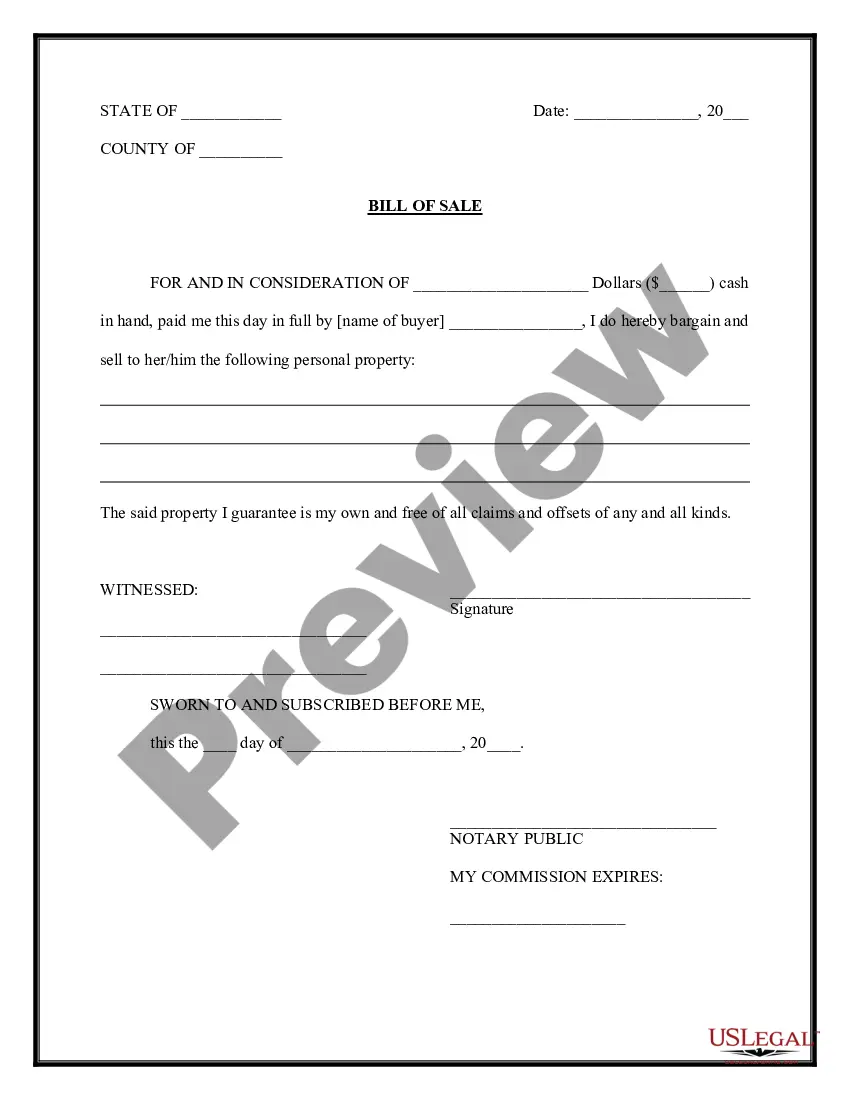

For your convenience, the complete English version of this form is attached below the Spanish version. In this form, the seller agrees to sell to the purchaser certain items of personal property. The seller warrants that the property is free from all claims and offsets of any kind. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Handwritten Bill Of Sale For Car With Gift Receipt In Maryland - Contrato de Compraventa de Bienes Personales - Bill of Sale

Category:

State:

Multi-State

Control #:

US-00429-SPAN

Format:

Word;

Rich Text

Instant download

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. En el mismo, el vendedor acuerda en vender al comprador ciertos bienes muebles. El vendedor garantiza que dichos bienes están libres de todo tipo de reclamo y derechos de embargo.

Free preview