Overpayment For Ssi In New York

Category:

State:

Multi-State

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

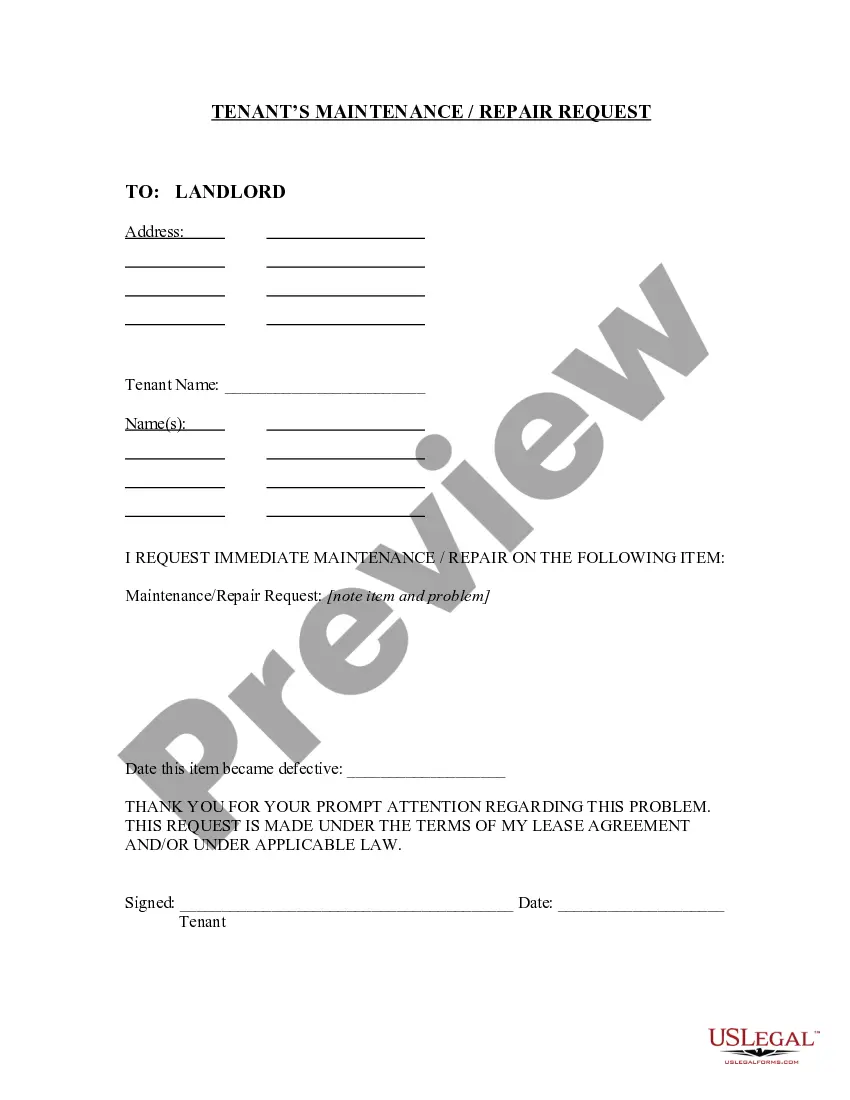

This form is a sample letter in Word format covering the subject matter of the title of the form.

Form popularity

FAQ

Employers should fix any payroll errors right away. For most employers, that means by the next paycheck.

The employer may make deductions to recover overpayments for a period of six years from the original overpayment. (b) Frequency. The employer shall recover overpayments by wage deduction no more frequently than once per wage payment, provided that such deduction complies with this Part. (c) Method of recovery.

Notify Employee: The Agency must immediately notify the employee, in writing, of the amount overpaid and the method of recovery. Recovery is done as 10% of the employee's biweekly paycheck. The employee has the opportunity to dispute the recovery and the amount to be recovered.

More info

If you have an overpayment debt, you may be eligible to make a full or partial payment using Pay. Gov or your bank's online bill pay option.You will need your remittance ID in order to repay your Social Security overpayment on Pay.gov. Overpayment notices explain why you've been overpaid, your overpayment amount, your repayment options, and your appeal and waiver rights. If an SSI recipient wishes to request waiver of an overpayment, he or she must file a Form SSA632. What causes an overpayment?