Directors Loan To Company Tax Relief In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00420BG

Format:

Word;

Rich Text

Instant download

Description

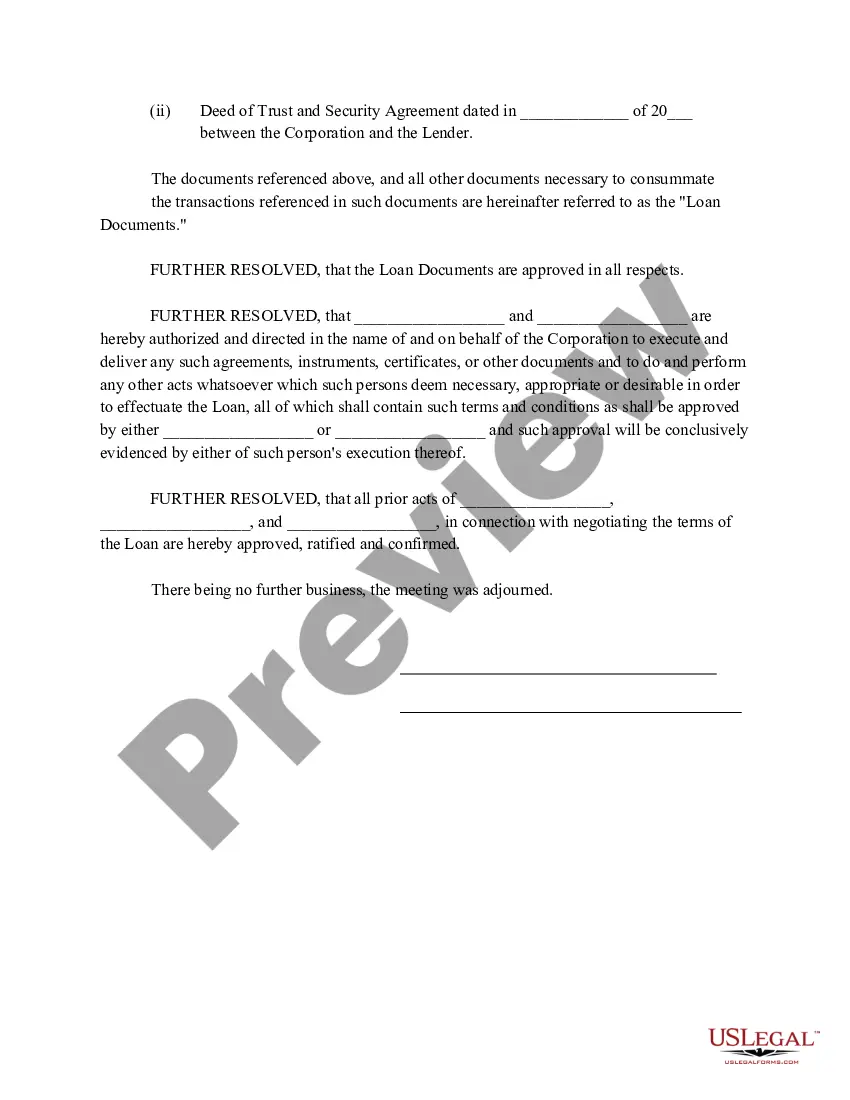

This form contains a resolution of the Board of Directors authorizing the refinancing of a loan of the corporation and names the officers of the corporation authorized to sign the loan documents.

Free preview

Form popularity

More info

Fairfax County provides real estate tax relief and vehicle ("car") tax relief to citizens who are either 65 or older, or permanently and totally disabled. Fairfax County provides real estate tax relief and car tax relief to citizens who are either 65 or older, or permanently and totally disabled.Provides comprehensive tax relief, tax deferral, and exemptions for seniors and people with disabilities. A Virginia resident return must include income from all sources. For questions about the FRHC program please call . To Make an Application Submission to the FRHC: DROP OFF SUBMISSION:. Howard County provides a variety of Real Property Tax Credits designed to meet the needs of County taxpayers and to promote specific activity. The itemized deductions shown below are used in the calculation of the 2008 tax burdens.