Overpayment Letter To Terminated Employee In Los Angeles

Description

Form popularity

FAQ

Under state law, a state agency must initiate action to collect an overpayment within three years from the date of the overpayment. This involves notifying the employee of the overpayment and requesting repayment.

In California, employers have up to 30 days to correct payroll errors. If they fail to rectify underpayment or issue late paychecks in that time, employees are entitled to a full day's wages at their regular rate for each day the mistake persists.

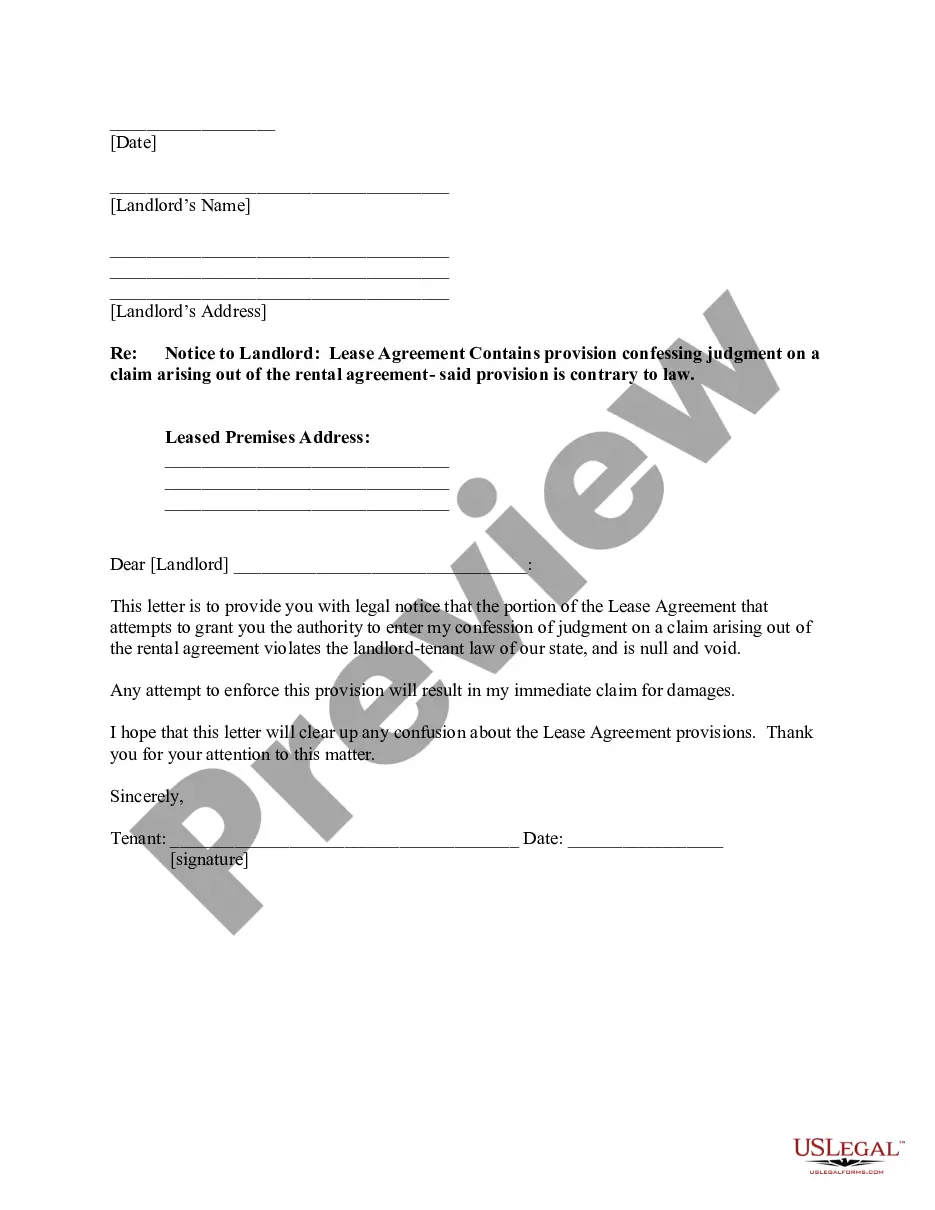

Dear insert name The purpose of this letter is to inform you that, insert company name (Company) has discovered a payroll error that has resulted in you being overpaid the amount of insert amount. The details of this overpayment are as follows: List the relevant dates and amounts of overpayment.

If we determine the potential overpayment was not your fault or was not due to fraud, you may qualify for an overpayment waiver. We will send you a Personal Financial Statement (DE 1446) with the Notice of Potential Overpayment.

Nondiscretionary bonuses are considered wages, and it is illegal for an employer to withhold payment. If you were promised a bonus for work you performed, you are entitled to receive the bonus regardless of whether you are still an employee, were fired, or quit.

Notify the employee of the fact that an overpayment has been made, providing them with an explanation as to how this has arisen, together with a breakdown, including the dates and amounts. In this way, both parties will be clear as to the reason for the overpayment and exactly what will need to be repaid in due course.

You can appeal against a decision that you have been overpaid, or the amount of the overpayment, by asking for a mandatory reconsideration. The request should be made within one month of being given the decision.