Residency Definition For Taxes In Riverside

Category:

State:

Multi-State

County:

Riverside

Control #:

US-0042BG

Format:

Word;

Rich Text

Instant download

Description

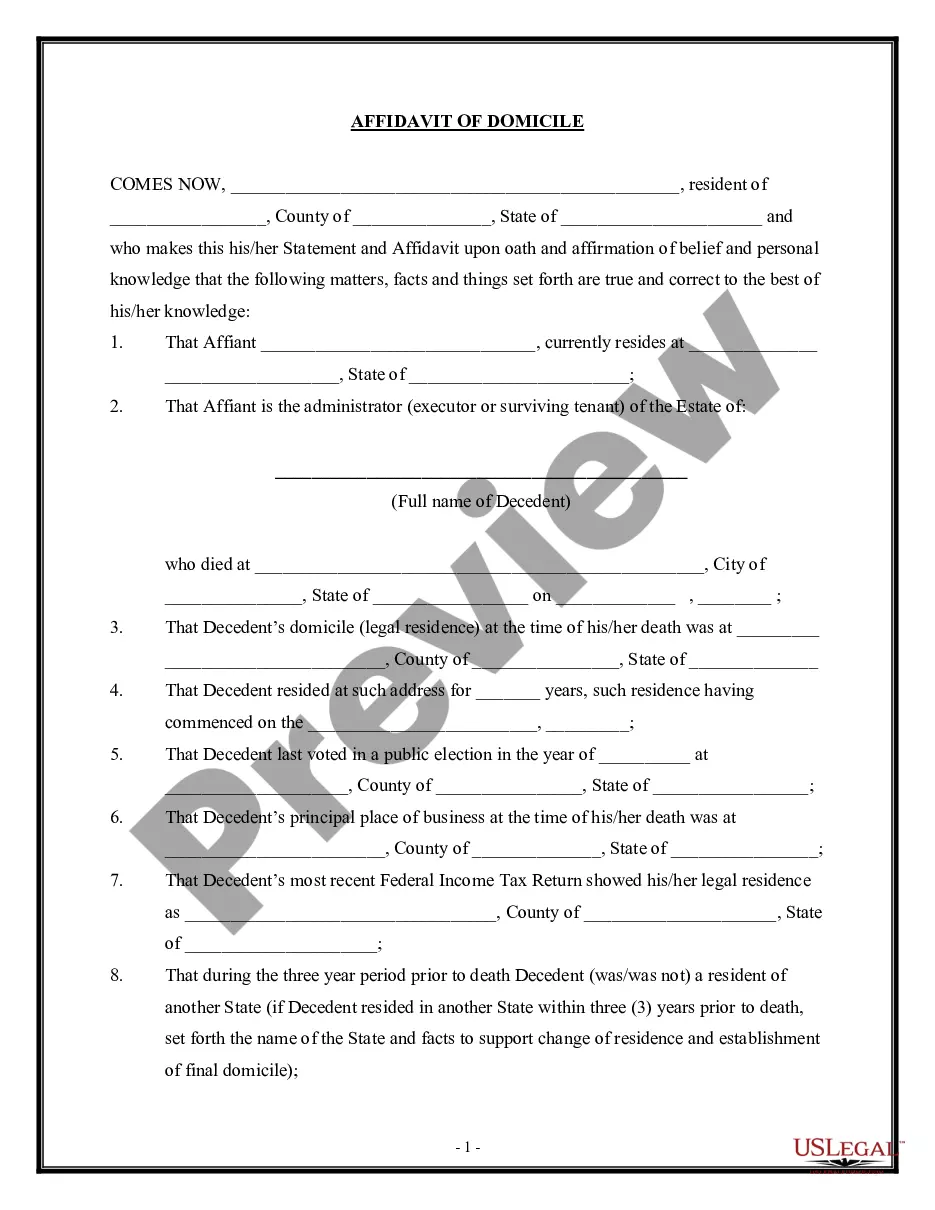

The Affidavit of Domicile serves as a crucial document when determining residency definition for taxes in Riverside. This form is primarily utilized to affirm the legal residence of a deceased individual, which is essential in managing their estate. The key features of this affidavit include the identification of the affiant, the declaration of the decedent's last known residence, and confirmation that the decedent had no other domiciles in the United States at their time of death. To complete the form, users must fill in personal details, including the decedent's address and information regarding their estate. Attorneys, partners, owners, associates, paralegals, and legal assistants can benefit from this form when settling estates, as it facilitates the transfer of securities and aids in tax assessments related to the decedent's residency. It is important to adhere to legal requirements and ensure that the affidavit is notarized properly to be valid. Overall, this affidavit streamlines the process of establishing residency for tax purposes and assists legal professionals in fulfilling their duties efficiently.