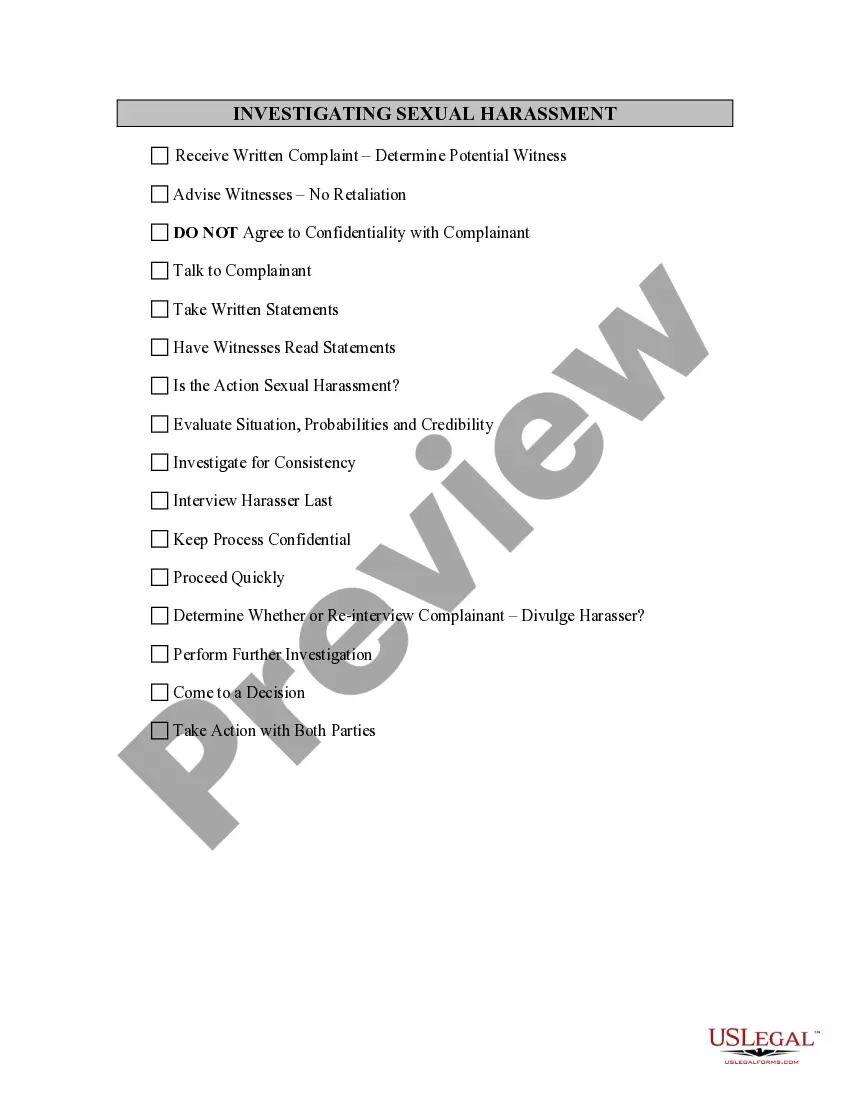

Online Payments - E-check Paying by E-check is a safe and convenient method for repaying your unemployment benefits overpayment. You may repay the overpayment in full, or submit the minimum monthly payment, which is shown on the Statement of Overpaid Unemployment Benefits Account letter that TWC sent to you.

The taxpayer must apply by filing the collector-provided application form or Comptroller Form 50-181, Application for Tax Refund Overpayments or Erroneous Payments (PDF), or by filing a written request with the collector that includes information that will allow the collector to determine whether the taxpayer is ...

For questions about property tax bills and collections, call the Property Tax Assistance Division's Information Services Team at 512-305-9999 or 1-800-252-9121 (press 3).

Please contact the 24-hour Harris County Customer Service Call Center at (713) 755-5000.

Owners who are age 65 or older, are disabled or are a disabled veteran qualify to receive additional exemptions.

Your Property ID and PIN are contained on all LPT correspondence from Revenue. If you do not have your Property ID and PIN, you can request that they be sent to you through the LPT online service.

The Tax Code allows a chief appraiser to approve the following late exemption applications, which may result in a refund: residence homesteads (Tax Code Section 11.431); veteran's organization exemption (Tax Code Section 11.438); and. disabled veteran's exemption (Tax Code Section 11.439).