Mortgage Assumption Agreement Form In Virginia

Category:

State:

Multi-State

Control #:

US-00424

Format:

Word;

Rich Text

Instant download

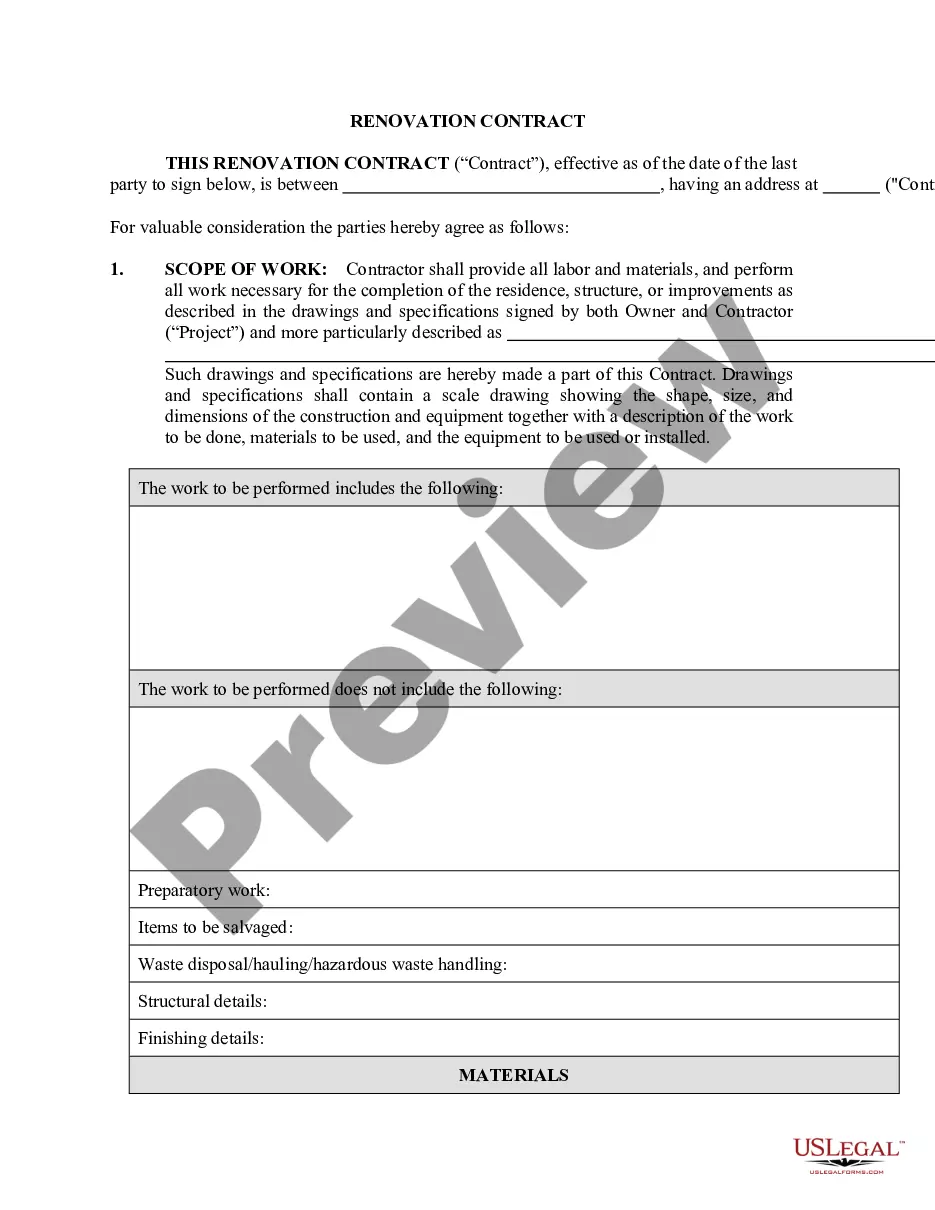

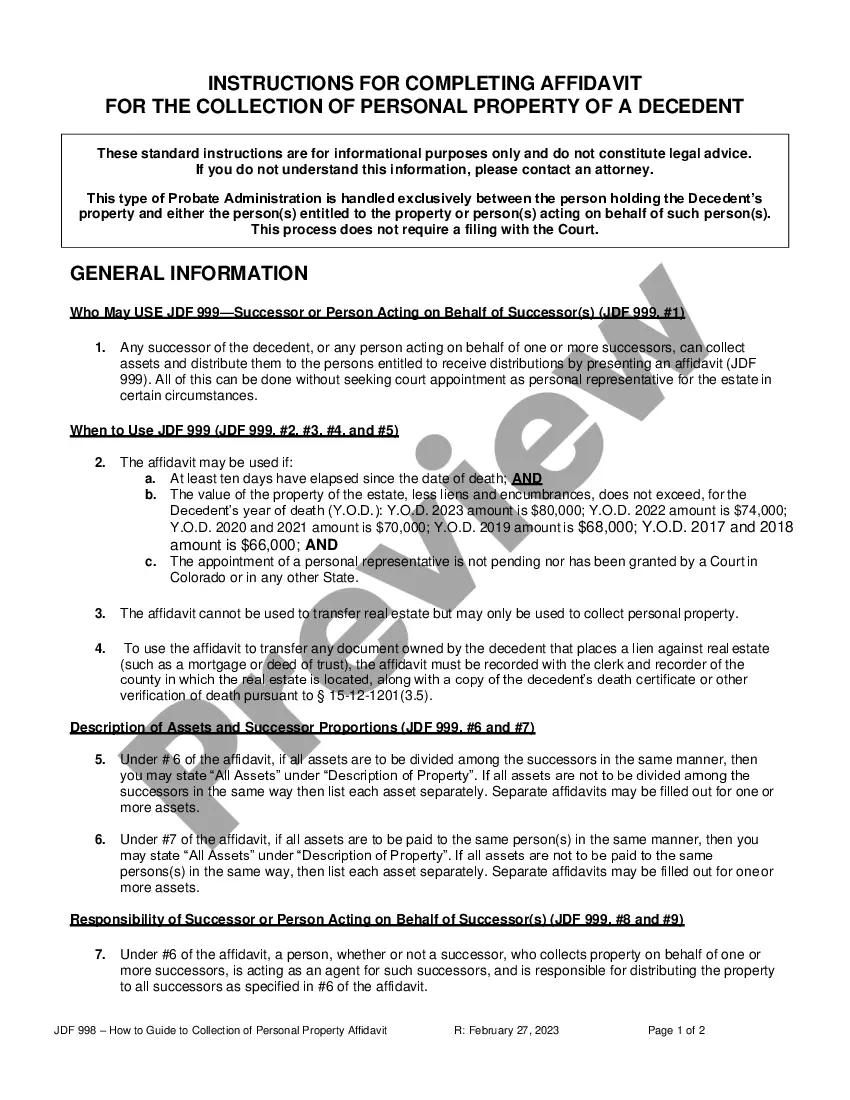

Description

The Mortgage Assumption Agreement form in Virginia is a legal document that facilitates the transfer of property ownership and the associated mortgage obligations from the seller (Grantor) to the buyer (Purchaser/Grantee). This agreement specifies the property in question, the amount owed on the mortgage, and the responsibilities of both parties regarding the debt. A key feature of this form is the assumption of the existing mortgage, allowing the Grantee to take over the mortgage payments, which helps streamline the buying process. Users should complete the form by filling in the names of the parties, property details, mortgage information, and relevant dates. Notarization is required for both parties to validate the agreement legally. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in real estate transactions. It serves as an essential tool in estate planning, financial planning, and real estate transactions, ensuring that rights and obligations are clearly defined and legally enforceable.

Free preview