Directors Loan To Company Written Off In Dallas

Category:

State:

Multi-State

County:

Dallas

Control #:

US-00420BG

Format:

Word;

Rich Text

Instant download

Description

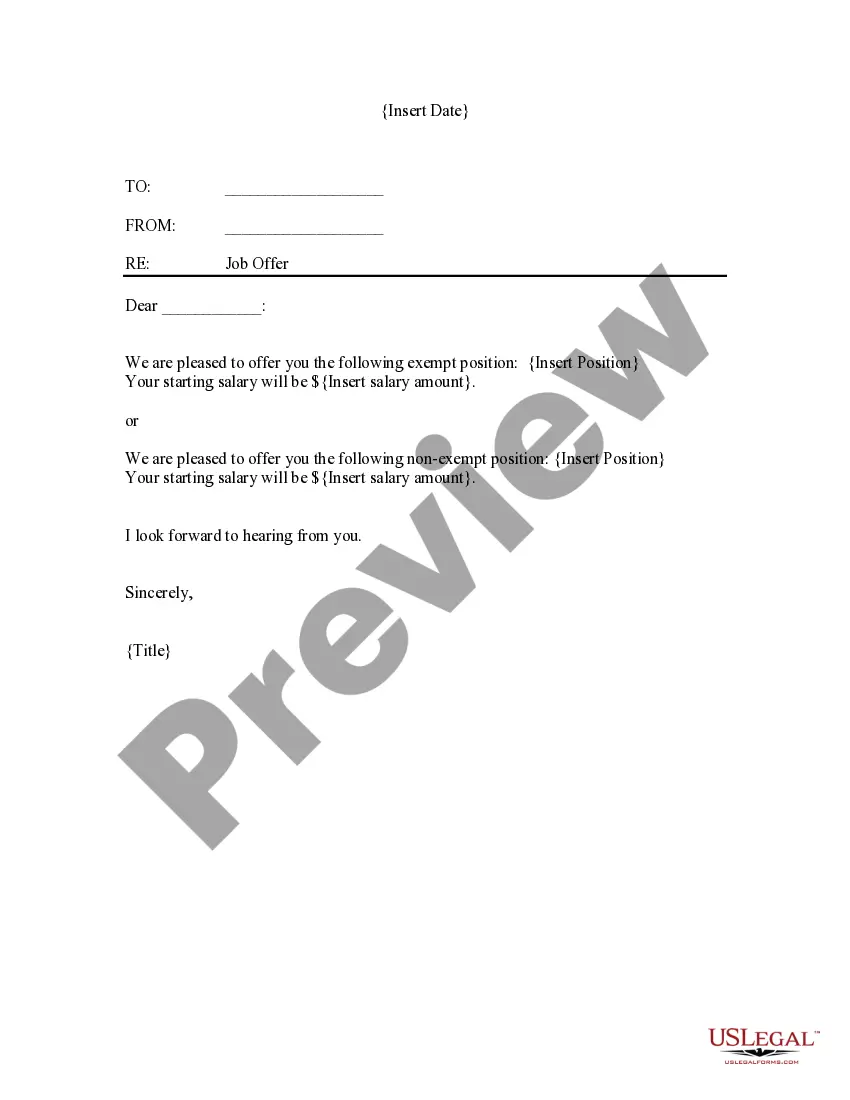

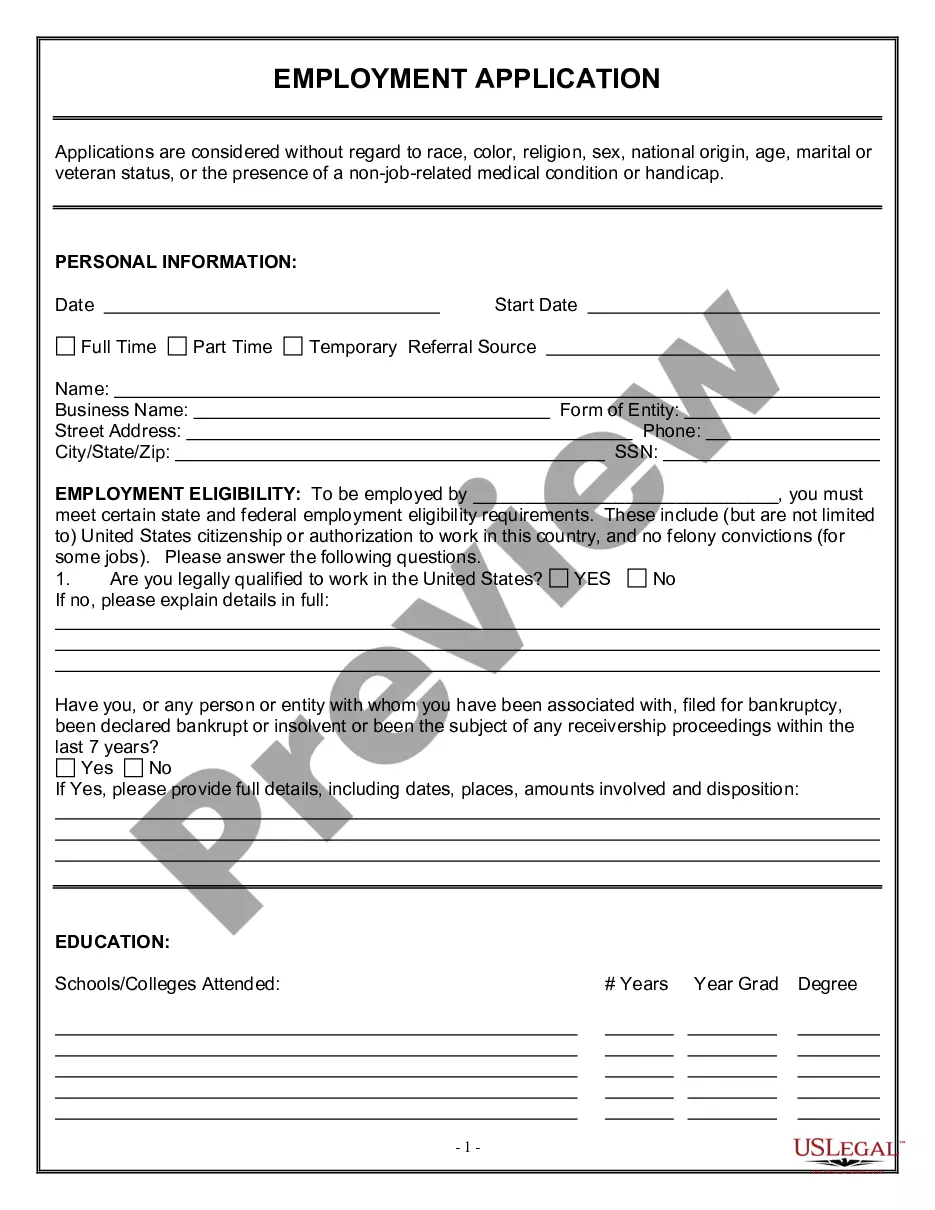

This form contains a resolution of the Board of Directors authorizing the refinancing of a loan of the corporation and names the officers of the corporation authorized to sign the loan documents.

Free preview

Form popularity

More info

The write-off will be recorded as an expense in the company's accounts, but won't be allowable against profits for corporation tax purposes. How do director's loans work?A complete guide to understanding and managing director's loans for business success. A Director's Loan Account, or DLA, is an account that reports all transactions between the director and the company. See Form 202 (Word 152kb, PDF 142kb). The amount of loan written off will have to be included in the director's self-assessment tax return on a specific box on the 'additional information' pages. Can a director's loan be written off? To work around this, your company can write off the debt. The VA National Cemetery Administration honors the military service of our Nation's veterans. A directors loan account write off is a legal process through which a business formally acknowledges that a loan owed to (or from) a director cannot be repaid.