Residency Definition For Taxes In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-0042BG

Format:

Word;

Rich Text

Instant download

Description

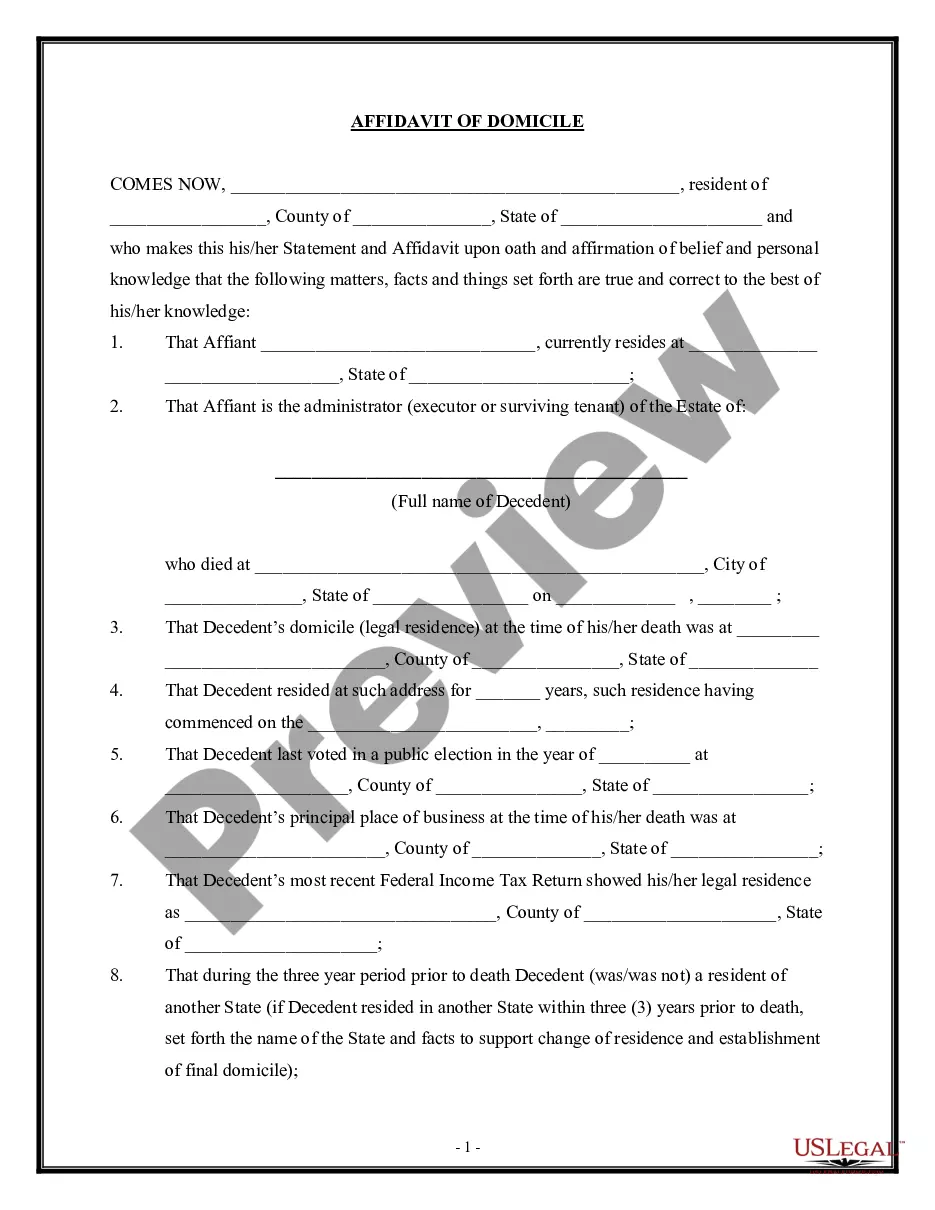

The Affidavit of Domicile outlines the residency definition for taxes in Clark, emphasizing the decedent's legal residence at the time of death. This form serves as a crucial document to verify the domicile of the deceased, which is essential for legal and tax purposes. Key features include sections for the affiant's details, the decedent's residence, and statements confirming the decedent's sole residency in the stated jurisdiction. Filling out this affidavit requires accurate information regarding both the affiant and the decedent, including their residential addresses and the number of years of residence. It is typically used in situations involving the transfer of securities owned by the deceased. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants, as it provides a straightforward method to establish residency for tax implications and secure necessary asset transfers.