Directors Loan To Company Tax Relief In Riverside

Category:

State:

Multi-State

County:

Riverside

Control #:

US-00420BG

Format:

Word;

Rich Text

Instant download

Description

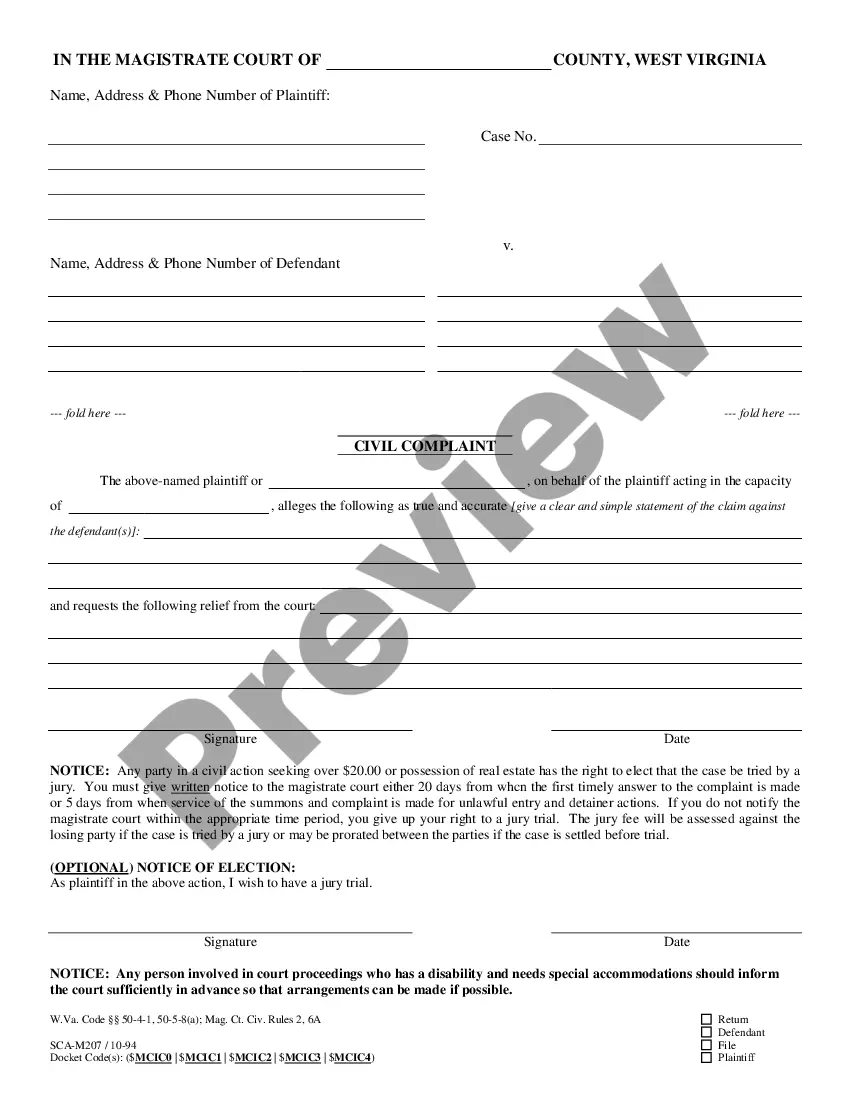

This form contains a resolution of the Board of Directors authorizing the refinancing of a loan of the corporation and names the officers of the corporation authorized to sign the loan documents.

Free preview

Form popularity

More info

To qualify for property tax relief after a disaster, file an Application for Reassessment within 12 months of the disaster. The State of California offers a wide range of tax and other incentives to help attract and retain businesses.You or your company may have to pay tax if you take a director's loan. Your personal and company tax responsibilities depend on how the loan is settled. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. Riverside County Restart Loan Program is Accepting Applications! Register with your state to obtain a tax identification number, workers' compensation, unemployment and disability insurance. 9. We also provide support for our business members with business checking, credit cards, savings, and commercial loans. A claim must be filed annually, forms can be found in the link below.