Attorney Certificate Of Title With Lien In Bronx

Description

Form popularity

FAQ

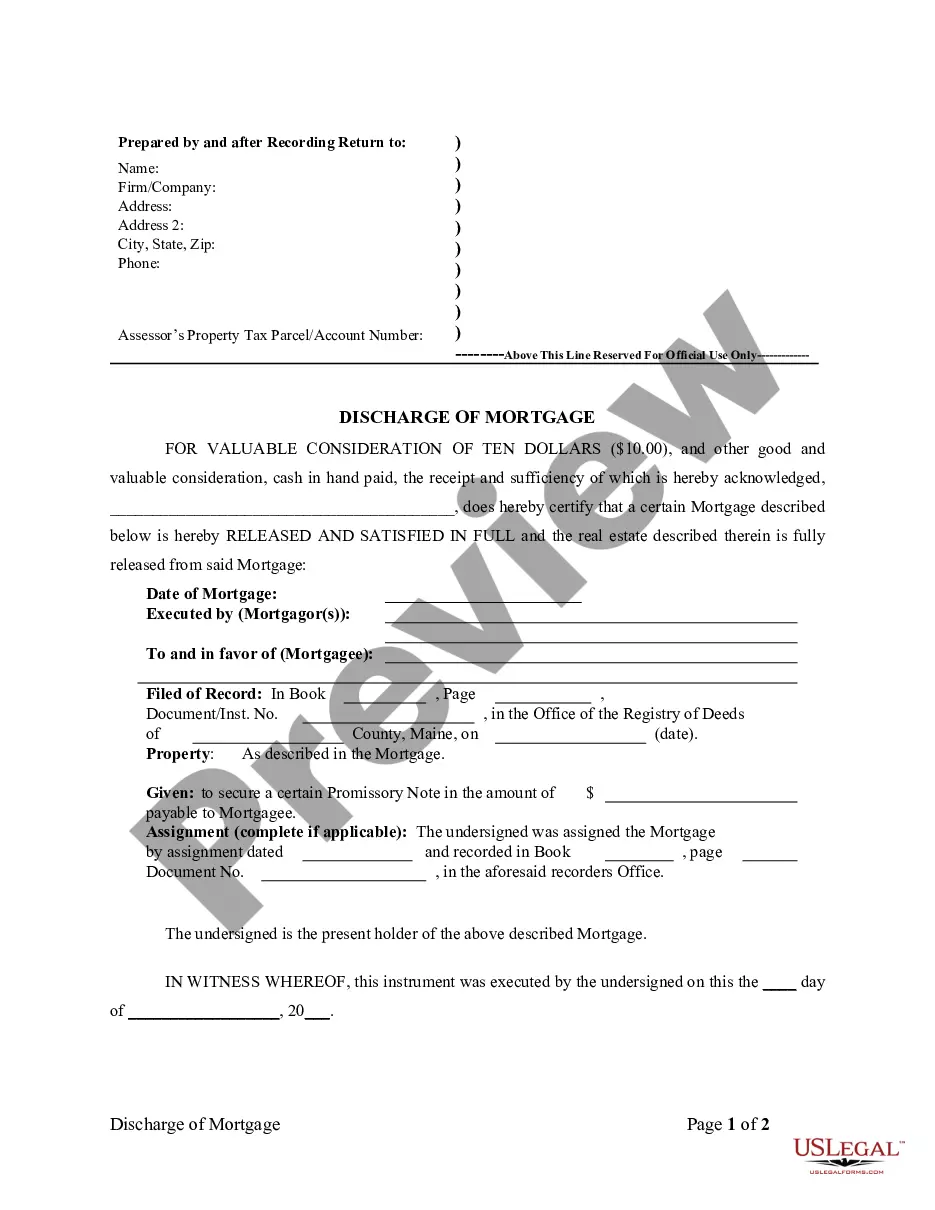

Homeowners can sell properties with liens. For a buyer to take possession of the property, the seller will need to clear title and satisfy all outstanding liens.

The most common forms of liens on a home include tax liens, mechanic's liens, and judgment liens. A tax lien can lead to a sheriff's sale of the property.

How to file a mechanics lien in New York Fill out the proper NY mechanics lien form. New York law sets specific requirements for the form to use when filing a mechanics lien claim. Serve a copy of the lien on the property owner. Record the lien with the NY county recorder. File an Affidavit of Service.

If you believe your lien is not valid and the creditor will not rectify the situation, you can file a motion in court and ask a judge to remove the lien. This can be difficult to prove, so clear evidence will be required.

In New York, like in most states, mechanic's liens are governed by a fairly extensive statutory scheme known as the “lien law” (hereinafter the “Lien Law”).1 Under the Lien Law, mechanic's liens may be filed by contractors, subcontractors, sub-subcontractors, laborers, materialmen (but only materialmen to owners, ...

A mechanic's lien can be filed during the course of a construction project when payment becomes due, or it can be filed after the project is completed. However, it must be filed no later than 8 months from the last day that the party asserting the lien (the lienor) performed work or furnished materials for the project.

Can I transfer a title certificate that has a lien listed? You can transfer the title certificate and give the new owner the original proof that any lien listed on the title certificate was satisfied. Keep a copy of the proof for your records.

To file a notice of lien, you must complete the Public Improvement Lien Form. You must also sign and notarize both the Lien Form and the Affidavit of Service. You can submit everything to DOF by mail or in person.