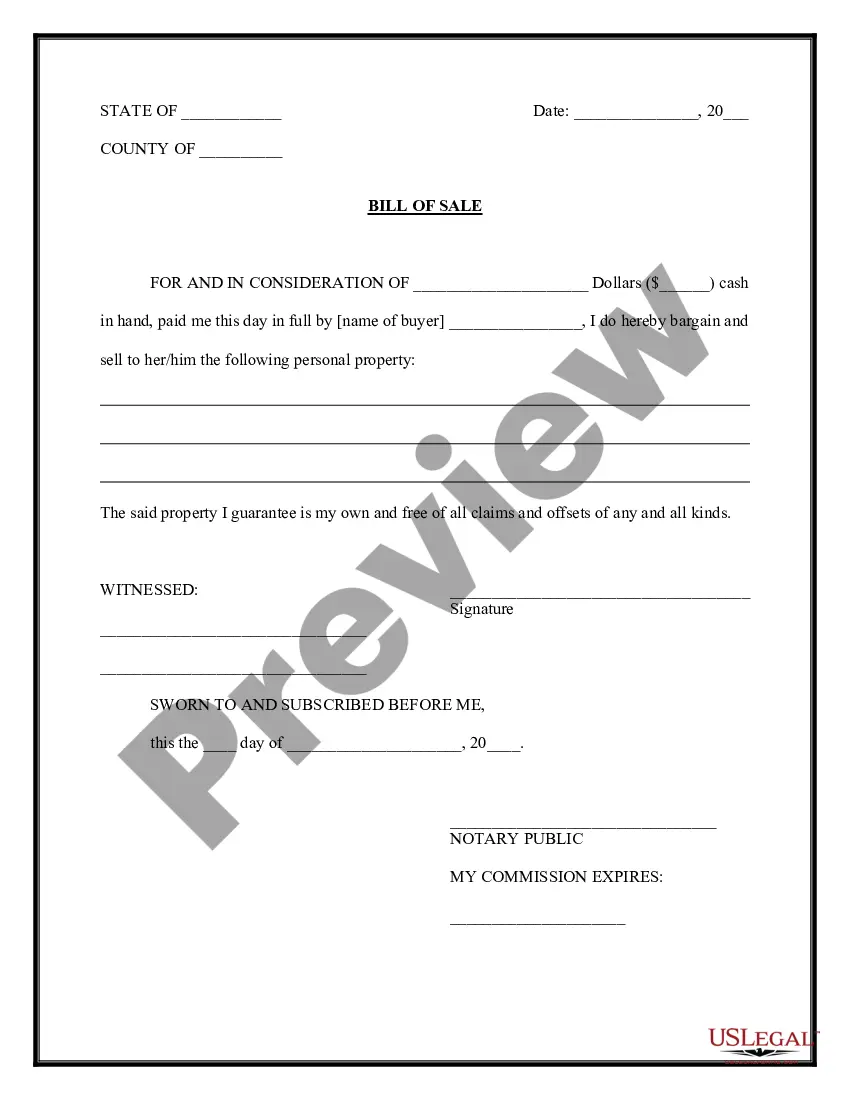

For your convenience, the complete English version of this form is attached below the Spanish version. In this form, the seller agrees to sell to the purchaser certain items of personal property. The seller warrants that the property is free from all claims and offsets of any kind. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Spanish Bill Of Sale With Payments In Minnesota - Contrato de Compraventa de Bienes Personales - Bill of Sale

Description

Form popularity

FAQ

If you are required to withhold federal income tax from a nonresident employee's wages for work performed in Minnesota, you must also withhold Minnesota income tax in most cases. If your employee is a resident of Michigan or North Dakota, you may not be required to withhold Minnesota income tax from their wages.

If you must file a Minnesota return, use Form M1, Individual Income Tax, and Schedule M1NR, Nonresidents/Part-Year Residents. Wages or salaries you earn while physically in the state may be taxable. If you're working in another state for a business located in Minnesota, that income is not taxable in Minnesota.

The nonresident entertainer tax replaces the regular Minnesota income tax. The promoter (the person or organization responsible for paying you) is required to withhold 2% of your gross compensation for performances in Minnesota and remit it to us on your behalf, see Exceptions.

Form AWC, Alternative Withholding Certificate for Year. for Nonresident Individual Partners and Shareholders. For use by nonresident individual partners or shareholders subject to Minnesota withholding. Complete a certificate each year you wish to reduce the amount withheld by the partnership or S corporation.

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

The choice between Form 1040 and Form 1040NR largely depends on your residency status, which influences both income reporting and deductions. For nonresident aliens, Form 1040NR should be used to report U.S.-sourced income only, while Form 1040 requires U.S. residents and citizens to report their worldwide income.

We sent Form 1099-MISC to all rebate recipients to use when filing federal returns. If you include this payment in federal adjusted gross income, subtract it from Minnesota taxable income on line 33 of Schedule M1M and on line 11 of Form M1PR on your state return.

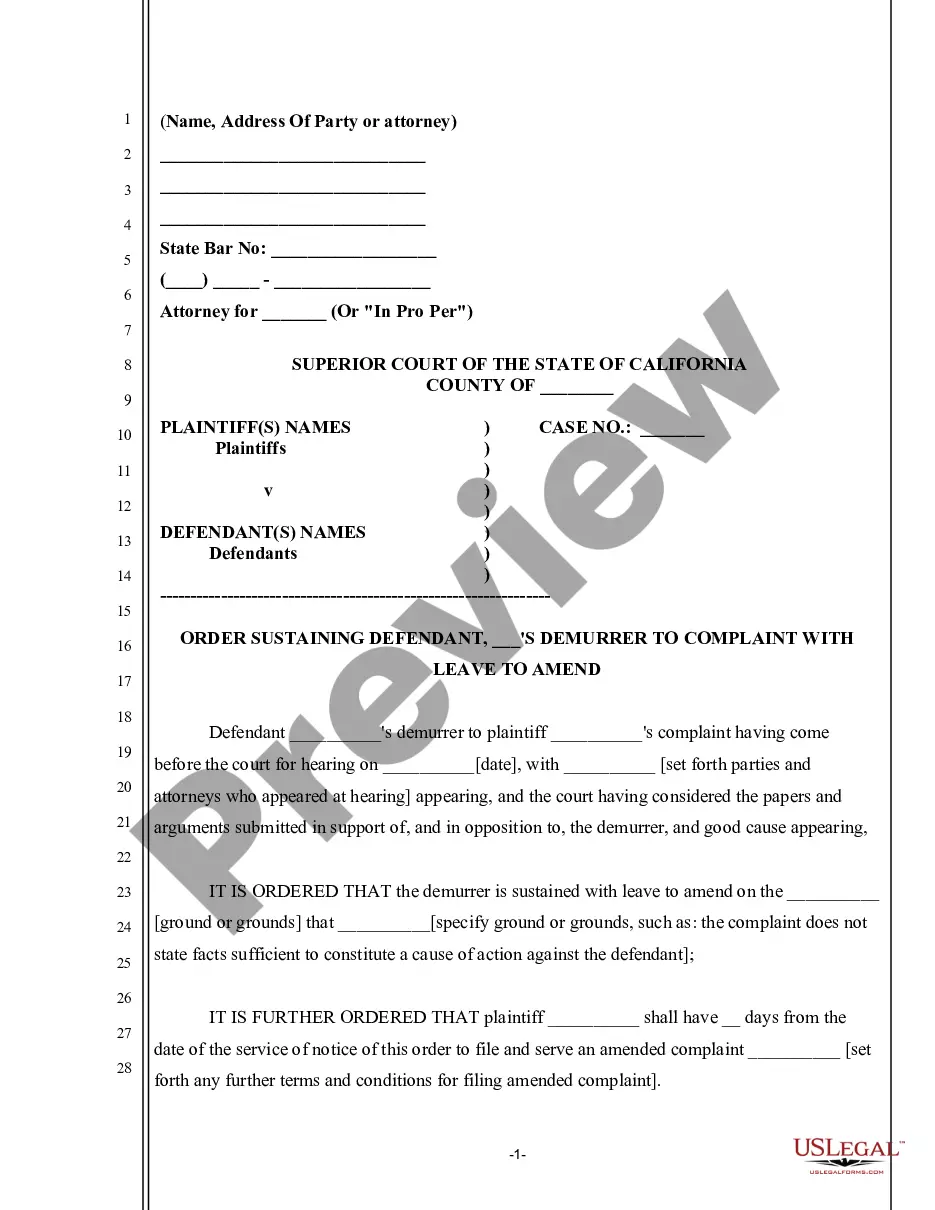

Minnesota law requires a title be transferred within 10 business days of the date of sale to avoid a penalty. The Anoka County License Centers recommend that all buyers and sellers appear in person to complete the title transfer.

Tax-exempt goods Examples include most grocery items, feminine hygiene products, and medical supplies. We recommend businesses review the laws and rules put forth by the Minnesota Department of Revenue to stay up to date on which goods are taxable and which are exempt, and under what conditions.

Sales tax is charged by the seller and applied to retail sales of taxable services and tangible personal property sold in Minnesota. Sales tax is a transaction tax. The seller must look at each transaction to determine its taxability.