Promissory Note Procedure In Sacramento

Category:

State:

Multi-State

County:

Sacramento

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

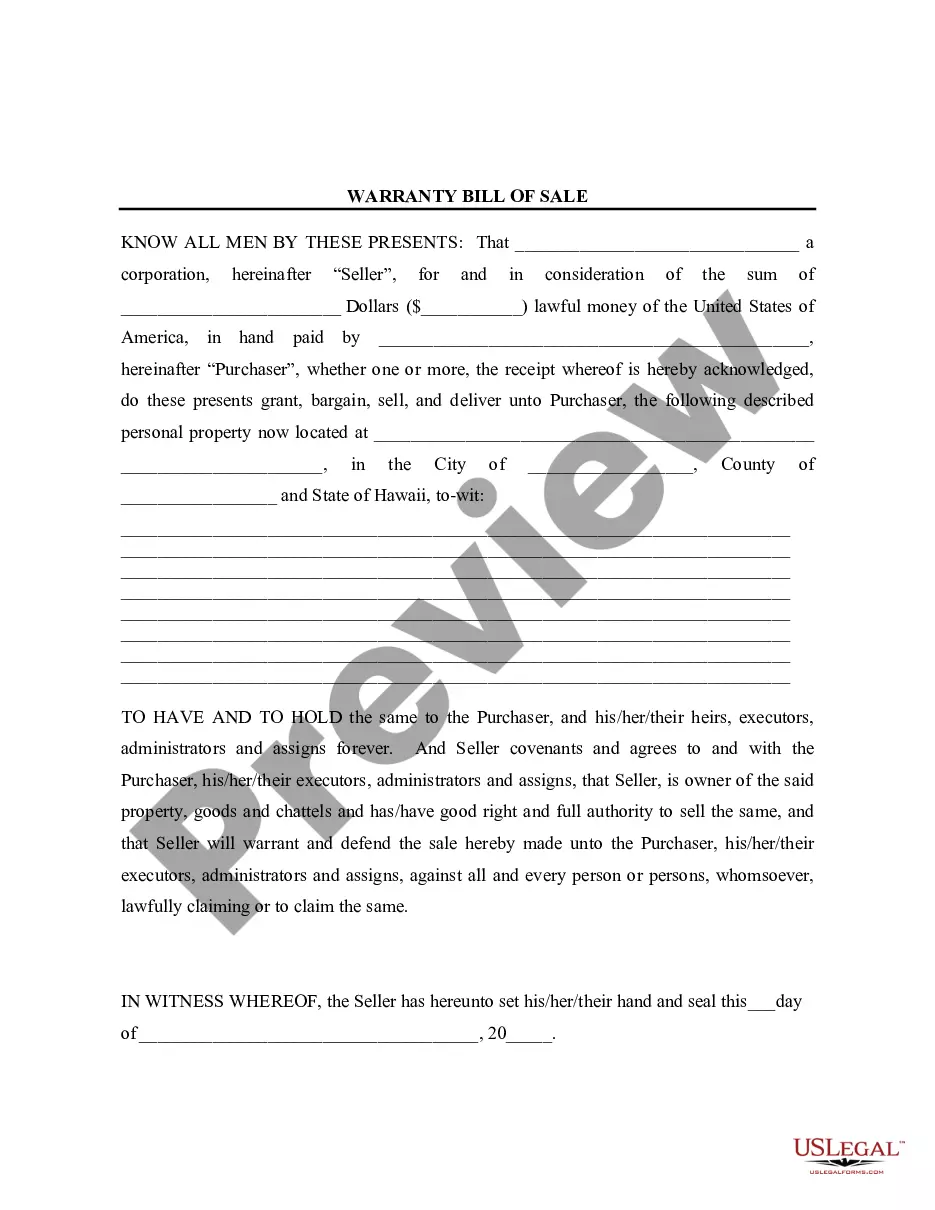

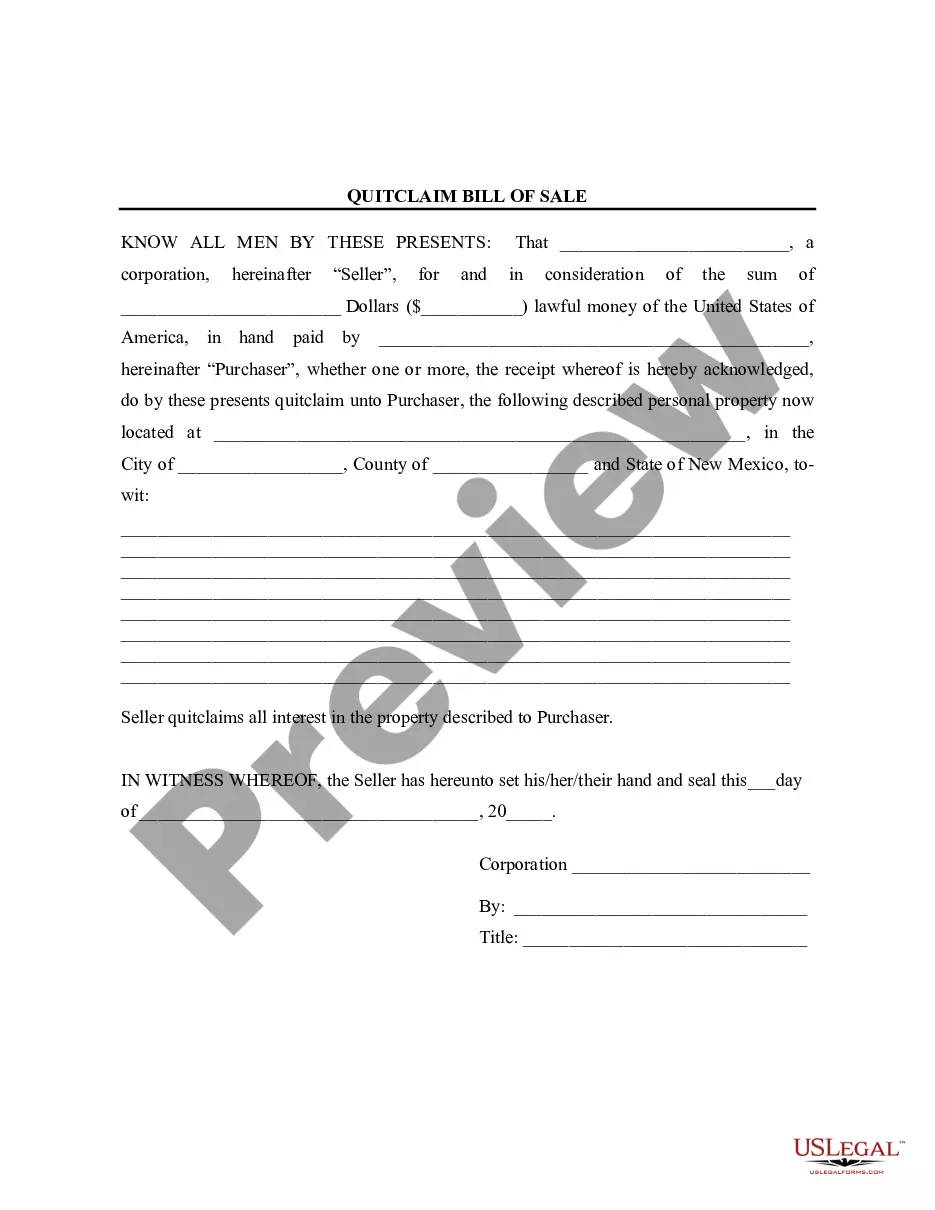

The Promissory Note procedure in Sacramento outlines the obligations of a borrower to repay a specified sum to a lender, including detailed provisions regarding interest rates, repayment schedules, and penalties for default. This form serves to formalize a loan agreement, establishing clear terms for the repayment of principal and interest, as well as the consequences of default. Notably, it includes a balloon payment structure, requiring a final lump sum payment after regular installments. Users are instructed to fill in the necessary fields like amounts, names, and dates to ensure clarity and compliance. Fillers should edit carefully for accuracy and completeness. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who require a reliable document to secure lending agreements and protect the rights of both lenders and borrowers. Legal professionals can leverage this standardized form to streamline transactions and facilitate clear communication regarding financial obligations. Overall, the Promissory Note is an essential tool in facilitating financial arrangements in Sacramento.

Free preview