Acknowledgement Letter For Stock Donation In Harris

Description

Form popularity

FAQ

Dear donor's first name, Thank you for your kind donation of amount, which was received on date. Your gift means so much to us and helps specific impact, e.g., fund scholarships for students or provide meals to families. For your records, we confirm that your donation is tax-deductible.

Here are a few effective methods: Verbal Acknowledgment. Sometimes, a simple spoken acknowledgment carries the most weight. Written Acknowledgment. Written acknowledgment works just as well, especially for contributions that might otherwise go unnoticed. Tangible s. Digital Badges and Signifiers.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Emphasize specific efforts and results and express your appreciation verbally or in writing. Acknowledge accomplishments publicly, such as in meetings or emails, and encourage a culture of appreciation. Provide opportunities for advancement or recognition such as nominations for awards or promotions.

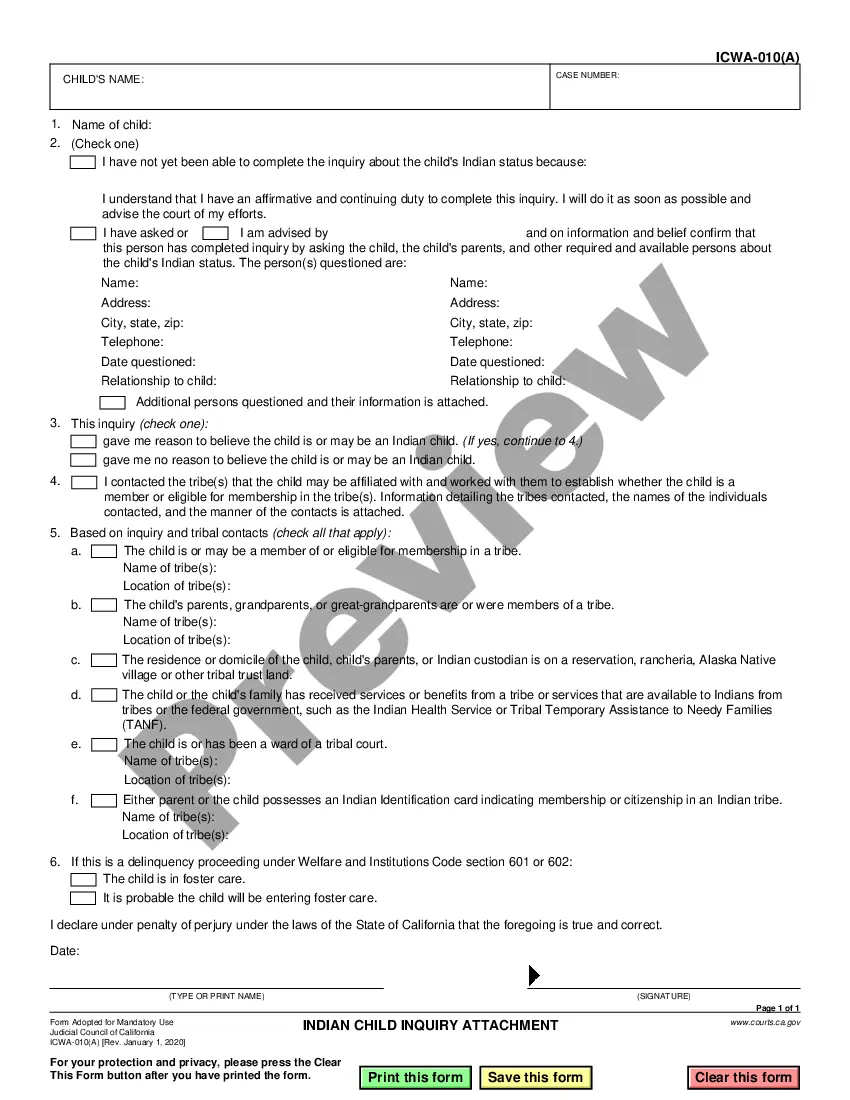

Once a donation of stock has been received, a thank you letter should be sent to the donor. This letter should acknowledge the gift of stock, such as the name and number of shares. It should not list the value of the stock received since the organization is not in the business of valuing stock.

How to Write a Gift Acknowledgment Letter State the purpose of your letter. Start your gift acknowledgment letter with a confirmation of the donation. Make your letter visually engaging. Personalize your note. Explain the impact of the gift. Express heartfelt gratitude. Invite supporters to stay involved.

Acknowledge work well done on a regular basis. Comments can range from the specific like, “The way you handled that client meeting was so smart,” to the general, “I appreciate the great work you do.” You'd be surprised how many teammates or bosses don't give high-fives.

Ing to the IRS guidelines on charitable contributions, an acknowledgement letter must include the following: The name of your organization. The amount of the donation. The date it was made. Whether any goods or services were exchanged.