Directors Loan To Buy Property In Wake

Category:

State:

Multi-State

County:

Wake

Control #:

US-00420BG

Format:

Word;

Rich Text

Instant download

Description

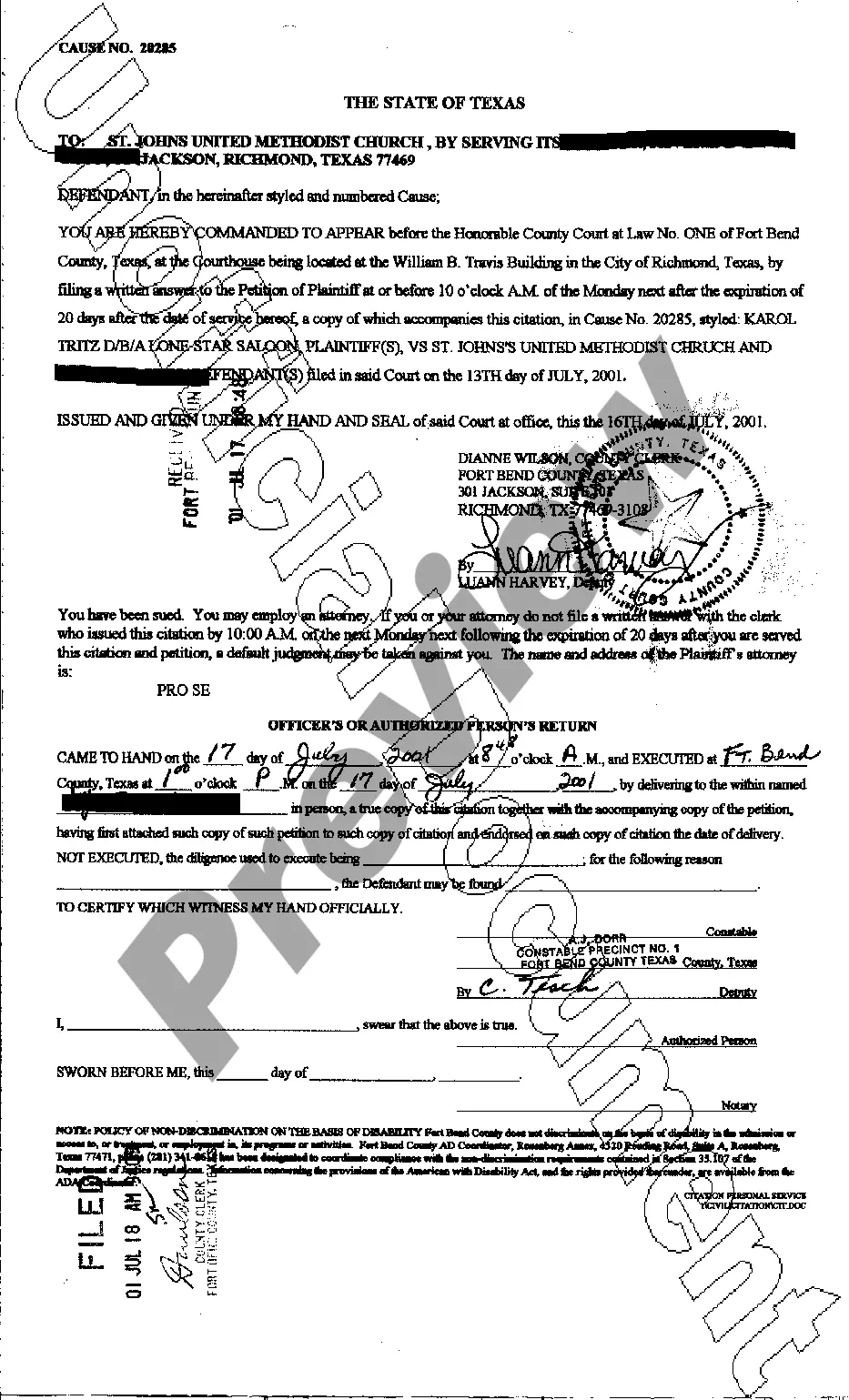

This form contains a resolution of the Board of Directors authorizing the refinancing of a loan of the corporation and names the officers of the corporation authorized to sign the loan documents.

Free preview