Directors Loan To Company Tax Relief In Montgomery

Category:

State:

Multi-State

County:

Montgomery

Control #:

US-00420BG

Format:

Word;

Rich Text

Instant download

Description

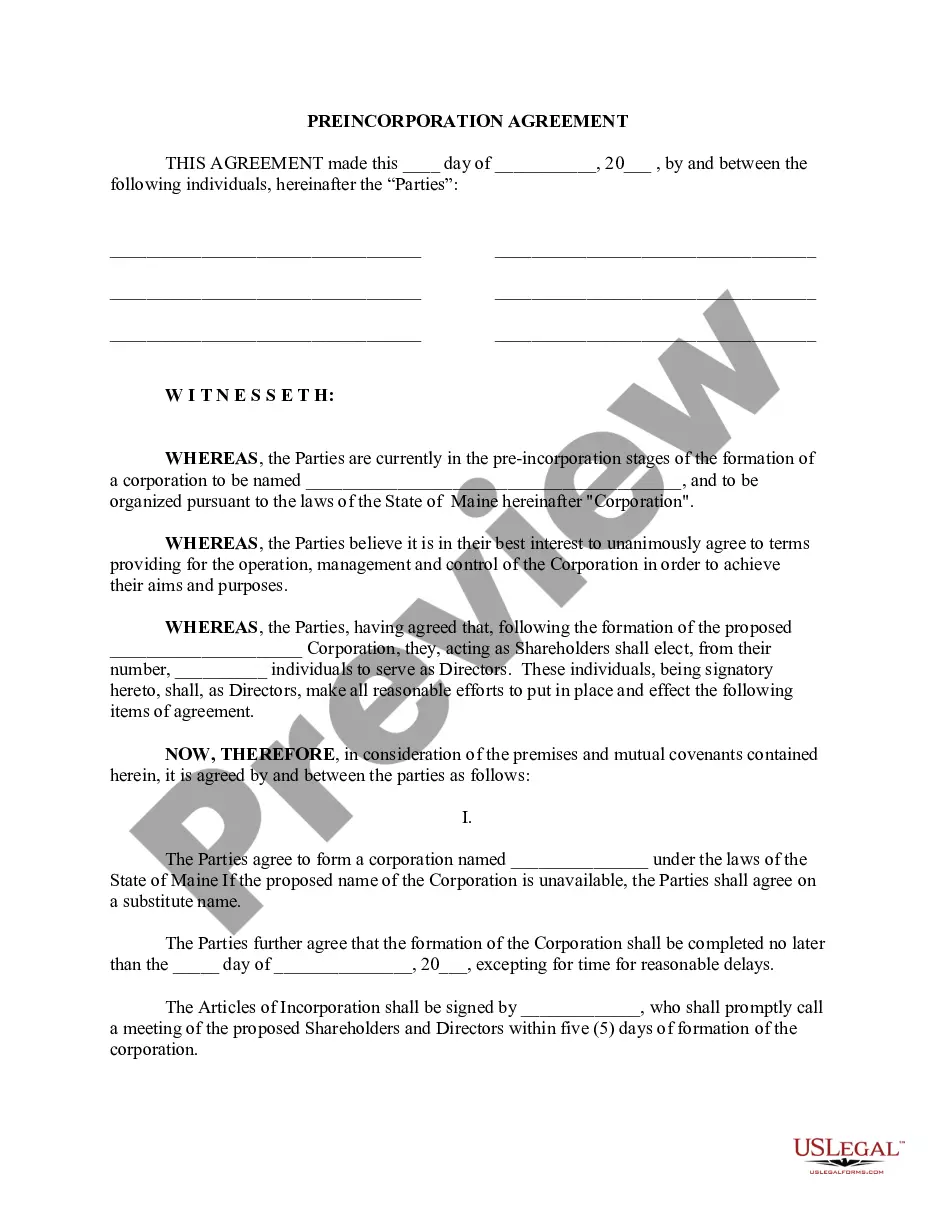

This form contains a resolution of the Board of Directors authorizing the refinancing of a loan of the corporation and names the officers of the corporation authorized to sign the loan documents.

Free preview

Form popularity

More info

Montgomery County offers two strong tax incentive programs for companies seeking to locate, maintain, or expand their business in our community. Alabama law offers several income tax incentives for new, existing, or expanding businesses in Alabama.To claim the credit, you must complete Part K of Form 502CR and attach to your Maryland income tax return. General Program Guidelines. 1. You or your company may have to pay tax if you take a director's loan. Your personal and company tax responsibilities depend on how the loan is settled. Exemption applications must be filed with your local assessor's office. See our Municipal Profiles for your local assessor's mailing address. The ID number is necessary to ensure proper credit to your account.