An interest-only promissory note with a balloon payment is a type of loan agreement where the borrower is only required to pay the interest on the loan for a specified period of time, typically ranging from a few months to several years. Unlike traditional loans where both principal and interest payments are made, interest-only promissory notes allow borrowers to have lower monthly payments during the initial period. The primary characteristic of this type of note is the "balloon payment," which refers to a large lump sum payment that comes due at the end of the interest-only period. This balloon payment is typically equal to the remaining principal balance of the loan and must be paid in full by the borrower. The loan term is typically shorter for interest-only promissory notes, typically lasting anywhere from one to ten years. One variation of the interest-only promissory note with a balloon payment is the "fixed rate" option. In this case, the interest rate is predetermined and remains fixed throughout the loan term, providing stability and predictability for both the borrower and lender. Another variation is the "adjustable rate" option, where the interest rate fluctuates periodically based on market conditions, leading to potential changes in monthly payments. Interest-only promissory notes with balloon payments are commonly used in real estate financing, particularly for commercial and investment properties. They offer flexibility in terms of lower initial monthly payments, allowing borrowers to free up cash flow for other purposes during the interest-only period. However, it is important to note that the substantial balloon payment at the end of the term requires careful financial planning. Prospective borrowers considering an interest-only promissory note with a balloon payment must carefully evaluate their financial situation and ability to make the balloon payment when due. It is crucial to have a well-thought-out repayment plan, such as savings, refinancing options, or the sale of the property, to ensure that the balloon payment can be met. In summary, an interest-only promissory note with a balloon payment is a loan agreement where the borrower pays only the interest for a specified period and makes a substantial lump sum payment at the end. This type of note can provide flexibility in terms of lower initial payments but requires careful financial planning. Additional variations include fixed and adjustable rate options.

Interest Only Promissory Note With Balloon Payment

Description secured promissory note installment with balloon final payment

How to fill out Interest Only Promissory Note With Balloon Payment?

Legal papers management can be overpowering, even for experienced experts. When you are searching for a Interest Only Promissory Note With Balloon Payment and do not get the time to commit searching for the appropriate and up-to-date version, the procedures can be demanding. A strong online form library can be a gamechanger for anyone who wants to take care of these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any needs you might have, from personal to enterprise documents, all in one spot.

- Make use of innovative resources to complete and deal with your Interest Only Promissory Note With Balloon Payment

- Access a useful resource base of articles, instructions and handbooks and resources related to your situation and requirements

Help save time and effort searching for the documents you will need, and make use of US Legal Forms’ advanced search and Review tool to get Interest Only Promissory Note With Balloon Payment and get it. In case you have a monthly subscription, log in to your US Legal Forms profile, search for the form, and get it. Review your My Forms tab to see the documents you previously downloaded and to deal with your folders as you can see fit.

If it is the first time with US Legal Forms, make an account and have unlimited use of all benefits of the platform. Listed below are the steps to take after getting the form you need:

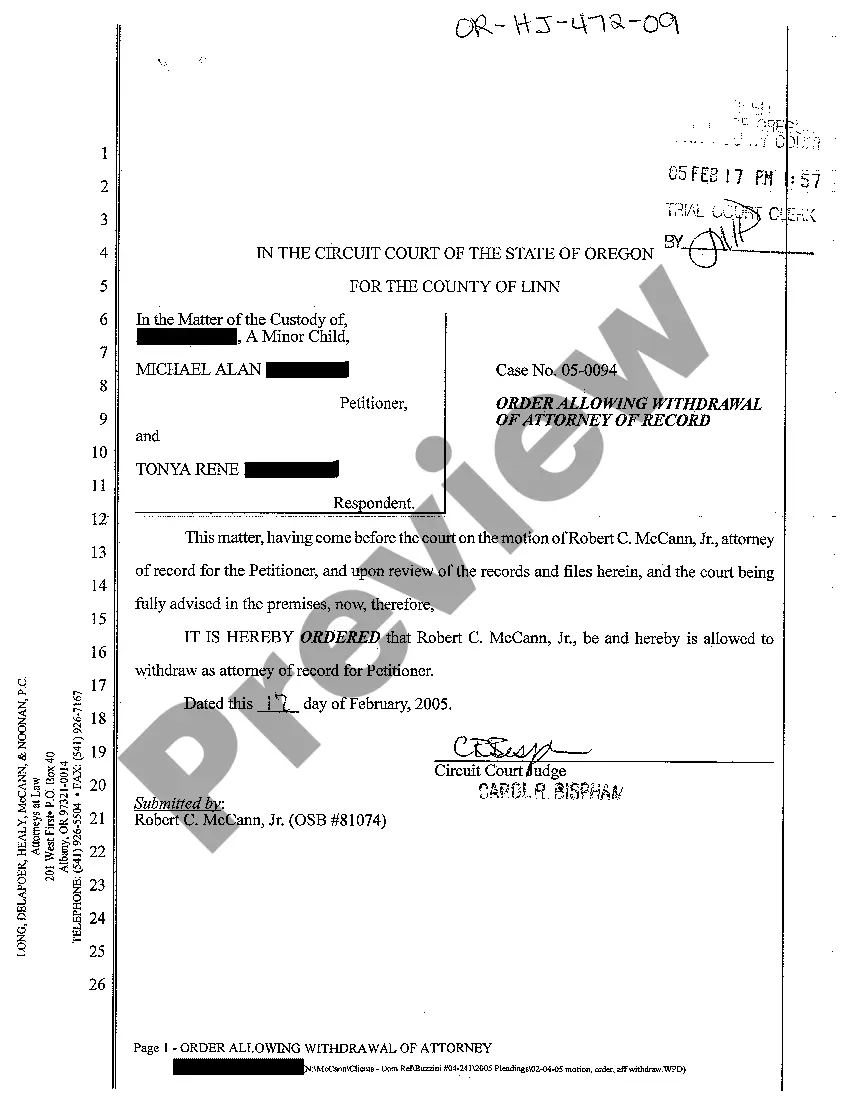

- Validate it is the proper form by previewing it and looking at its description.

- Ensure that the sample is approved in your state or county.

- Select Buy Now when you are ready.

- Select a monthly subscription plan.

- Find the file format you need, and Download, complete, sign, print and send out your document.

Take advantage of the US Legal Forms online library, supported with 25 years of experience and reliability. Transform your everyday document managing in a easy and user-friendly process right now.

Form popularity

FAQ

A balloon mortgage is a home loan with an initial period of low or interest-only payments. The borrower pays off the balance in full at the end of the term. A balloon mortgage is usually short-term, often five to seven years.

A balloon promissory note has all the usual repayment requirement details, with one important distinction. Instead of an even amount of payments over the term of the loan, smaller payments are made at first and a single large payment is made at the end.

For clarity, a balloon payment or residual payment is only paid at the end of the loan period and you continue to pay interest on it.

You pay more interest on your loan when you have a balloon payment. That's because you're effectively paying interest on the value of the residual value or balloon payment for the entire term of the loan.

When the loan is interest-only, you only pay interest throughout the life of the loan. The final payment on the loan is called a balloon payment and equals the entire principal. This amount is due at the end of the loan period.