Directors Loan To Company Tax Relief In Wake

Category:

State:

Multi-State

County:

Wake

Control #:

US-00420BG

Format:

Word;

Rich Text

Instant download

Description

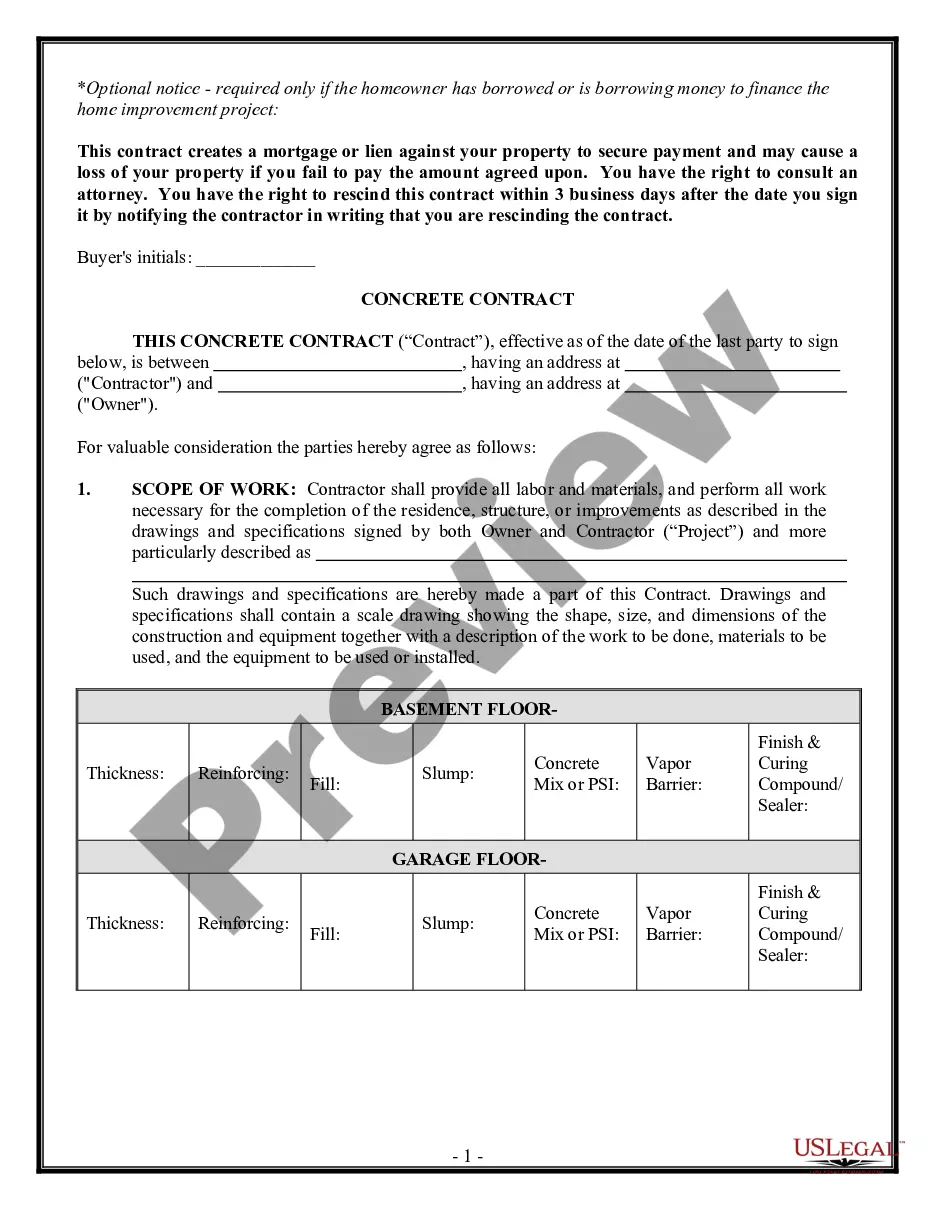

This form contains a resolution of the Board of Directors authorizing the refinancing of a loan of the corporation and names the officers of the corporation authorized to sign the loan documents.

Free preview

Form popularity

More info

The amount of loan written off will have to be included in the director's self-assessment tax return on a specific box on the 'additional information' pages. You or your company may have to pay tax if you take a director's loan.Your personal and company tax responsibilities depend on how the loan is settled. A writeoff is merely an accounting adjustment and does not formally release the director from the obligation to pay. A director's loan is defined as any money that a director or close family member receives from a company that is not a salary, dividend, expense repayment. The "Responsible Person" of a business may be left holding the bag for employment taxes not paid because of Covid19. If a loan chargeable to tax under S455 Corporation Act 2010 has been repaid, has any relief been claimed in the correct year? Learn about directors loan accounts, including tax implications and legal risks. Get expert guidance on managing your DLA effectively. The main tax implications of loans from companies to their directors are the possibility of a taxable employment benefit for the director and a tax liability.