Difference Between Domicile And Deemed Domicile In New York

Description

Form popularity

FAQ

It is possible for an individual who becomes deemed domicile under Condition B to lose this deemed status - it does not last indefinitely. They can lose their deemed domicile status if they leave the UK and there are at least 6 tax years as a non-UK resident in the 20 tax years before the relevant tax year.

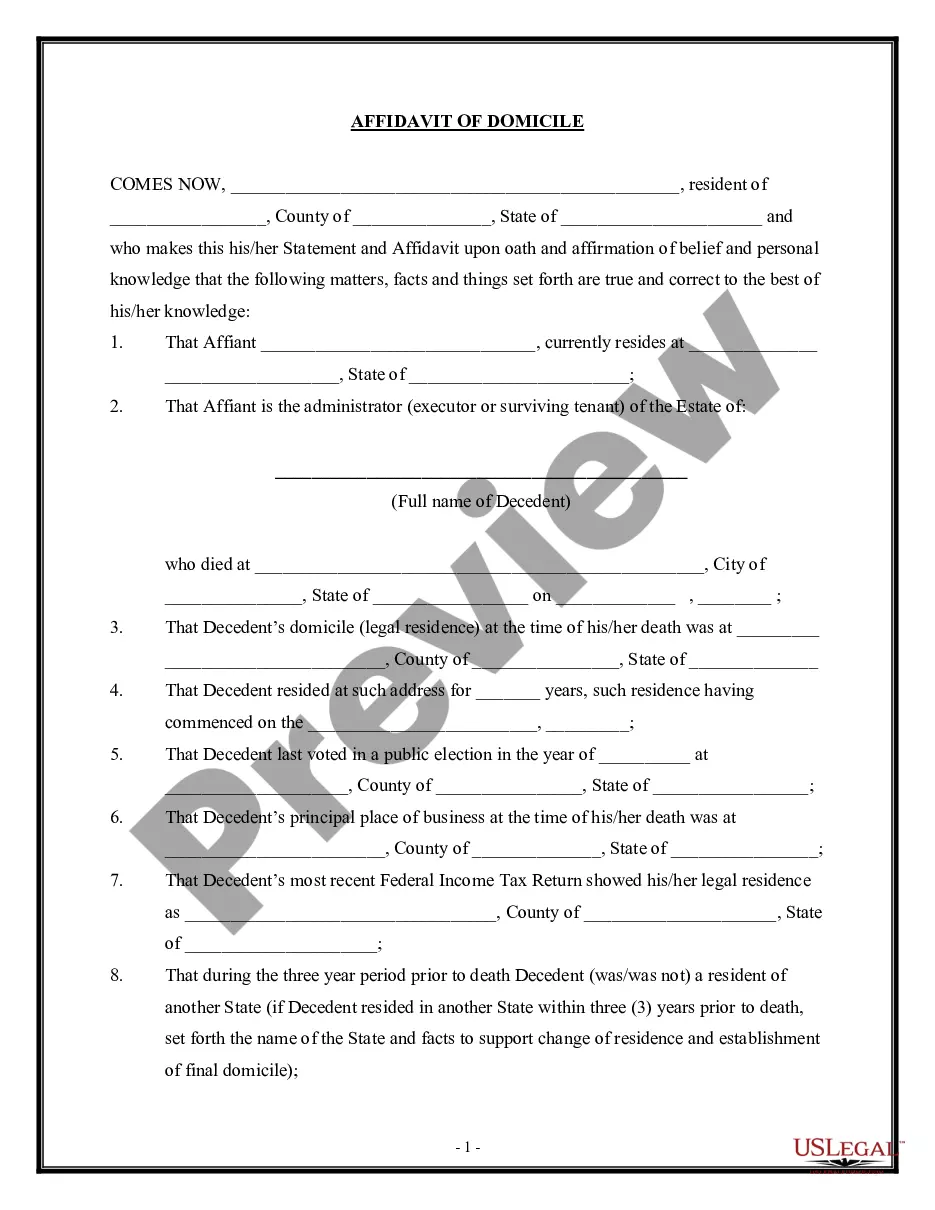

Proof of domicile is based upon an intention to make New York State a permanent home and the existence of facts tending to confirm such intention. Factors relevant to a determination of domicile include: residence of parents, spouse and children. place of voter registration.

Proof of domicile is based upon an intention to make New York State a permanent home and the existence of facts tending to confirm such intention. Factors relevant to a determination of domicile include: residence of parents, spouse and children. place of voter registration.

Any part of any day spent physically in New York, including days in transit, counts as a day of presence in New York. N.Y.C.R.R. 105.20(c). Because residency is determined in part by day count (183-day rule), generally a part-year resident is a person whose domicile changes to or from New York State during a tax year.

U.S. immigration laws generally require sponsors to have a U.S. domicile, meaning they live in the U.S. or plan to return permanently. If a sponsor is living abroad, they need to show strong ties to the U.S., like property, a job, or intent to return.

The rule stipulates that if an individual spends at least 10 months in New York City during the tax year, they are presumed to be a resident for tax purposes, even if their primary home is elsewhere.

A New York Resident is an individual who is domiciled in New York or an individual that maintains a permanent place of abode in New York and spends 184 or more days in the state during the tax year.

The effect of being UK resident in a tax year and deemed domiciled in the UK for income tax and capital gains tax purposes is that you are chargeable to UK tax on your worldwide income and gains on the arising basis in the same way as individuals who are actually UK resident and UK domiciled.

In general, your domicile is your permanent and primary residence that you intend to return to and/or remain in after being away (for example, on vacation, business assignments, educational leave, or military assignment). Residence means a place of abode.

The most straightforward way to avoid NYC city tax is by ensuring you are not considered a resident of the city. NYC residents are subject to local income tax, which can range from 3.078% to 3.876%. To avoid NYC city tax, you must establish residency outside of the city.